Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

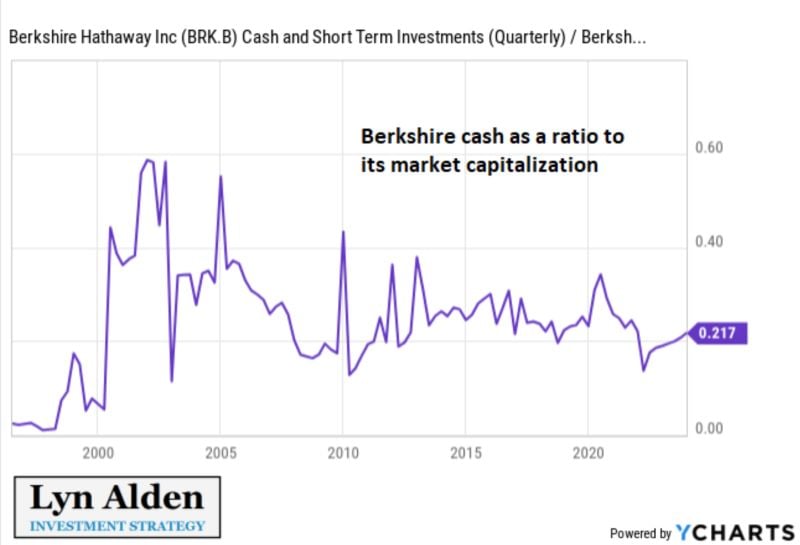

As highlighted by Lyn Alden ->

"People often report the nominal amount of cash that Berkshire $BRK.B has, as though Buffett is hoarding cash. You can't just look at the nominal cash level. All of Berkshire's numbers go up. An insurer needs a lot of liquidity. His cash as a % of his assets is in a normal range".

Great observation by Dr. Michael Stamos, CFA - Head of Global Research & Development of Global Multi Asset Department at Allianz Global Investors

-> "On days when bonds were up, stocks tended to go up as well. When bonds fell, stocks managed to stay at least flat. Overall it was a pretty nice environment for equity investors. Lets hope this doesn't turn into a high-correlation-when-markets-are-down type of environment".

JUST IN 🚨: Treasury Secretary Janet Yellen says the Bank of Japan BoJ should consult with her before intervening to support Japanese Yen

Source: Barchart

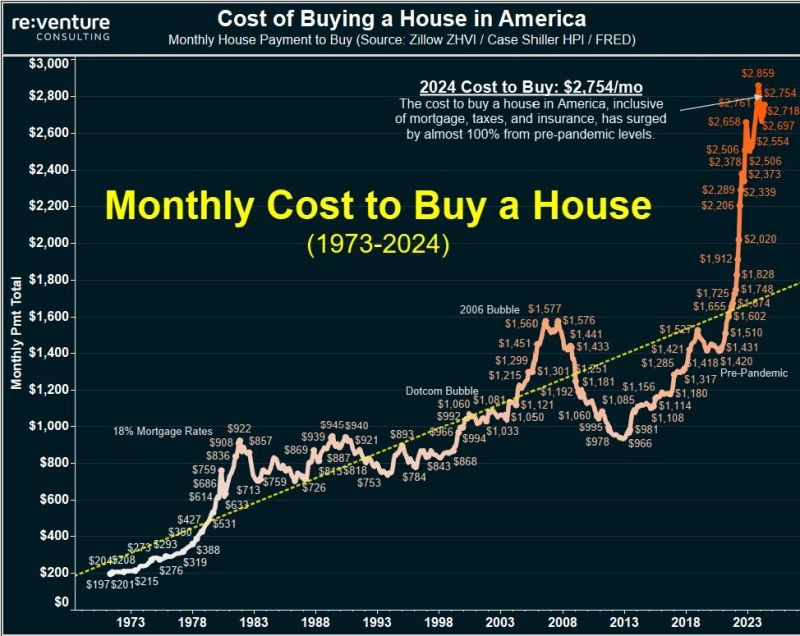

The cost of buying a home in the US rises to $2,750/month, the second highest ever recorded, according to Reventure.

Prior to the pandemic in 2022, the average home in the US would cost $1,400/month. In other words, it is now 100% MORE expensive to buy a home in 2024 compared to 2020. Even at the peak of the 2008 Financial Crisis, the average home payment peaked at $1,550/month. The average US family would need to spend 44% of their PRE-TAX income to buy a home today. Source: The Kobeissi Letter, re.venture

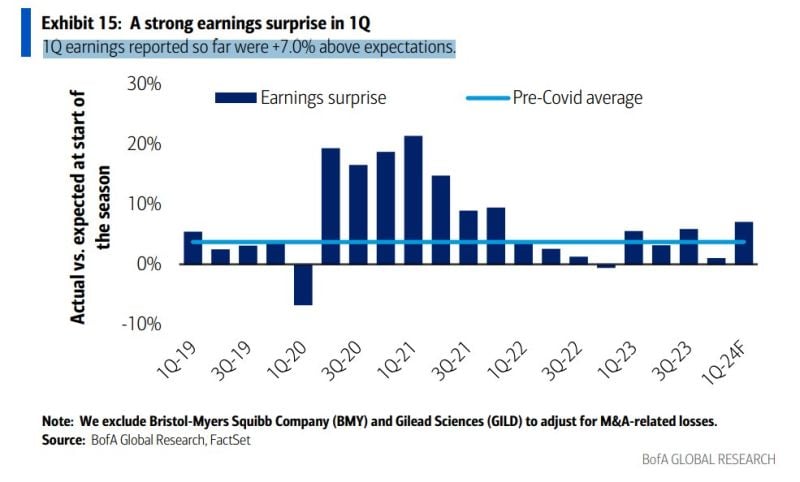

US earnings season UPDATE: 1Q earnings reported so far are +7.0% above expectations. (Clone)

Source: Mike Zaccardi, BofA

US earnings season UPDATE: 1Q earnings reported so far are +7.0% above expectations.

Source: Mike Zaccardi, BofA

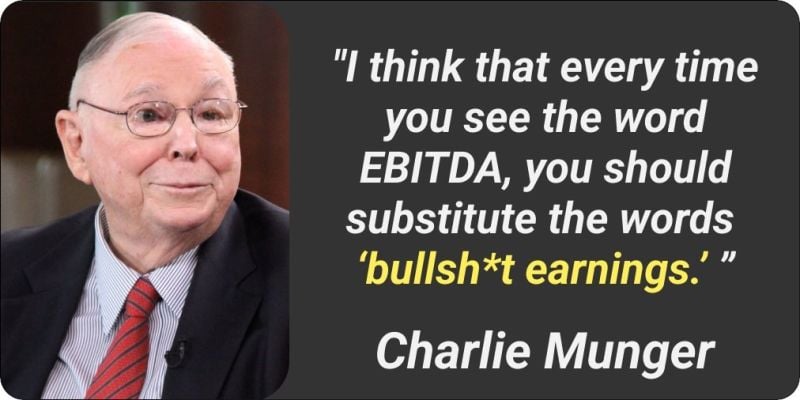

Charlie Munger helped Warren Buffett turn Berkshire Hathaway into one of the most successful companies in the world.

Here's one of his famous quotes... Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks