Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

France 10y risk spread over Germany keeps rising. Jumps to 62bps.

Source: HolgerZ, Bloomberg

2024 is a year with an extremely busy election agenda. Don't believe in all what they say..

Source image: Asif Majid

The US is adding almost $100B of deficit PER WEEK

Source: Geiger Capital

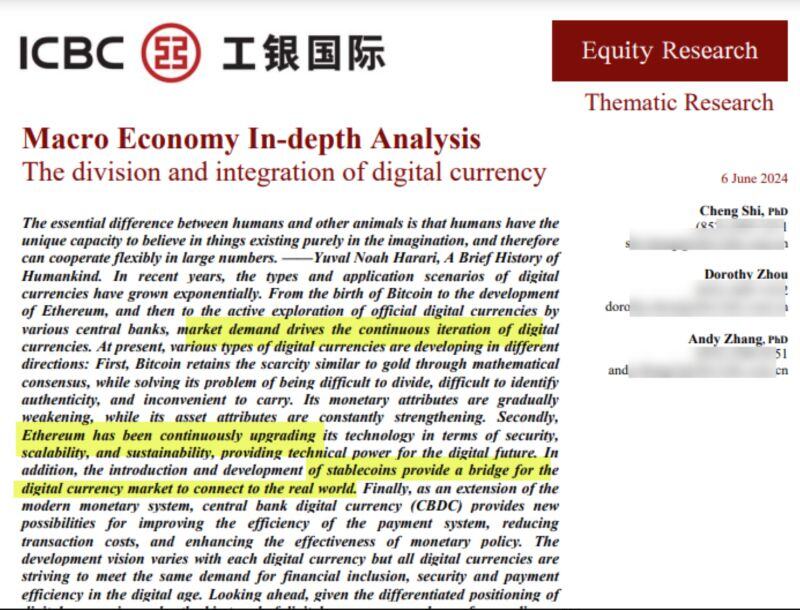

🚨WORLD'S LARGEST BANK, ICBC, CALLS ETHEREUM "DIGITAL OIL"

ICBC: “Ethereum has been continuously upgrading its technology in terms of security, scalability and sustainability, providing technical power for the digital future. In addition, the introduction and development of stablecoins provide a bridge for the digital currency market to connect to the real world.” ICBC described Ethereum as the “digital oil.” Being Turing-complete and having its own programming language, Solidity, allows developers to deploy complex smart contracts and dApps. This has made Ethereum the mainstay in inventive new fields such as NFTs and DeFi “and is gradually extending to the physical infrastructure network.” Source: Crypto News Flash thru Mario Nawfal

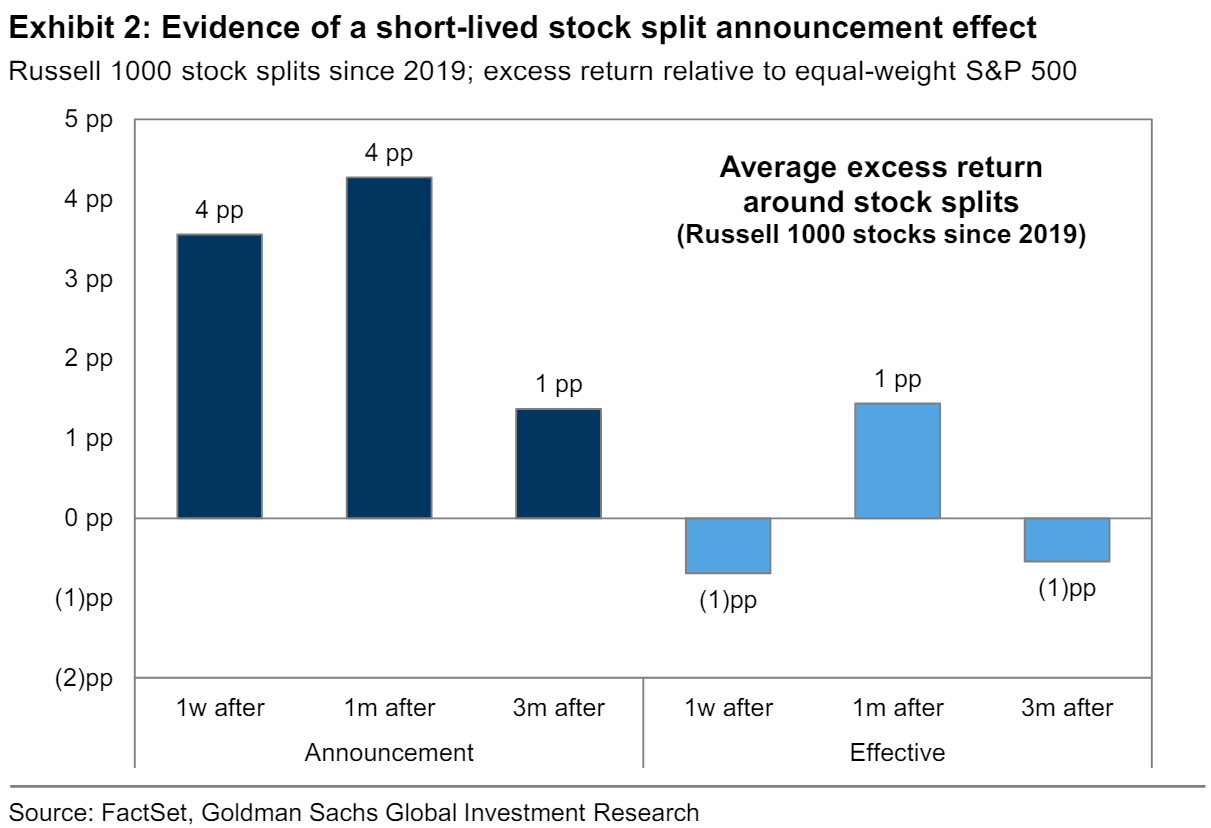

Goldman Sachs on the mixed impact of corporate stock splits

“Share prices typically rise after a firm announces a stock split. In theory, there is no change in the underlying value of a company when it splits its stock. However, empirically, the academic literature has generally found positive announcement effects around stock splits. We consider a sample of 46 Russell 1000 firms that completed stock splits since 2019. On average, these stocks generated a 4 pp excess return vs. the equal-weight S&P 500 in the week following stock split announcement. However, the stock price did not evidence a clear reaction after the stock split took effect. In addition, because many companies announce stock splits alongside earnings releases, it can be challenging to know how much of the stock rallies are due to the stock split as opposed to strong earnings results”. Source: Goldman Sachs

Goldman and Bank of America expect another bounce as July Communist Party meeting seen including more support measures.

Source: South China Morning Post

Investing with intelligence

Our latest research, commentary and market outlooks