Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

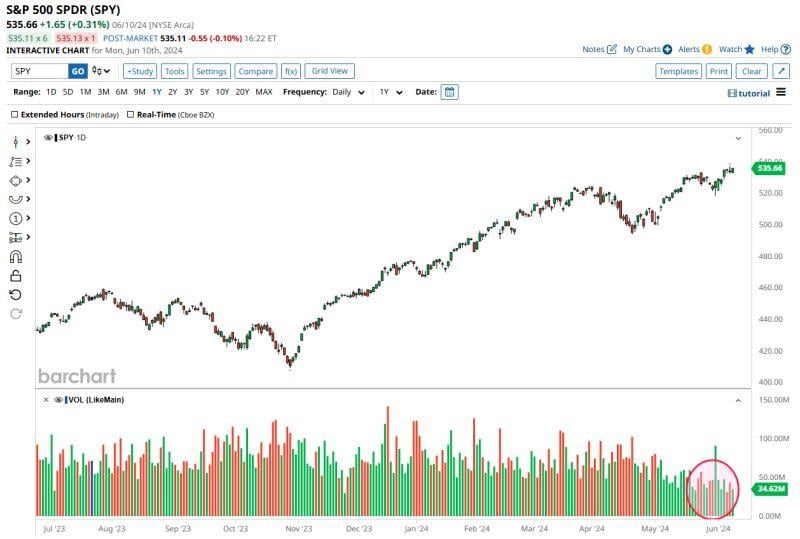

S&P 500 continues to hit record highs on EXTREMELY low volume.

Today was the 4th lowest volume day of the year for $SPY. Three of this year's four lowest volume days have come in the last week. All 4 of the lowest volume days have come in the last 3 weeks. Source: Barchart

Chief executive Tim Cook said the iPhone maker’s 'next big step' will be driven by generative AI and large language models.

Apple on Monday said it has partnered with OpenAI to integrate ChatGPT into its devices, as chief executive Tim Cook set out the iPhone maker’s “next big step” driven by generative artificial intelligence and large language models. Cook and his team outlined upgrades to the company’s software ecosystem coming this year at Apple’s annual developer conference on Monday, aiming to leverage the power of AI to provide a smarter Siri voice assistant and more personalised features on its devices to enhance productivity and tap into more advanced computer intelligence. This year’s Worldwide Developers Conference has been watched especially closely as investors waited to see how Cook will position the company to take advantage of generative AI, amid concerns it is falling behind its Big Tech competitors. Link >>> https://lnkd.in/eNQdmDW9 Source: FT

Billionaire Elon Musk said he would ban Apple devices from his companies if OpenAI’s software is integrated into the products at the operating system level.

In a series of posts on his social media platform X, Musk shared concerns about whether Apple and OpenAI will protect users’ information. He called the software integration between the two companies “an unacceptable security violation,” and said Apple has “no clue what’s actually going on.” “It’s patently absurd that Apple isn’t smart enough to make their own AI, yet is somehow capable of ensuring that OpenAI will protect your security & privacy!” Musk wrote after the event. The remarks followed a presentation Monday by Apple, when it said that customers would have access to OpenAI’s ChatGPT chatbot through the Siri digital assistant. Apple plans to roll out the capabilities as part of a suite of new AI features later this year. Musk co-founded OpenAI but had a falling out with the San Francisco-based startup. Source: HolgerZ

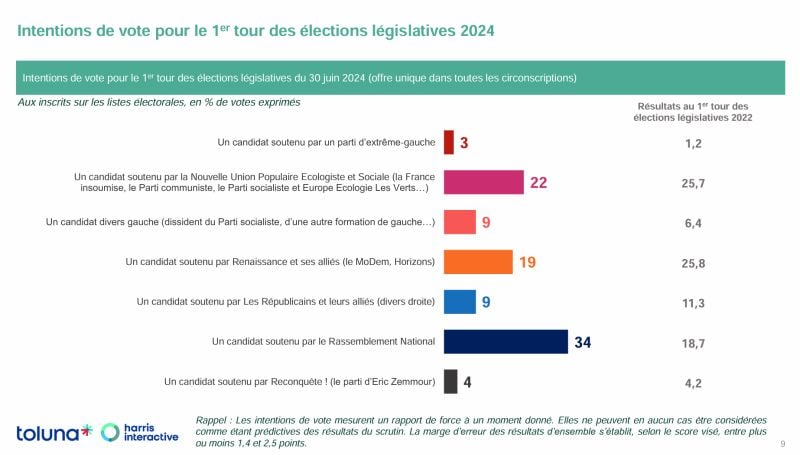

FRENCH POLITICS >>>

With 20 days to go to the lower house snap elections, a poll credits Marine Le Pen RN with 34% of the vote, far ahead of the left & far-left coalition and the Macron camp. One election can hide another. No sooner have the results of the European elections been announced than all eyes have turned to the early legislative elections. With 20 days to go to the first round, a Toluna Harris Interactive poll for Challenges, M6 and RTL puts the Rassemblement National (RN) well ahead. If the legislative elections had been held today, the Rassemblement National would have won 34% of the vote. A clear improvement on the 18.7% recorded in 2022. Long under-represented in the Assembly, the RN would be the leading force in the lower house. However, as the legislative elections will be held in 577 constituencies over two rounds, it is very difficult to project a precise number of seats. For the time being, it's impossible to know whether the Marinist troops will win an absolute or even a relative majority. Nevertheless, they seem to be well positioned to win the election, especially if they can create a coalition with other right-wing parties and traditional right. A win by RN could lead to a cohabitation with Jordan Bardella (RN) as Prime Minister. Source: Le Figaro

** Regional Banking Crisis Alert! **

**Huntington Bank Spooks Investors Yesterday, Shares Plunged 6%** - **New Guidance:** Net interest income to fall 1% to 4% this year - **Previous Range:** -2% to +2% - **Impact:** Largest drop since March 2023 Source: The Coastal Journal

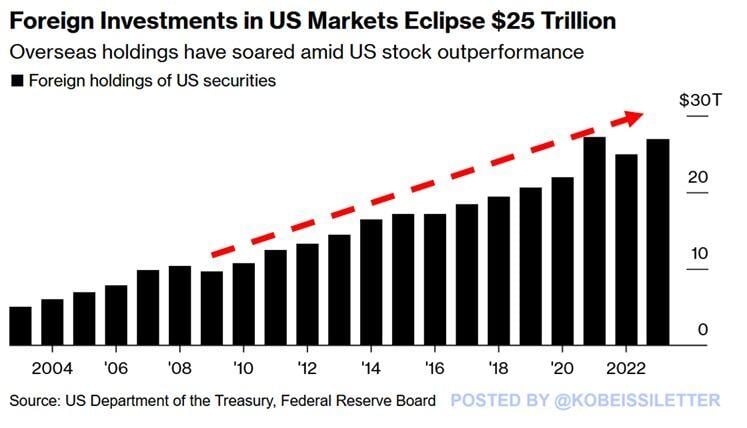

Foreign investors are piling into US markets:

Foreign holdings of US securities have hit ~$27 trillion in 2023, near the all-time highs seen in 2021. Since 2009, foreign investments in US markets have skyrocketed by 180%. This comes after the S&P 500 has gained 573% during this time materially outperforming other markets such as the EU, Canada, and Japan. Meanwhile, foreign investors’ share of the $78 trillion US equity market has risen to ~17%, an all time record. Source: Bloomberg, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks