Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

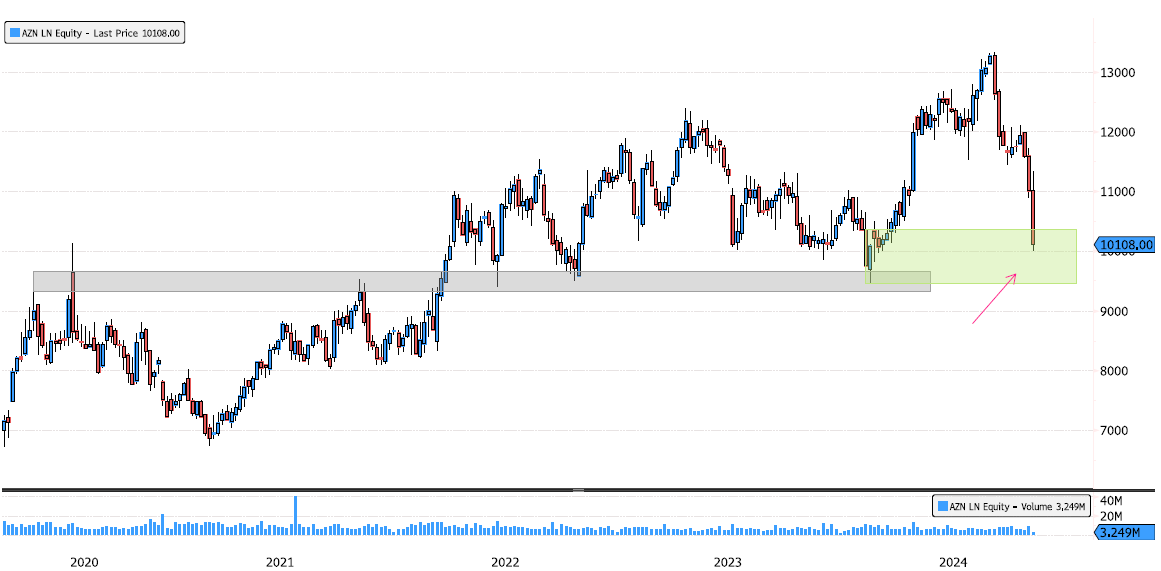

AstraZeneca on a Key Support Zone

AstraZeneca (AZN LN) has declined 25% since the end of September and is now reaching a key support zone between 9460-10360. Additionally, there is a major support zone at 9333-9655, marked by the March 2022 breakout level, which has seen multiple rebounds. These levels will be crucial to watch for potential support. Source: Bloomberg

🚨 THE SHOCKING CHART OF THE DAY >>>

THE FEDERAL RESERVES REVERSE REPO HAS FALLEN TO $155 BILLION WHICH IS THE FIRST TIME WE SEEN THIS LEVEL SINCE MAY 2021🚨 USUALLY WHEN IT FALLS IT LOWERS YIELDS BUT INSTEAD THEY’RE MOVING UP AND 10YR YIELDS FLEW TO 4.3% LAST WEEK. It was initially used to pull money out of the economy to reduce inflation. Then it went back into economy and then into equites. What's next? Source: Mike Investing on X

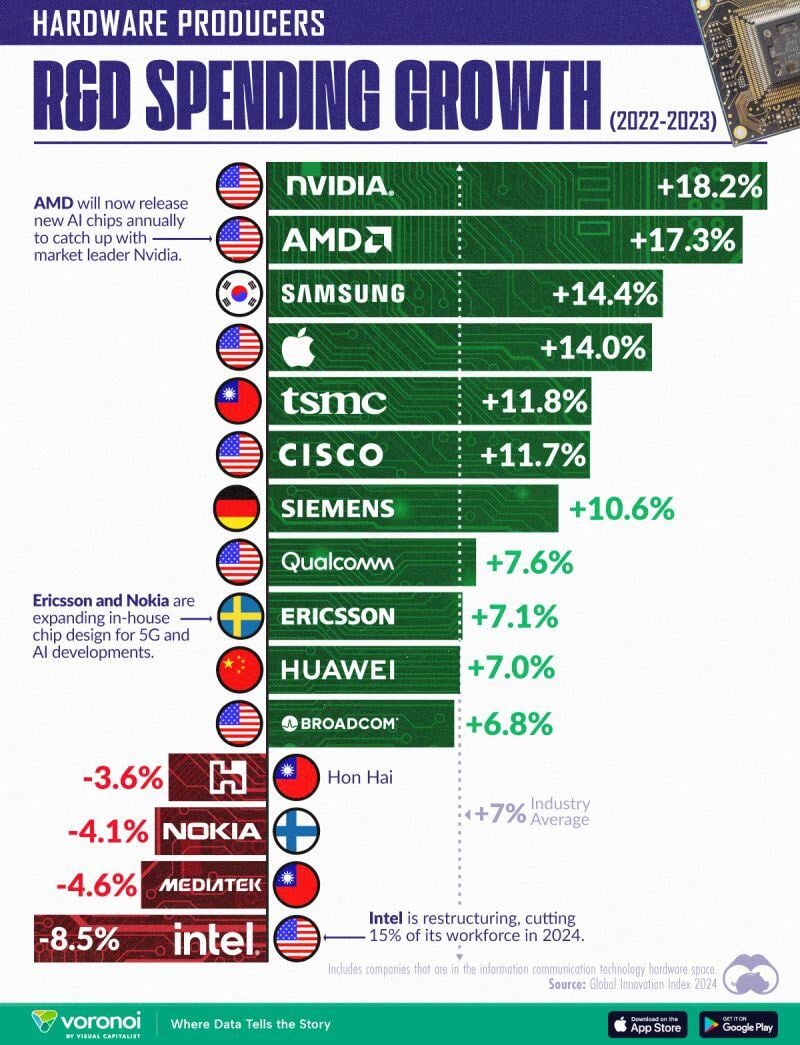

Ranked: Tech Manufacturers by R&D Investment Change in 2023

Source: Visual Capitalist

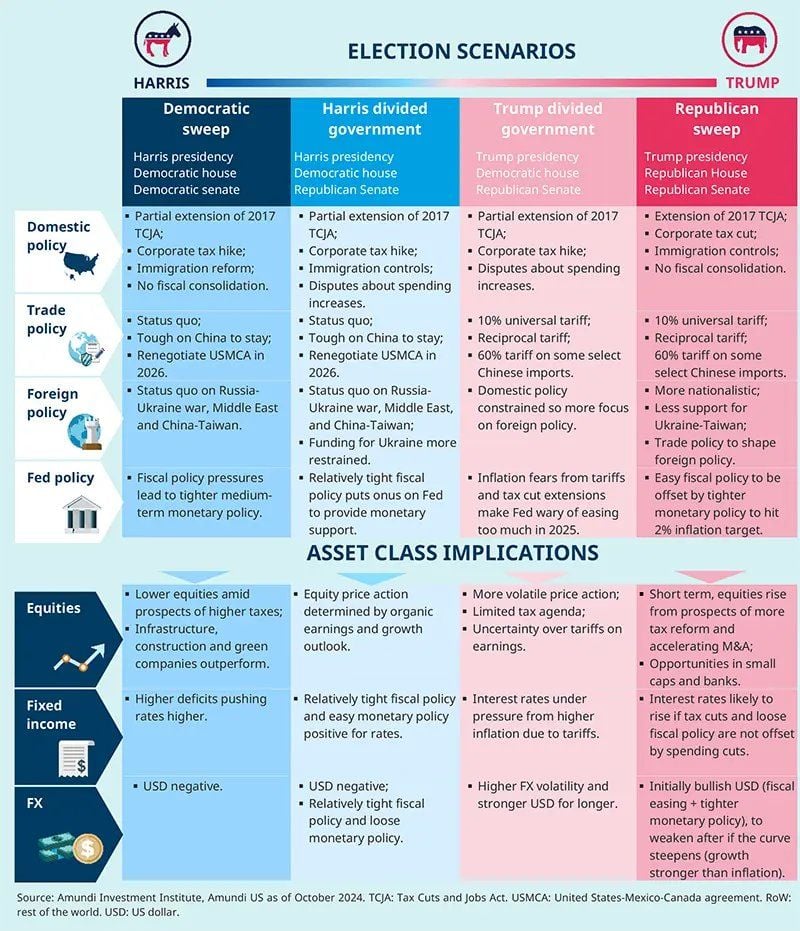

Goldman has some potential reaction functions:

* Trump w/ Republican Sweep = 25% probability; S&P +3% * Trump w/ Divided Government = 30% probability; S&P +1.5% " Harris w/ Democratic Sweep = 5% probability; S&P -3% * Harris w/ Divided Government = 40% probability; S&P -1.5% Source: Carl Quintanilla on X, Goldman Sachs

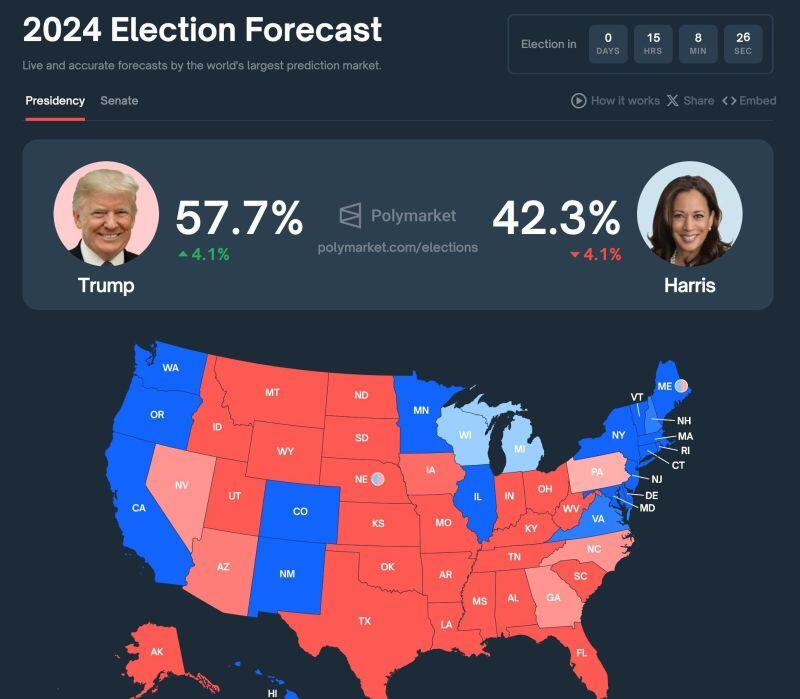

Trump's odds are back on the rise.

🟥 Trump • 57.7% chance 🟦 Harris • 42.3% chance Tomorrow is election day. Source: Polymarket

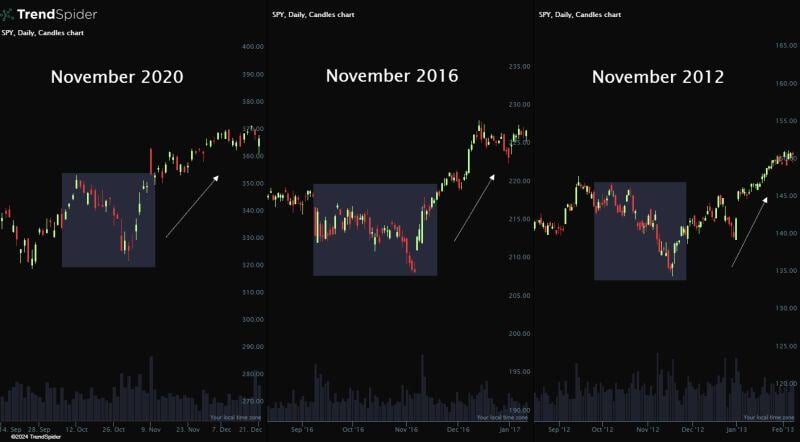

$SPY Price Action Around Elections

In the last three election cycles, we've seen risk-off behaviour before the vote, followed by a strong rally in the weeks that follow. This year’s pattern is shaping up similarly, will history repeat? Source: TrendSpider @TrendSpider

Investing with intelligence

Our latest research, commentary and market outlooks