Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

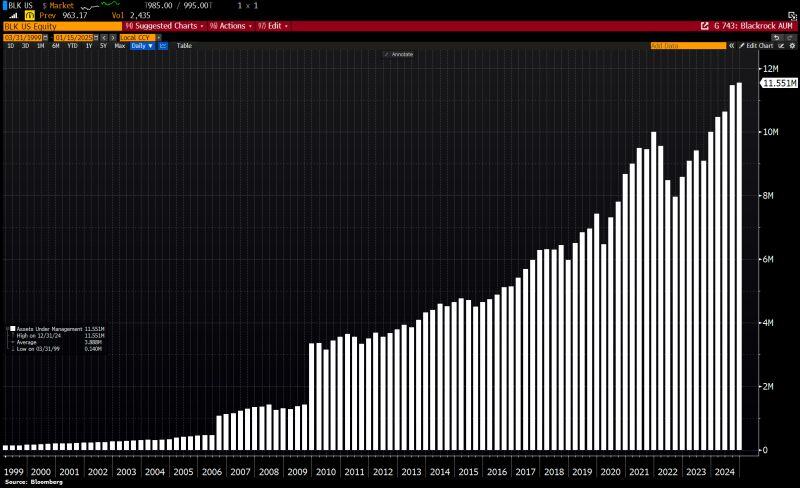

BlackRock is eating the world:

Assets Under Management (AUM) grew by 15% to hit a fresh ATH at $11.55tn. BlackRock has raised $641bn in investor funds in 2024. Tally includes $390bn flowing into its ETF business overall, $226bn into equity funds, and $164bn into fixed-income. Source Bloomberg, HolgerZ

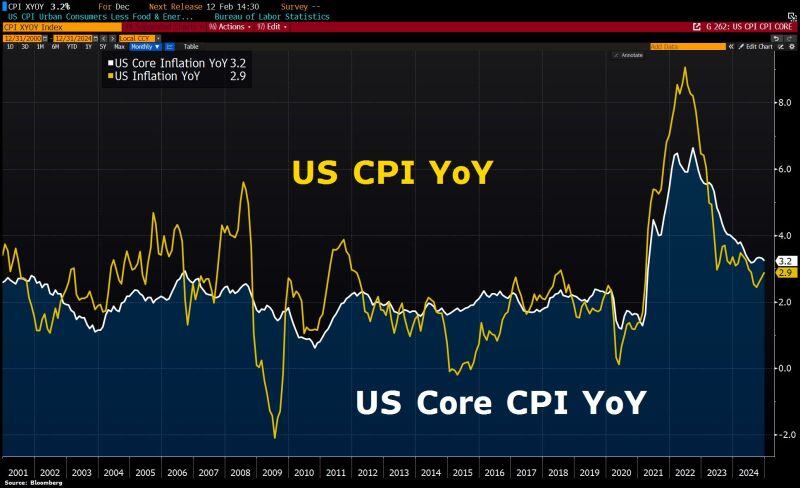

Good news are coming... while US Q4 earnings season is off to a strong start thanks to banks beating estimates, US inflation numbers came in somewhat cooler than expected:

Core CPI slows to 3.2% in December from 3.3% in November. Analysts had expected the rate to remain unchanged at 3.3%. Overall CPI is unchanged at 2.9% as forecasted. Headline CPI inflation is up for 3 straight months, but core inflation is falling again. It seems enough to please investors: S&P 500 futures are surging over +85 points - the equivalent of a $750B market cap gain - as 10y US bond yields are tumbling by 10 basis points. The dollar is easing, gold is shining and cryptos is surging with bitcoin back to $99K. Alles gut... Source: Bloomberg

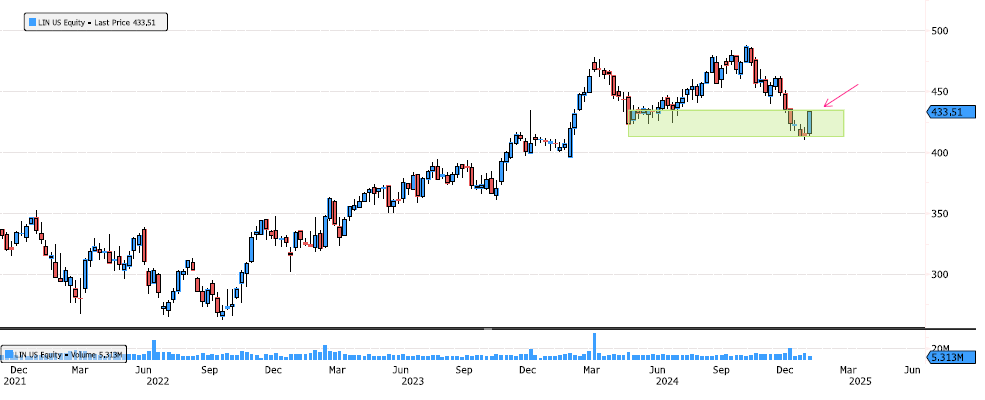

Linde Price Action on Support Zone

Linde (LIN US) remains in a very bullish trend overall. The stock has seen a recent consolidation (-15%) from its all-time highs, but we’re now witnessing a strong rebound from the support level at 413. Source: Bloomberg

On this day of 2015, the SNB (Swiss National Bank) discontinued the minimum exchange rate of 1.20 EUR/CHF...

This "quasi-peg" level never got revisited. Meanwhile, the 0.95 new support level does not seem to hold. Today we trade at 94 cents and many traders do have 90 cents in mind. And even much lower levels... Good luck... Source chart: Brian Reutimann

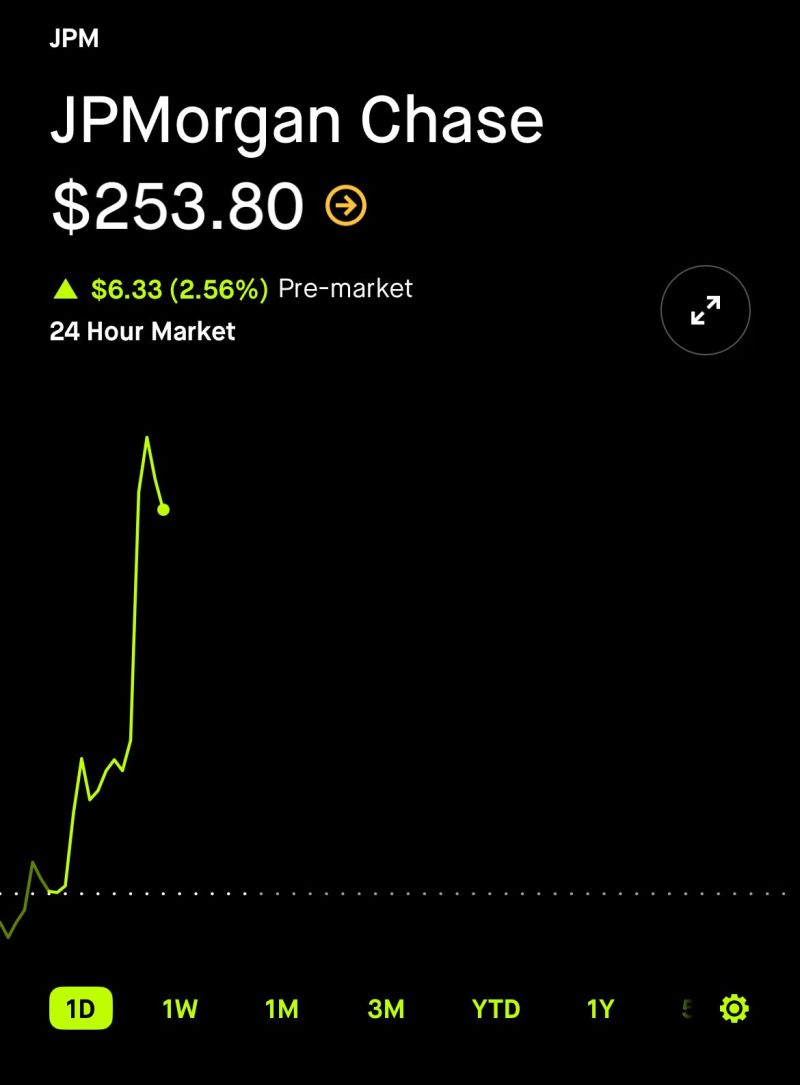

JPMorgan $JPM reported earnings

EPS of $4.84 beating expectations of $4.11 Revenue of $43.7B beating expectations of $41.7B Jamie Dimon added … “two significant risks remain. Ongoing and future spending requirements will likely be inflationary, and therefore, inflation may persist for some time. Additionally, geopolitical conditions remain the most dangerous and complicated since World War II” Source: App Economy Insights

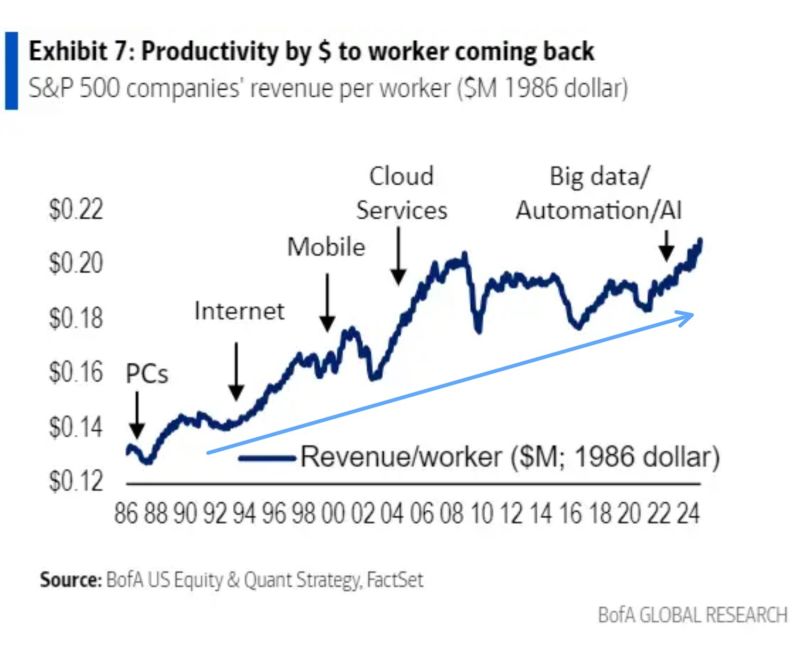

SP500 companies’ revenue per worker.

Source: Eugene Ng on X, BofA

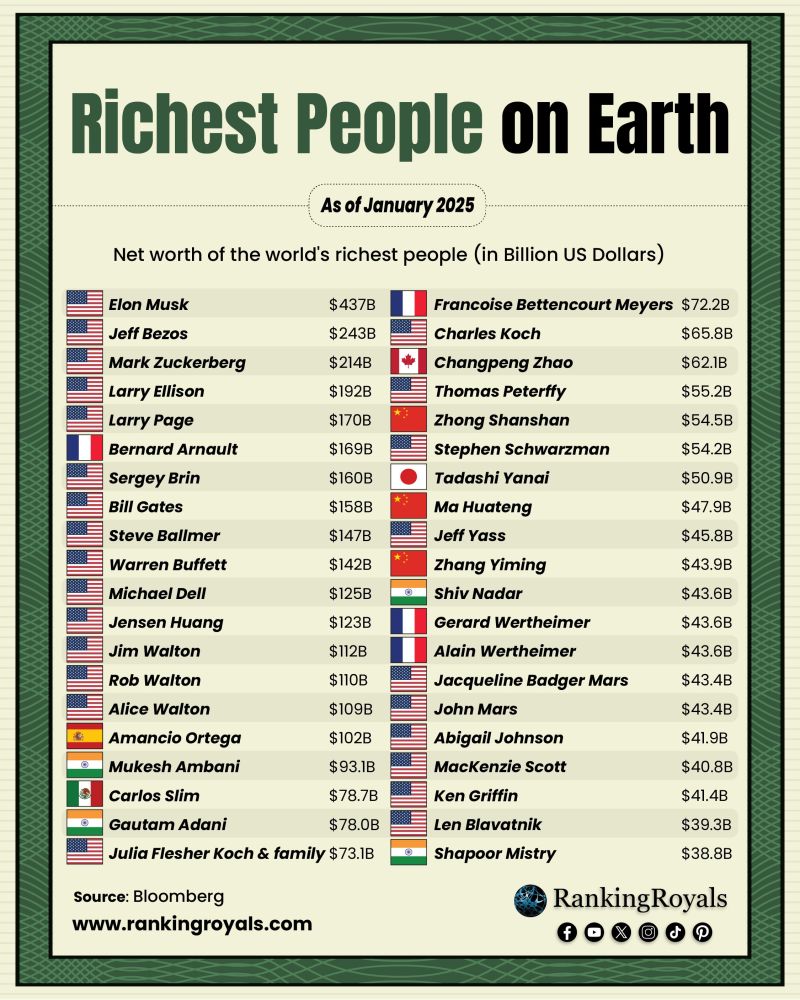

Net Worth of the World's Richest People as of January 2025.

Source: RankingRoyals @RankingRoyals on X·

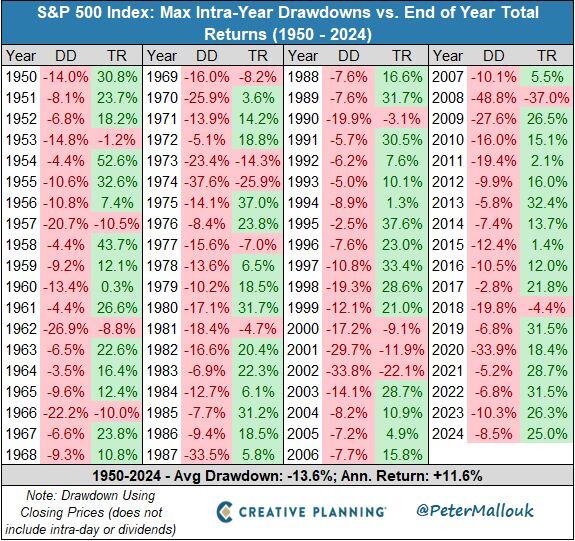

Since 1950, the S&P 500 has had an average intra-year drawdown of -13.6% but is still up 11.6% per year annualized.

No Risk, no Reward. Source: Peter Mallouk @PeterMallouk

Investing with intelligence

Our latest research, commentary and market outlooks