Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

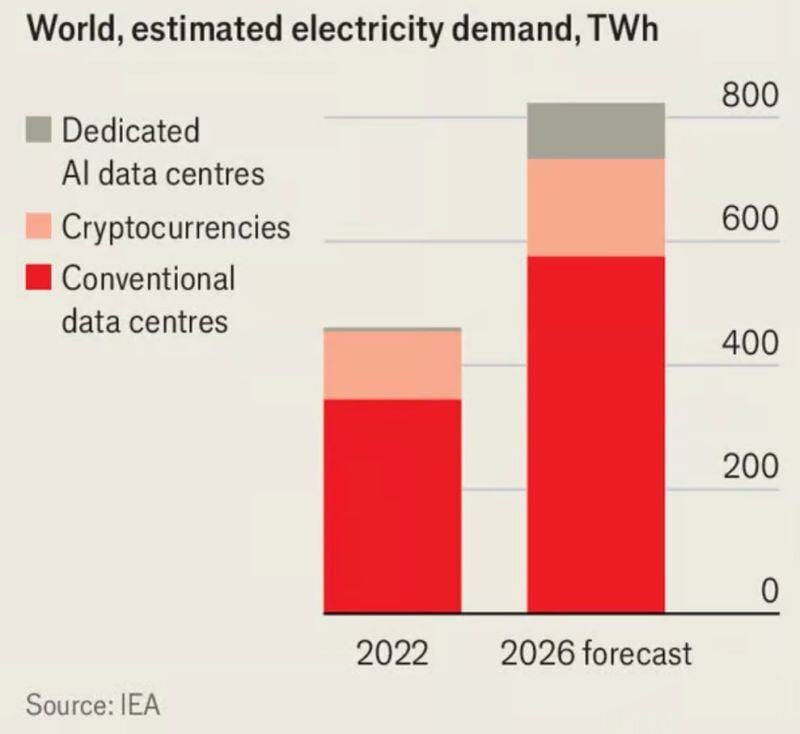

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JUST IN: Argentina to print its first 10,000-peso note as a result of hyper-inflation.

Source: Radar

In case you missed it...

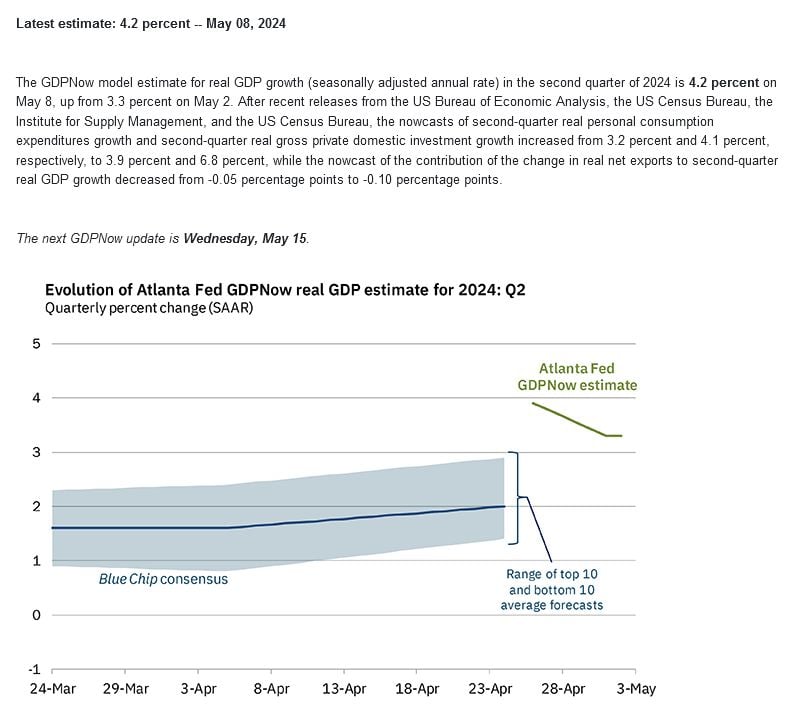

Atlanta Fed US Q2 GDP Now latest 4.18%, vs last 3.31%...

Bank of England declares independence from the US Fed ->

BoE's Bailey pushed back against a slower rate cutting cycle for the UK: “Quite a lot of the market movements of late appear to have been US-originated. Inflation dynamics here are different to inflation dynamics in the US. (It’s a) very different sort of situation in terms of our economies.” Percentage odds of a June cut were similar for the BOE and Fed at the start of the quarter, but now the market sees a wide gap. Source: Jeffrey Kleintop, Bloomberg

Retail investors have bought over $5 billion of leveraged equity ETFs in the last 12 months, the most since 2022.

This marks a $3 billion increase on a 1-month rolling sum basis in just a few months. Since the October 2023 low, retail investors have been piling into leveraged ETFs. However, a similar pattern was seen in 2021 and early 2022 after which retail experienced significant losses. The average retail investor portfolio drawdown from the 2022 peak was 35% and took 1.5 years to recover. Retail risk appetite is near record highs. Source: FT, The Kobeissi Letter

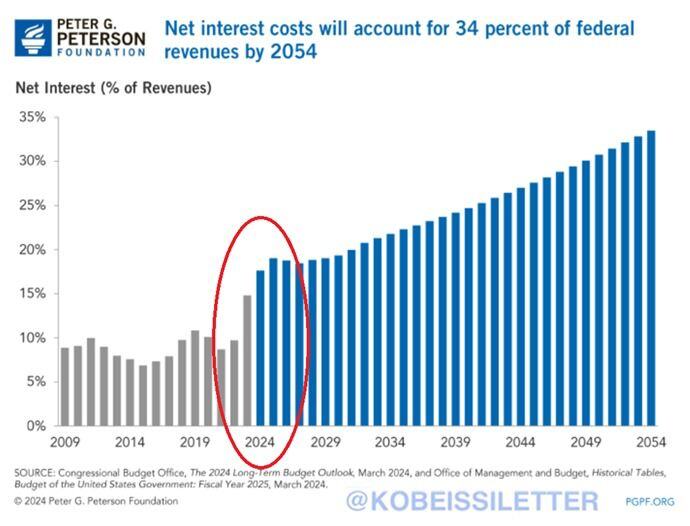

Shocking stat of the day by The Kobeissi Letter:

US net interest payments as a percentage of federal revenues are set to reach 34% by 2054. This means that ONE THIRD of all government revenue would be spent only to service the national debt. Over the past 8 years, the percentage has already doubled to ~15% and is at its highest in 3 decades. Meanwhile, nominal annualized interest payments have crossed above $1 trillion for the first time ever. We could see $1.6 trillion in annual interest expense by the end of the year if the Fed leaves rates steady. The US government needs lower interest rates more than anyone - i.e Fiscal policy leads monetary policy. Source: The Kobeissi Letter, Peter G.Peterson

Who needs Mag 7 if one can buy utilities stocks?

Source: Michel A.Arouet

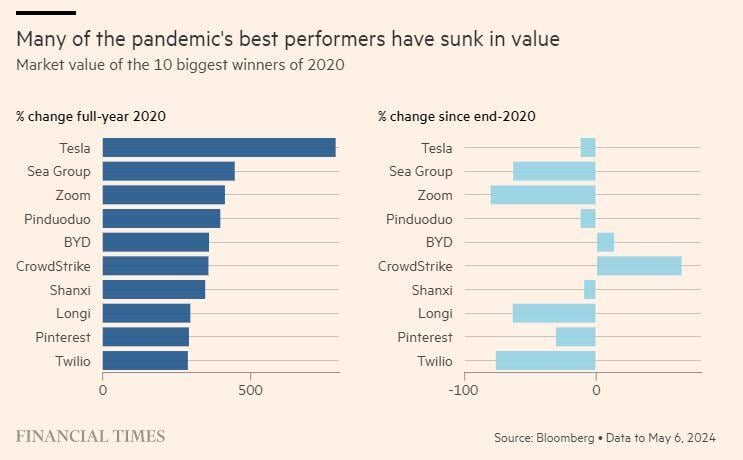

8 of the 10 biggest winning stocks in 2020 have lost value since the end of that year including Tesla $TSLA

Source: Barchart, FT

Investing with intelligence

Our latest research, commentary and market outlooks