Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

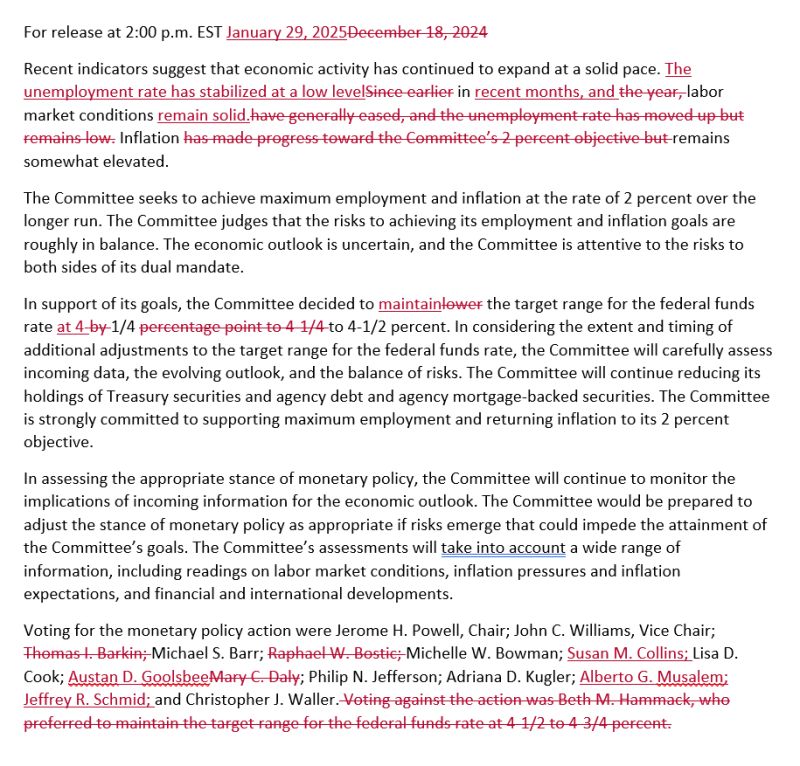

The Fed held rates steady as widely expected.

The FOMC statement contains only minor changes that mark to market recent economic developments: 👉 "Labor market conditions remain solid" = Hawkish❗ 👉 "Inflation remains somewhat elevated." (The central bank notably removed reference to inflation making progress towards the goal) = Hawkish❗ The Fed will continue its QT program at an unchanged pace of $60 billion a month. The market does not expect rate cuts at least until June 2025. Source: Nick Timiraos, The Kobeissi Letter

🔴 FED CHAIR POWELL SAYS BANKS CAN NOW SERVE CRYPTO TO CUSTOMERS 🚀

Banks can serve crypto customers as long as they can manage the risk, said U.S. Federal Reserve Chair Jerome Powell, amid allegations that the crypto industry is being cut off from financial institutions. "The threshold has been a little higher for banks engaging in crypto activities and that's because they're so new," Powell said on Wednesday when asked by a reporter during a Federal Reserve press conference about risks associated with cryptocurrency. The central bank is not against innovation, he added. Crypto firms have complained about the difficulty behind establishing and maintaining bank accounts in the U.S. Following the collapse of crypto exchange FTX in late 2022, several governmental agencies, including the Federal Reserve, issued warnings on "crypto-asset risks." Source: The Block

Trump is not happy with “hawkish” Powell.

Source: @realDonaldTrump

Magnificent 7 stocks have underperformed the market in 2025:

The Magnificent 7 stocks are down -1.4% while the S&P 500 itself is up ~2.9%. Meanwhile, the remaining 493 stocks in the S&P 500 have gained +6.6%. To put this into perspective, in 2024, the Magnificent 7 stocks returned +67.4% while the remaining 493 firms gained just +5.0%.

Why "cheap" AI will benefit the overall ecosystem explained in one chart

As the cost of AI comes down, what are the sectors that benefit from cheap intelligence? 1. Cybersecurity (e.g $CRWD) 2. Data Storage/Analytics (e.g $NOW) 3. Robotics (e.g $AMZN) 4. AI Agents (e.g $MSFT $CRM) 5. Advertising (e.g $META, $GOOGL) 6. Ecosystems (e.g $AAPL) NB: These are not investment recommendations Source: Lin@Speculator_io

Czech Central Bank Plans Bitcoin Reserve

Source: Bloomberg thru Willem Middelkoop

Investing with intelligence

Our latest research, commentary and market outlooks