Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

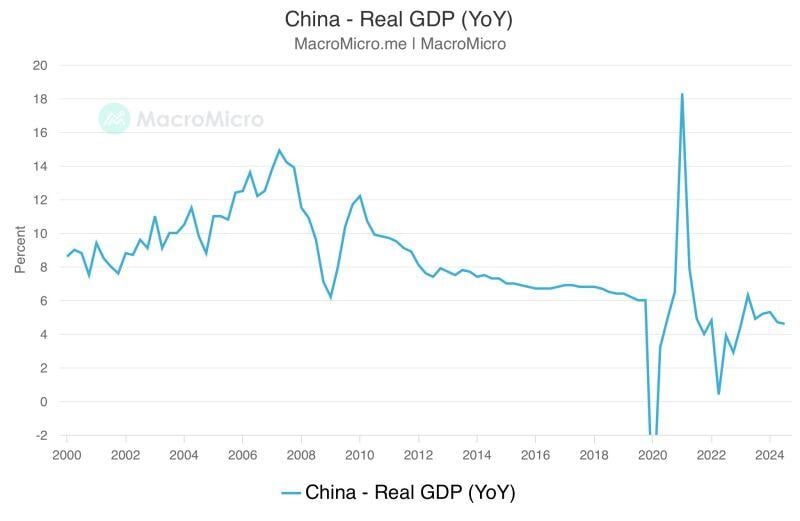

China's Q3 GDP hits weakest pace since early 2023, backs calls for more stimulus

China's economy grew at the slowest pace since early 2023 in the third quarter, and though consumption and factory output figures beat forecasts last month a tumbling property sector remains a major challenge for Beijing as it races to revitalise growth. See below key China GDP data: Q3 GDP 4.6% y/y [Est.+4.5%] Q1-Q3 GDP 4.8% y/y [Prev.+5.0%] Sept retail sales 3.2% y/y [Est.2.5%] Sept industrial growth 5.4% y/y [Est.4.5%] Jan-Sept fixed asset investment 3.4% y/y [Est.3.3%] Sept Unemployment 5.1% [Prev. 5.3%] Source: Reuters, MacroMicro

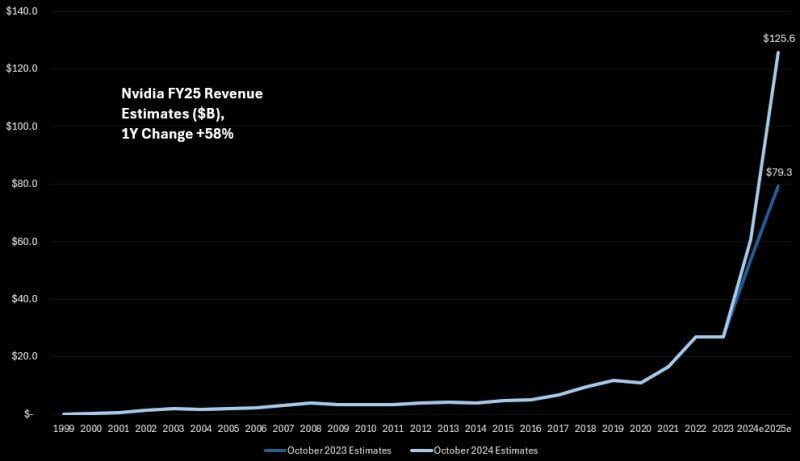

One year ago, Nvidia $NVDA was estimated to generate $79.3 billion in revenue in FY25.

Now, Nvidia is estimated to generate more than $125.6 billion in FY25. Source: Beth Kindig @Beth_Kindig

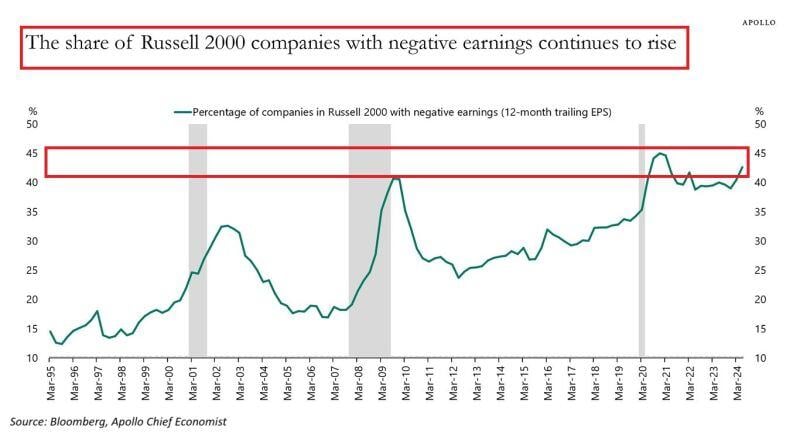

🚨THE NUMBER OF ZOMBIE COMPANIES IN THE US IS SKYROCKETING🚨

43% of the Russell 2000 companies are unprofitable, the most since the COVID CRISIS. At the same time, interest expense as a % of total debt of the Russell 2000 firms hit 7.1%, the highest since 2003. Source: Global Markets Investor

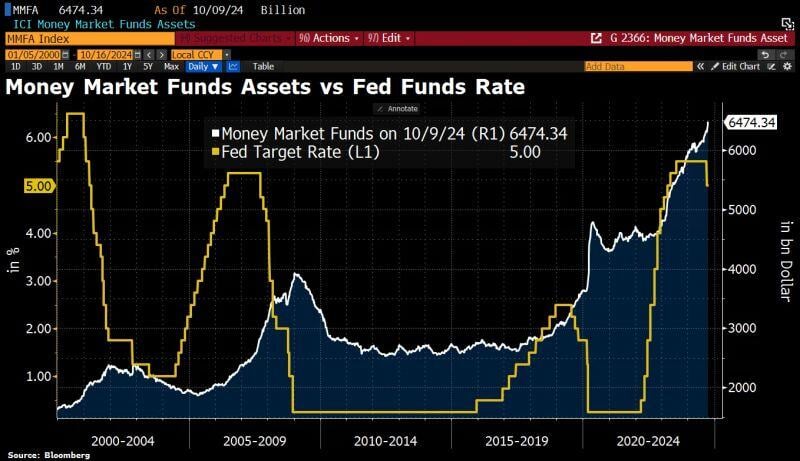

Mind the gap: Assets in US money market funds have hit a fresh ATH at $6.5tn, although the relevant Fed Funds Rates have fallen and are likely to fall further.

Note however that the "relative" figures (i.e money market funds AuMs as a % of total assets AuMs) currently stand at all-time low whereas equities weight is at all-time high... Source. Bloomberg, HolgerZ

There it is: Trump now leads in every battleground state, according to Polymarket

(chart via BBG ECAN) Source: www.zerohedge.com

BREAKING 🚨: Chinese Stocks enter technical correction after falling more than 10% from the October 8th high

Source: Barchart

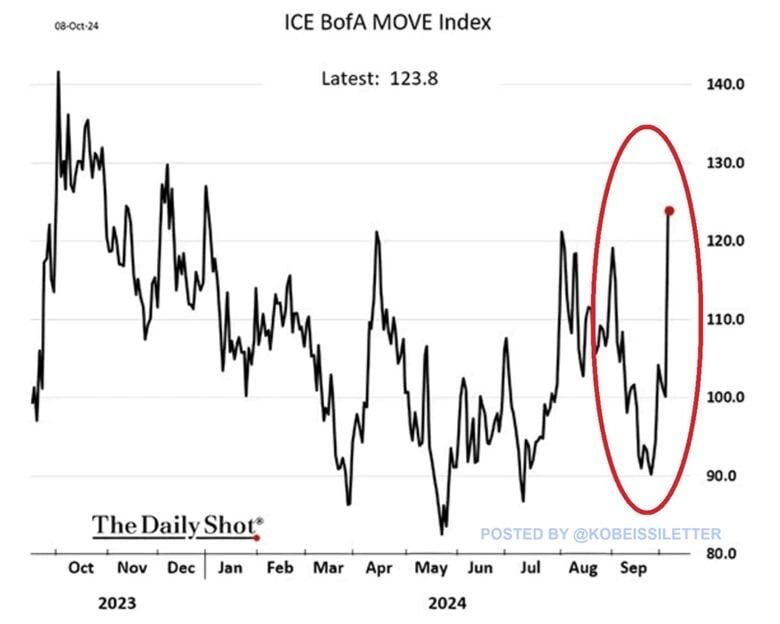

Bond market volatility is spiking:

The ICE BofA MOVE Index hit 123.8 points last week, the highest level since January. The MOVE index, also called the “VIX of bonds” is a metric measuring yield volatility of 2-year, 5-year, 10-year, and 30-year Treasuries. The index has skyrocketed 38% in just 3 weeks as yields started rising following the Fed's decision to cut rates by 50 bps. Over this period, the 10-year Treasury yield jumped from 3.64% to 4.10%. At the same time, the popular bond-tracking ETF, $TLT, fell by 6.8%. What happened to the "Fed pivot?" Source: The Kobeissi Letter, The Daily Shot

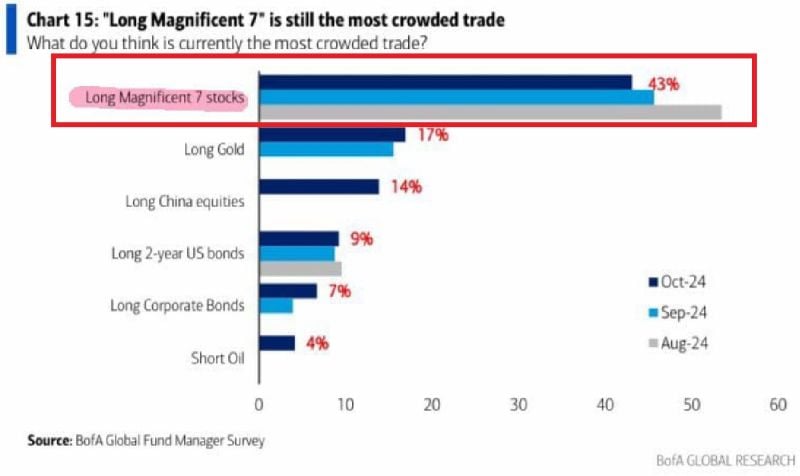

🔥LONG MAGNIFICENT 7 IS THE MOST CROWDED TRADE ACCORDING TO GLOBAL INVESTORS🔥

43% of global investors* believe Long Magnificent 7 is the most crowded trade, down from ~54% in August. Has the trade become overcrowded? *BofA survey of 195 participants with $503 billion assets. Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks