Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Positive market breadth ALERT >>>

77% of S&P 500 stocks are now trading above their 200-day moving average, one of the highest levels in the last 2 years Source: Barchart

Home Depot testing strong support again

Home Depot (HD US) has just tested support zone 330-335 after earnings report. Keep an eye at this important level. Source : Bloomberg

Meme Stocks' Performance on Monday:

1. Gamestop, $GME: +110% 2. AMC Entertainment, $AMC: +25% 3. Reddit, $RDDT: +15% 4. Spirit Airlines, $SAVE: +15% 5. Lucid Motors, $LCID: +13% 6. Rivian, $RIVN: +10% 7. Nio, $NIO: +10% 8. ContextLogic, $WISH: +9% Monday alone, meme stocks have officially added over $10 BILLION in market cap. Over the last 3 weeks, these stocks have added nearly $25 billion in market cap. Most meme stocks all hit multi-year highs on the return of "Roaring Kitty" on Monday... How high can this go? Source: The Kobeissi Letter

BREAKING 🚨: GameStop Short Sellers

Short Sellers in $GME have reportedly lost more than $1 billion from Monday's huge move according to S3 partners Gamestop, $GME, is now a $10 BILLION company for the first time since October 2022. The stock was up 91% on Monday and has been halted FOUR times. Since April 23rd, $GME has now added $6 BILLION in market cap. The return of "Roaring Kitty" to X has sparked a return of the 2021 meme stock rally. As a result, $GME is now one of the 600 largest public companies in the US.,, Source: Barchart, The Kobeissi Letter

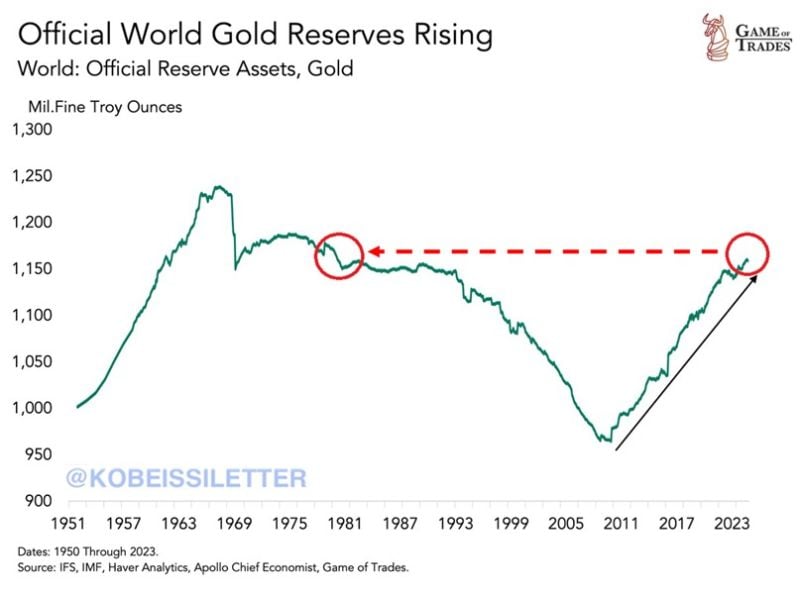

Official world gold reserves have reached 1,170 million fine troy ounces, the most since the 1970s.

Over the last 13 years, world central banks' gold holdings are up roughly 21%. Global gold reserves are now even higher than just before President Nixon broke the US Dollar's link to gold in 1971. In 2022 and 2023 alone, world central banks bought 1081 and 1037 tons of gold, respectively. Meanwhile, gold is up 15% year to date and 85% over the last 5 years. Source: The Kobeissi Letter

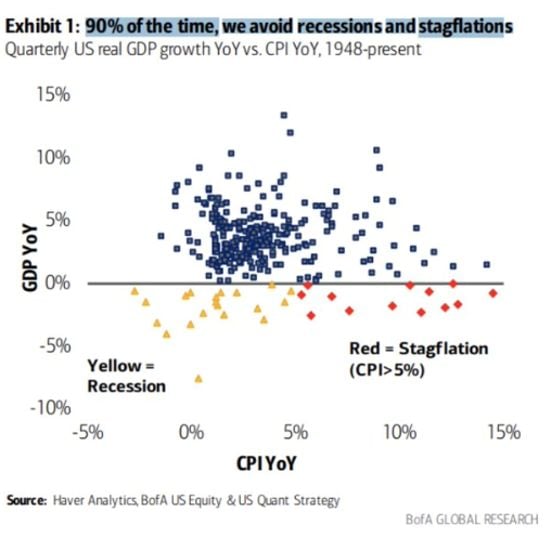

Recession and stagflation don't happen often in the grand scheme of things... 90% of the time we avoid them...

Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks