Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Chainlink always bullish trend

Chainlink (XLIUSD) always in a bullish trend. Last week consolidation hit a low at 16.84 intraday and a very strong candel reversal with a close above the strong support 17.60. This is good news for the trend. Today up 15%, trying to break all time high 21.709. Keep an eye at that level. Source : Bloomberg

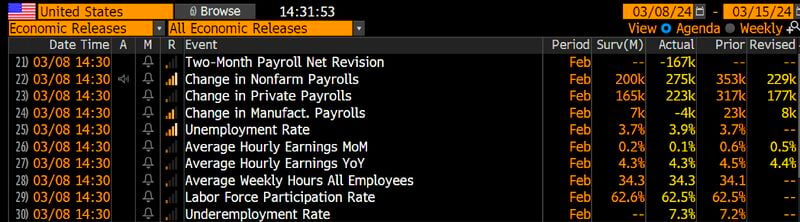

A "Goldilocks" us job report -> risk assets

Gold and digital gold rally after a soft US Jobs report. February Non-Farm-Payrolls beat estimates with 275k new jobs BUT 2 months revisions look notable with -167k. Unemployment rate rose to 3.9% from 3.7% and hourly earnings weaker than expected w/+0.1% MoM. January’s blow-out release has been relativized. Source: HolgerZ, Bloomberg

risk assets">

risk assets">

risk assets">

risk assets">

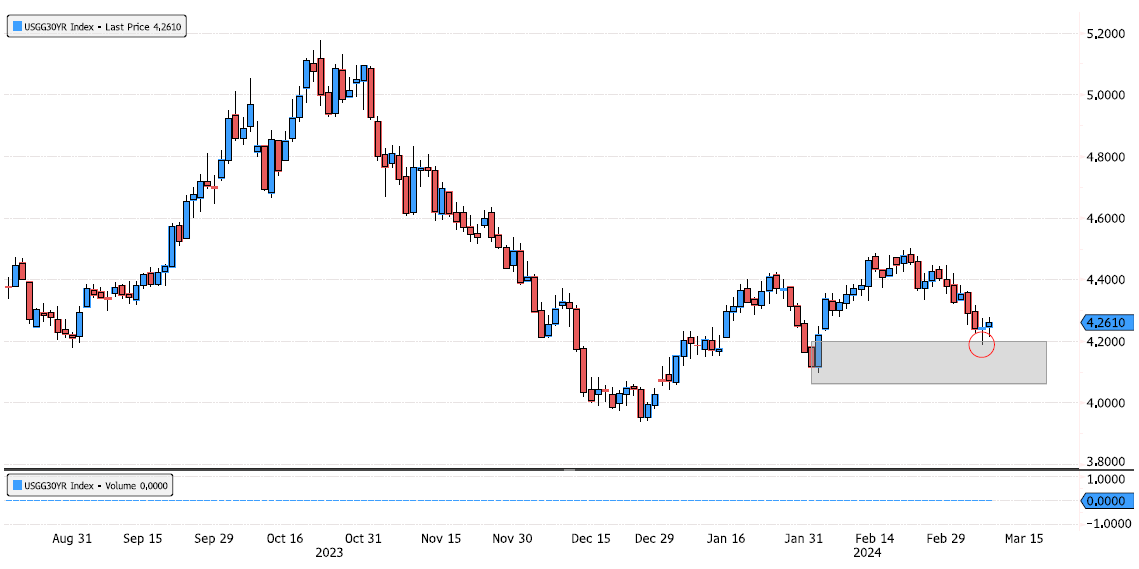

US 30 year yield on support zone

US 30 year yield (USGG30YR) has just reached it's demand zone 4.0623 - 4.2000. Keep an eye at this level. Source : Bloomberg

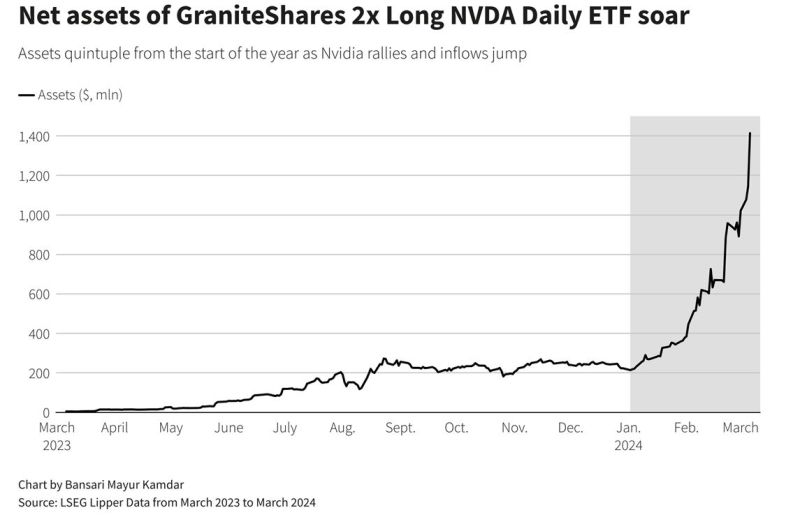

Inflows into bullish Nvidia ETF hit record

Net daily inflows into the GraniteShares 2x Long NVDA Daily ETF NVDL.O hit a record of $197 million, according to LSEG Lipper data. The assets managed by the ETF have grown to $1.41 billion from $213.75 million at the start of the year." source : reuters

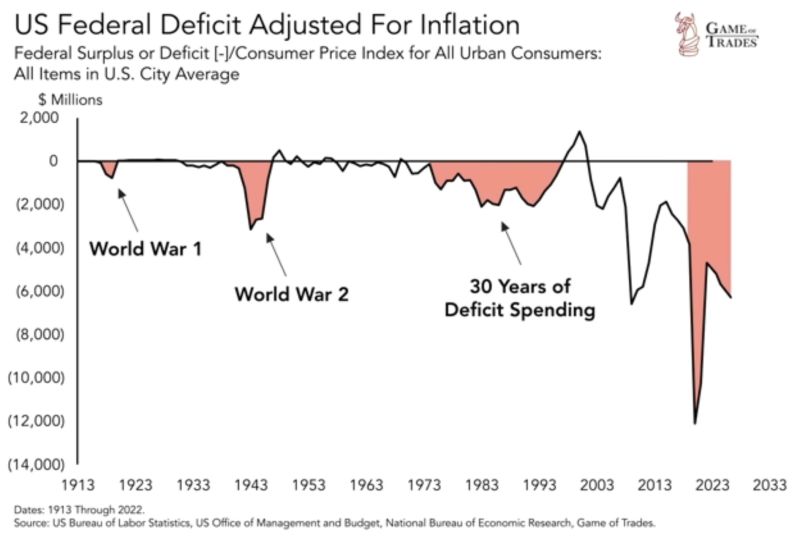

Inflation-adjusted US government spending since 2020 exceeds the combined spending of:

- World War I - World War II - 1970 to 1990 Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks