Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

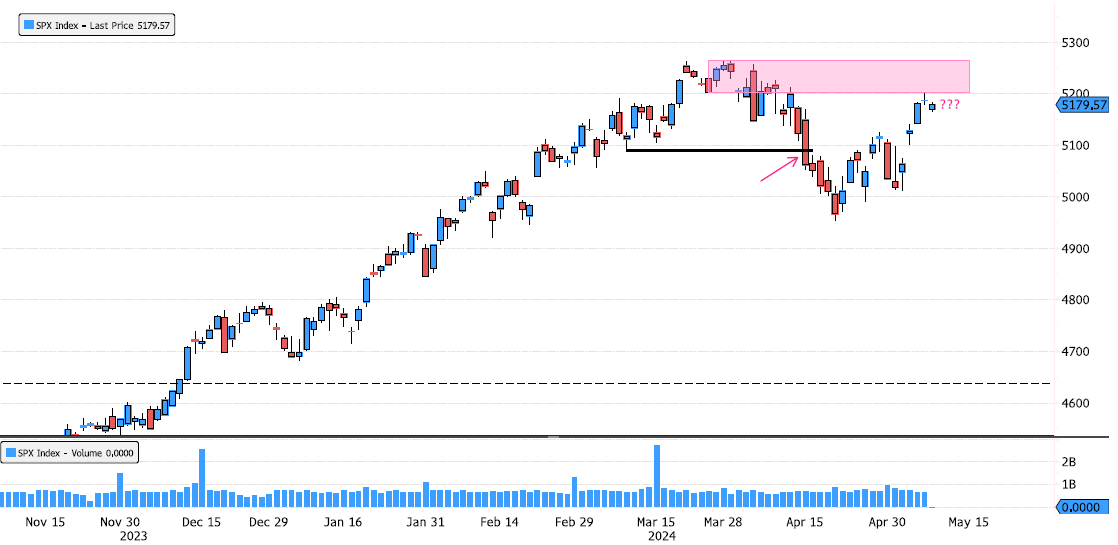

S&P 500 pullback to supply zone

S&P 500 Index broke the swing low on 15th September suggesting a change in trend ! Market has made more than the 50% Fibonacci retracement and is approaching supply zone 5200-5265 !!! Market needs to break 5265 if not risk of pressure will grow. Source : Bloomberg

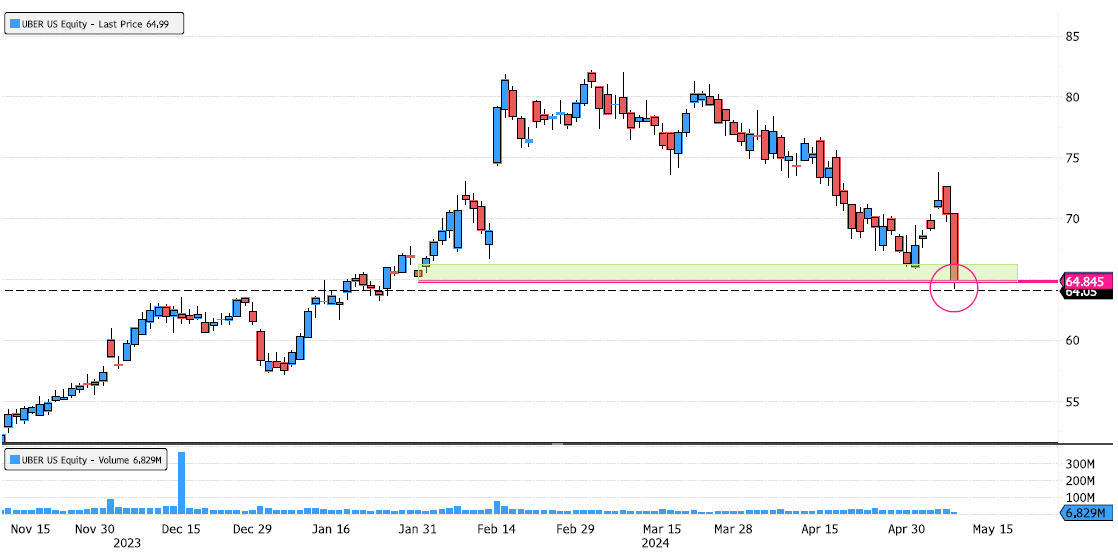

Uber testing again swing low.

Uber (UBER US) is testing for a second time in less than 7 days swing low support 64.84. Keep an eye at this important level. Source : Bloomberg

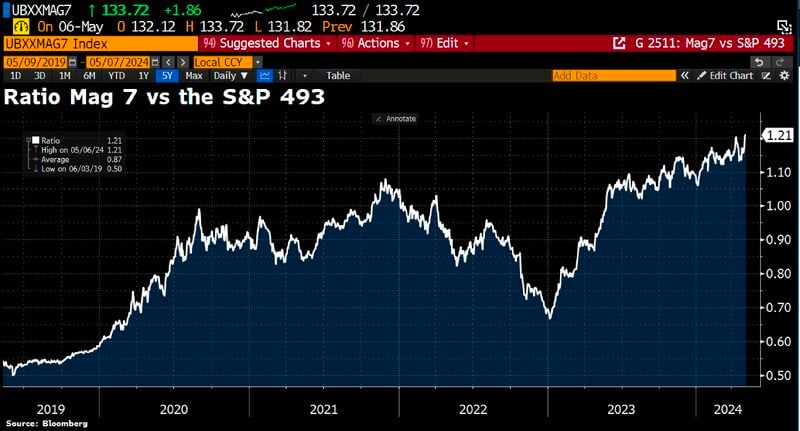

Don't fight the Mag 7?

The ratio of the Mag 7 vs the S&P 493 (S&P 500 ex Mag 7) has just hit another ATH. Source: Bloomberg, HolgerZ

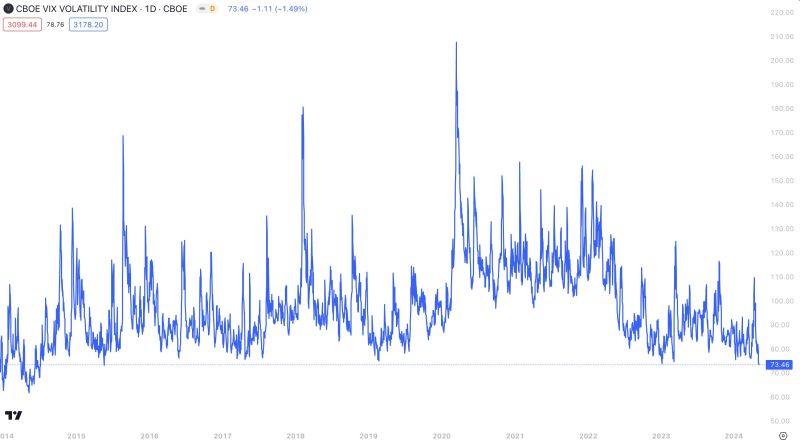

$VVIX just made its lowest close in about 8 years

What is the Cboe VVIX Index? Volatility is often called a new asset class, and every asset class deserves its own volatility index. The Cboe VVIX IndexSM represents the expected volatility of the VIX®. VVIX derives the expected 30-day volatility of VIX by applying the VIX algorithm to VIX options. Source: Swordfishvegetable

Wall Street is turning less negative on China stocks

Source: Daily Compounding

The S&P 500 $SPX - it has now reclaimed its 50D moving average

Source: Barchart

Sell in May and Go Away?

It hasn't worked in the last decade, and it isn't working this year either, with the S&P 500 already up more than 3% this month! Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks