Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

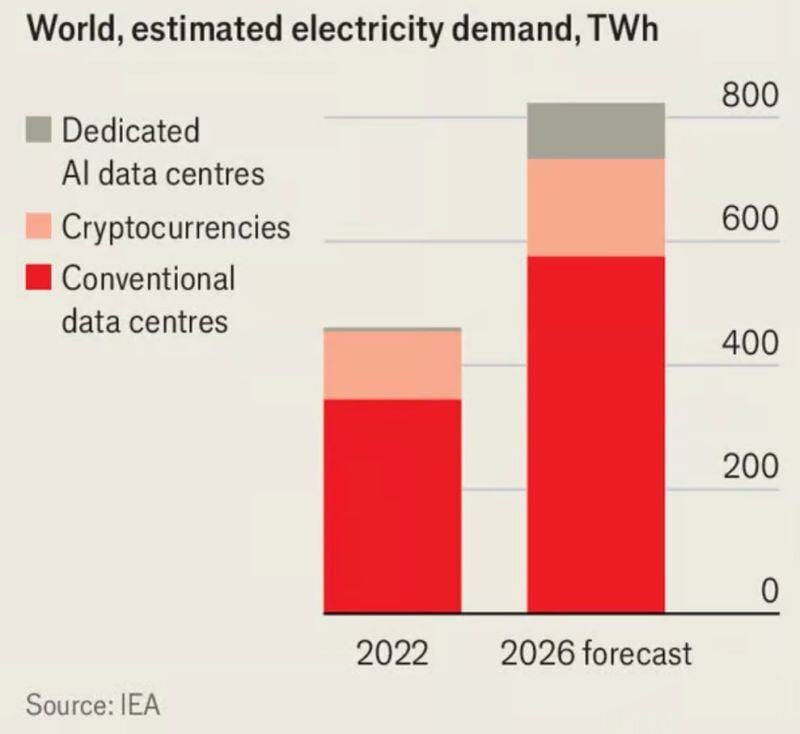

Who needs Mag 7 if one can buy utilities stocks?

Source: Michel A.Arouet

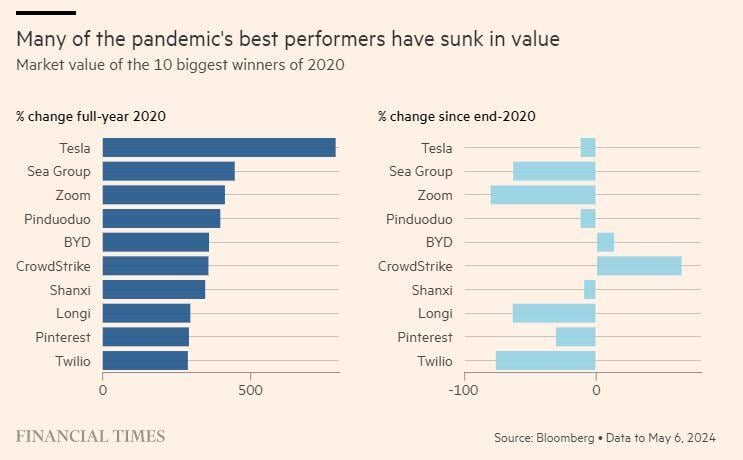

8 of the 10 biggest winning stocks in 2020 have lost value since the end of that year including Tesla $TSLA

Source: Barchart, FT

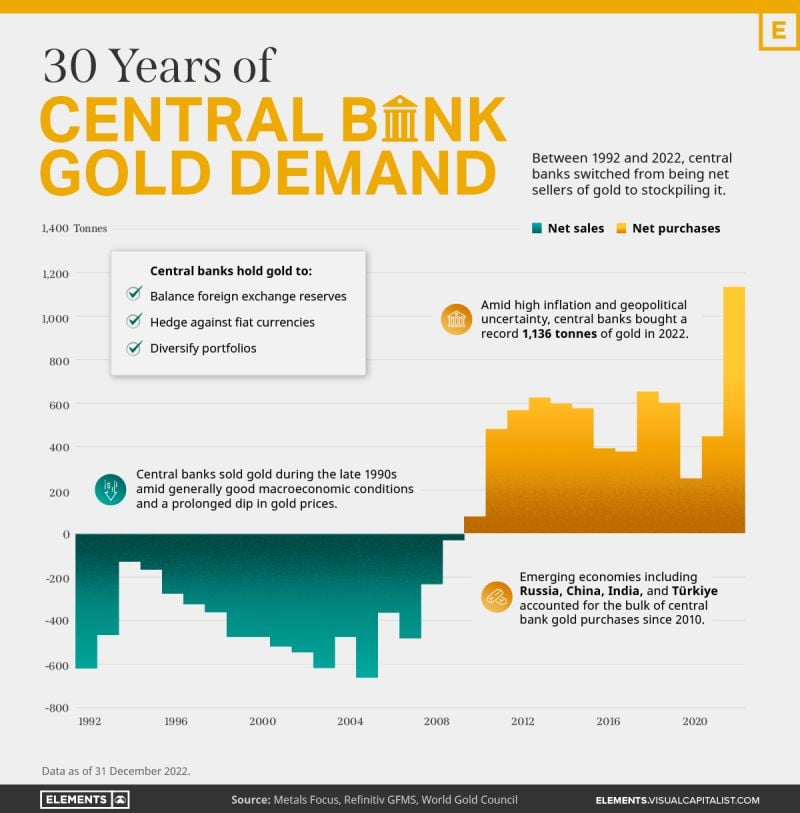

Charted: 30 Years of Central Bank Gold Demand

by Elements / Visual Capitalist

Believe it or not, utilities $XLU is now the best performing SP500 ETFsince the start of the year (+13.4%).

Technology $XLV is in the second half of the ranking (+5.4%). So what's going on? Utilities has been on a run as we are reaching the 2nd derivative of the AI trade. Investment bankers are pushing new AI baskets and many of them include some Utilities stocks. Source: Mike Zaccardi

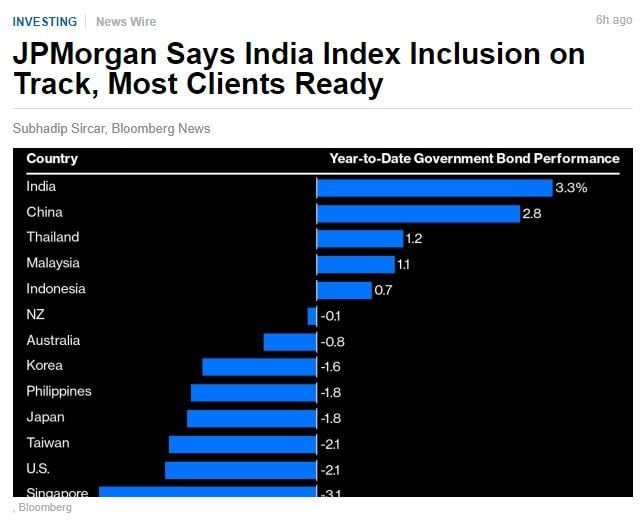

JP Morgan Says India Index Inclusion on Track, Clients Ready.

Firm expects $20 billion to $25 billion of foreign inflows JPMorgan Chase & Co. is on track to include India in its emerging market debt index from June with most of its clients ready to trade despite some “teething issues,” according to the firm’s global head of index research. The difficulty in setting up to trade in India due to an elaborate documentation process has been one reason why foreign investors have been apprehensive about the nation’s entry into global indexes. Last September, JPMorgan said it would include India in its emerging market bond index, where it will have a maximum weight of 10%. JPMorgan estimates foreign inflows will be between $20 billion and $25 billion, assuming an index-neutral position, Kim said. The firm estimates its emerging-market bond gauge currently has $216 billion of assets under management, she added. India’s entry into global bond indexes will open up an insular market where foreigners own just over 2%, helping develop another investor base. It also adds to the growing heft of the nation and its financial markets, which are seen as the next driver of global growth amid China’s economic woes. Indian sovereign bonds have seen about $8 billion of inflows into the so-called Fully Accessible Route securities since the JPMorgan announcement, though there were some outflows in April amid a global debt selloff. A Bloomberg gauge of the bonds has outperformed major peers this year. Source: BNN

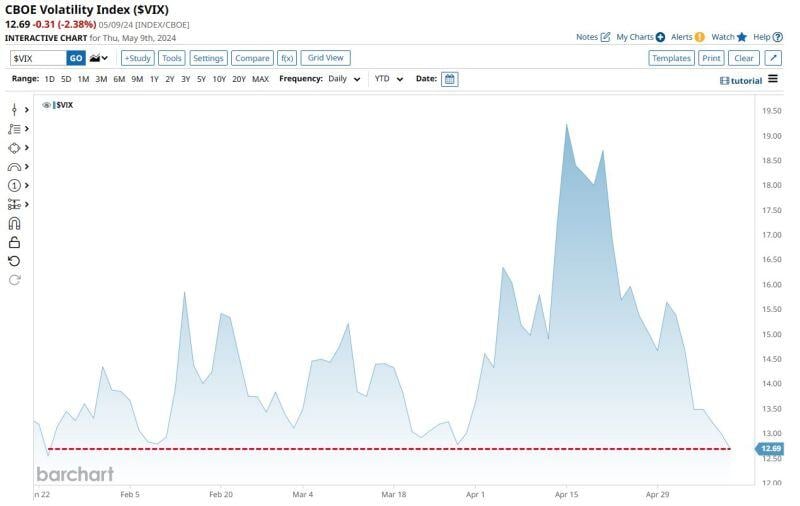

NO FEAR... CBOE Volatility Index $VIX closed at its lowest level since January 23!

Source: barchart

Hong Kong’s New Home Sales Hit Record High of $5.4 Billion

New home sales in Hong Kong surged to a record high in April, as buyers rushed to the market after the government removed property curbs. The value of firsthand residential property sales reached HK$42 billion ($5.4 billion) last month, more than triple the value of transactions in March, according to Ricacorp Properties Ltd. That’s the highest in data going back to 1996. The number of sales at 3,545 was also the most since 2006. This sales boom follows the removal of extra taxes in February, which led Hong Kong’s developers to speed up new project launches and discount properties to capture increased demand. Last month, CK Asset Holdings Ltd. priced its homes in the Blue Coast project roughly 20% lower than nearby competitors, while Great Eagle Holdings Ltd.’s units in the Ho Man Tin area were initially priced at about 30% below nearby new projects that launched a year earlier. Developers are racing to clear their inventory with discounts, after a weak property market in the past year led to the accumulation of unsold homes. The number of properties available in the primary market rose 6% to 91,300 in the fourth quarter of 2023 from three months earlier, according to Jones Lang LaSalle. By comparison, only 13,000 new homes were sold on average every year from 2021 to 2023, government data show.

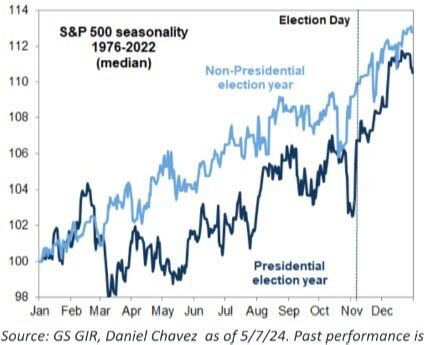

Sell in May and go away? Not in election years…

History shows that the mid-May to mid-June seasonal period is very strong during election years. Source: David Marlin, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks