Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

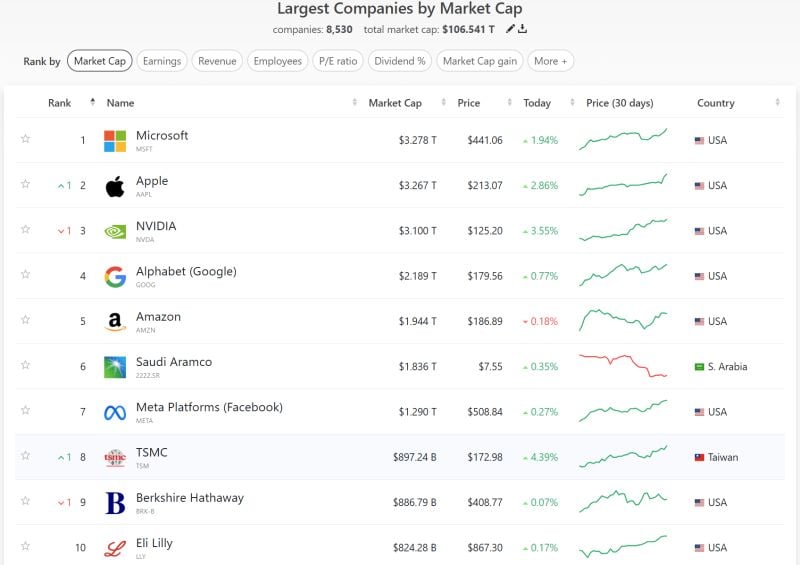

Apple almost overtook Microsoft as the largest market cap in the world.

Source: Companies Marketcap

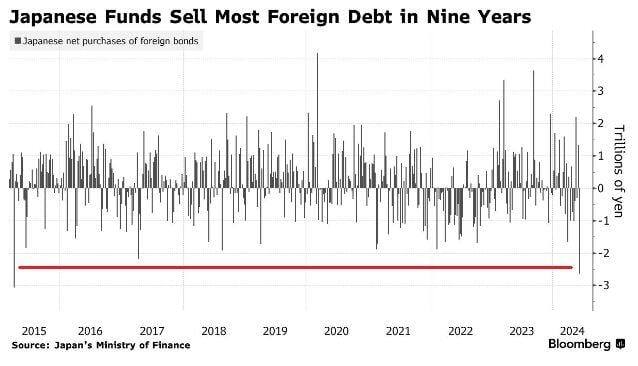

japan just sold $17 billion worth of Foreign Debt, the largest sale in 9 years...

Source: Bloomberg, Barchart

s de-dollarisation (or at least attempts of de-dollarisation) accelerating?

=> Saudi Arabia ditches US dollar and will NOT renew the 50 year 'petro-dollar' agreement with the United States. Saudi Arabia will now sell oil in multiple currencies, including the Chinese RMB, Euros, Yen, and Yuan, instead of exclusively in US dollars. => Russia's Moscow Stock Exchange suspends all trading in $USD & $EUR => El Salvador securities market launching on liquid with trading pairs in Bitcoin Source: radar, Global Times

BREAKING: May PPI inflation was unchanged, at 2.2%, below expectations of 2.5%.

Core PPI inflation fell to 2.3%, below expectations of 2.4%. This ends the first 3 consecutive monthly increase in PPI inflation since April 2022. Another welcomed sign by the Fed after CPI. YoY Growth: PPI (May), 2.2% Vs. 2.5% Est. (prev. 2.2%) Core PPI, 2.3% Vs. 2.5% Est. (prev. 2.4%) MoM Growth: PPI (May), -0.2% Vs. 0.1% Est. (prev. 0.5%) Core PPI, 0.0% Vs. 0.3% Est. (prev. 0.5%)

TotalEnergies Reaching Support Zone

TotalEnergies (TTE FP) is reaching its first support zone between 60.90-62.30. It is also at the 61.8% Fibonacci retracement level. Keep an eye on it. Source : Bloomberg

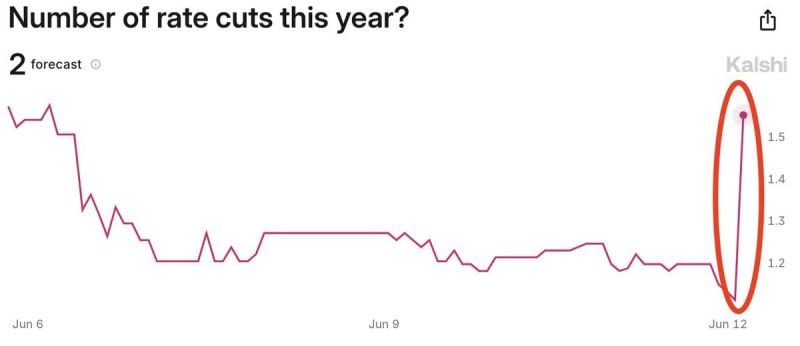

BREAKING: Prediction markets officially price-in 2 interest rate cuts this year after CPI inflation data.

The odds of no cuts have fallen from 33% to 24% over the last few minutes, according to @Kalshi. Meanwhile, market implied odds of exactly 2 rate cuts have spiked from 21% to 35%. Less than 2 months ago, the base case showed 0 rate cuts in 2024 with odds of rate HIKES spiking. 6 months ago, markets showed a base case of 6 interest rate cuts in 2024. Source: The Kobeissi Letter

The global debt crisis: Total world governments' debt hit a whopping $315 trillion in Q1 2024, a new all time high.

In Q1 alone, total global debt increased by $1.3 trillion. At the same time, emerging markets debt hit $105 trillion, rising by ~$50 trillion in just a decade with the biggest increase in China. Across developed markets, the US and Japan have added the most debt. Currently, the global debt-to-GDP ratio has surged to 333%, just below a record high of 362% in 2021. Debt is becoming the global "solution." Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks