Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A fascinating chart by James Bianco ->

The 10-year yield (blue) and Trump's Political Betting probabilities (orange). The chart starts the day Biden dropped out. Coincidence, or are these series related? If they are related, what happens to 10-year yields if the orange line (man) goes to 100 in 14 days? Source: Bianco Research

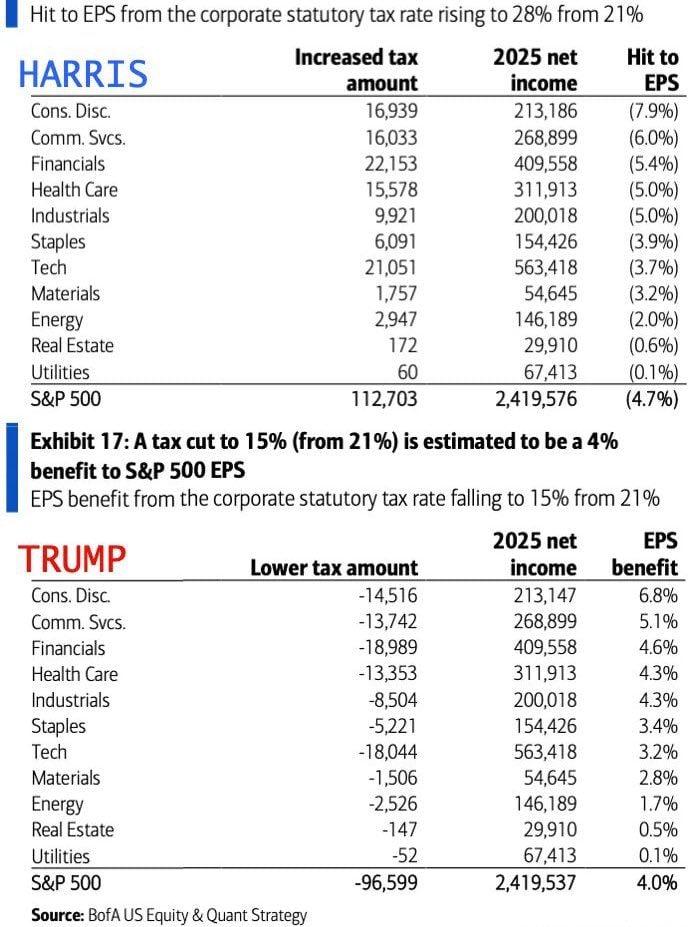

What could be the tax effects on SP500 EPS based on a Trump or Harris win? Here's what BofA projects:

- They said a Harris administration would be a 4.7% headwind to overall S&P EPS growth and a Trump administration would be a 4% tailwind to S&P earnings. - The only caveat here is if we have a split congress. If so, Kamala may win but not be able to pass sweeping tax policies. Given current market action, it seems the market is currently pricing in those 2 scenarios: 1) Either Trump wins 2) or if Kamala does, she can’t pass her new tax policies because of a divided congress. Source: amit @amitisinvesting on X, BofA

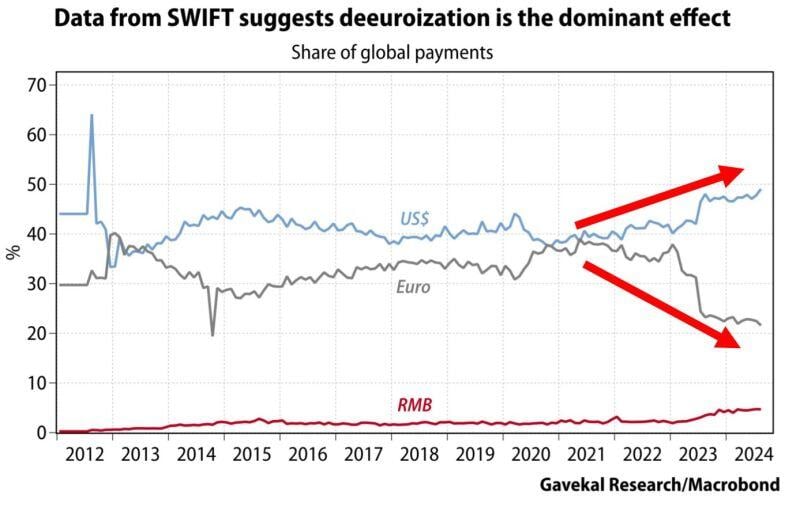

⁉️IS THE US DOLLAR RESERVE CURRENCY STATUS STRENGTHENING⁉️

The US Dollar share in global payments jumped to 49% in 2024 the highest since 2012. This is up from ~40% at the beginning of 2022. The Euro share has plummeted to ~21%. The US dollar fall does not look so imminent. Source: Global Markets Investor

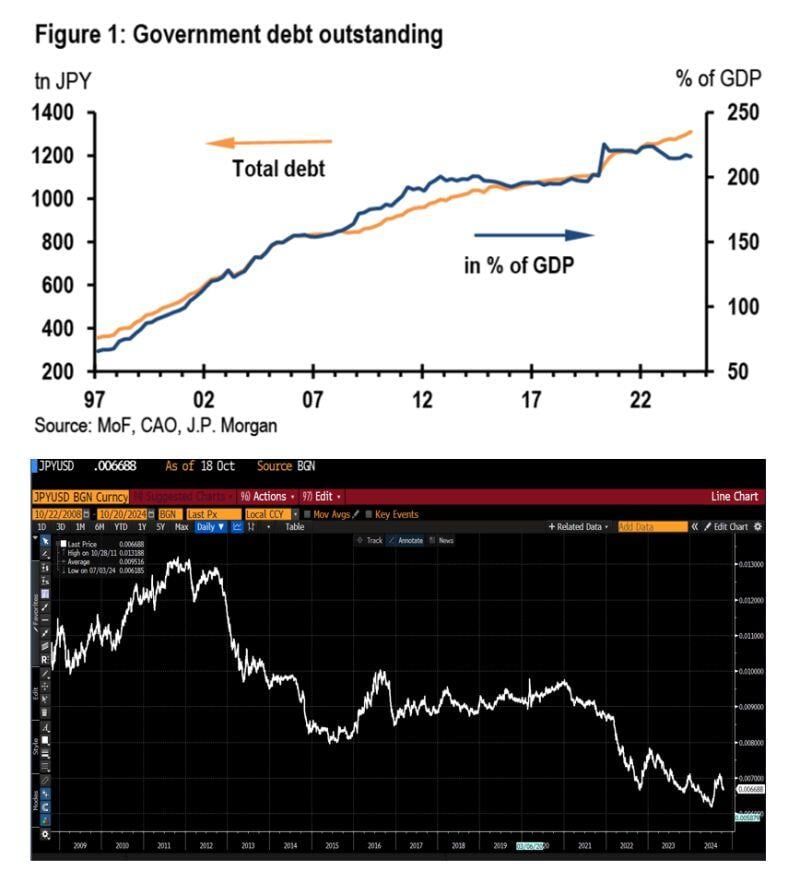

Japan is the perfect example of the failure of Keynesian policies.

More government spending only generates more debt and stagnation, and with years of printing, the yen keeps depreciating. Graphs JP Morgan and Bloomberg thru Daniel Lacalle on X

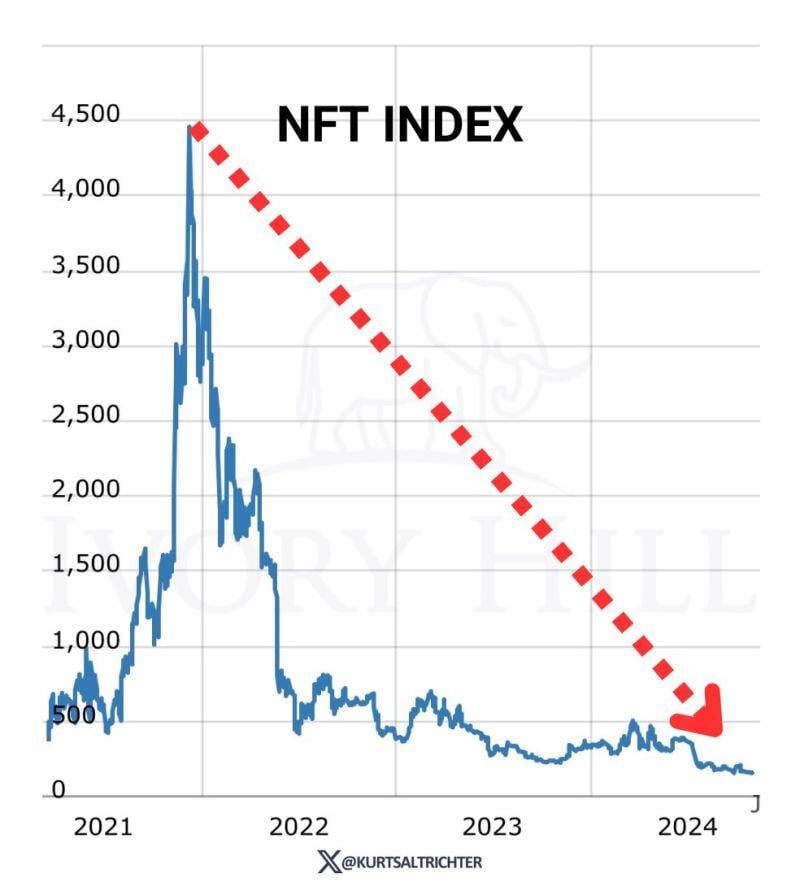

The NFT bubble was as bad as the Tulips one.

They aren’t ever coming back. Imagine paying $1 million for one a few years ago Source: tealthQE4 (@QE Infinity) on X

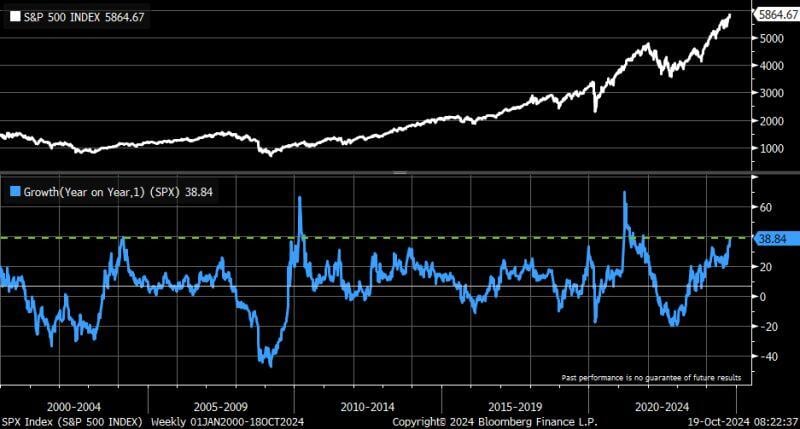

This is quite impressive ... the S&P 500 is up by 38.8% year/year.

Going back to 2000, there are only 25 weeks that had stronger gains, 24 of which were either in 2010 or 2021. Source: Bloomberg, Kevin Gordon on X

Investing with intelligence

Our latest research, commentary and market outlooks