Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

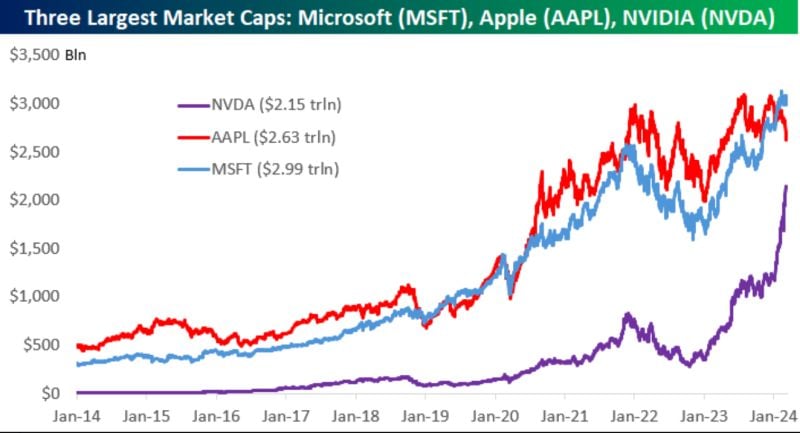

There are no longer any companies in the $3 trillion market cap club.

source : bespoke

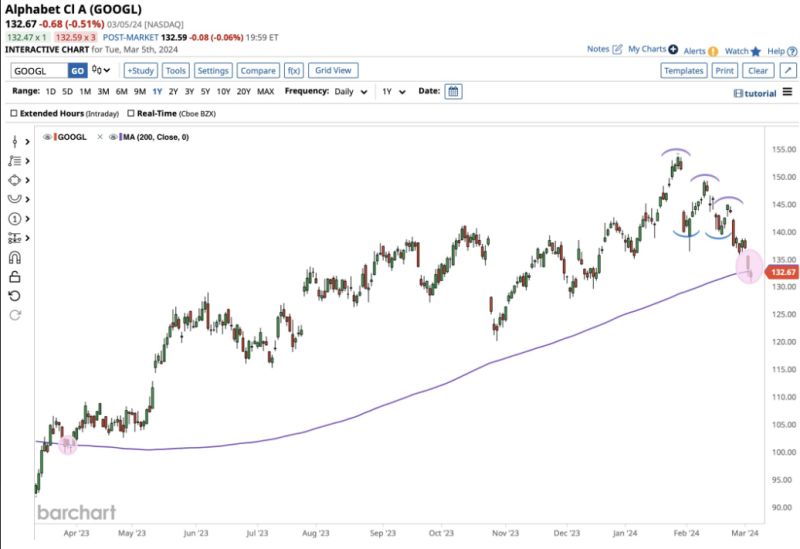

GOOGL closed under its 200D moving average for the first time in 12 months

source : barchart

Germany Stock Exchange Firm Deutsche Boerse Launches Crypto Trading Platform

Germany-based Deutsche Boerse announced fully regulated crypto trading platform Deutsche Boerse Digital Exchange (DBDX). The spot trading platform is targeted for institutional clients said the Deutsche Boerse. The new Deutsche Boerse Digital Exchange is the latest step in its digital strategy to deliver a fully regulated and secure environment for institutional trading, settlement, and custody for this digital asset class. The German exchange group last year committed to introduce an integrated digital asset platform as part of its Horizon 2026 program. The initial trading will be request-for-quote basis and gradually moving to multilateral trading. Deutsche Boerse will offer trading venue and Crypto Finance (Deutschland) to provide digital asset clearing and settlement services. source : coingape

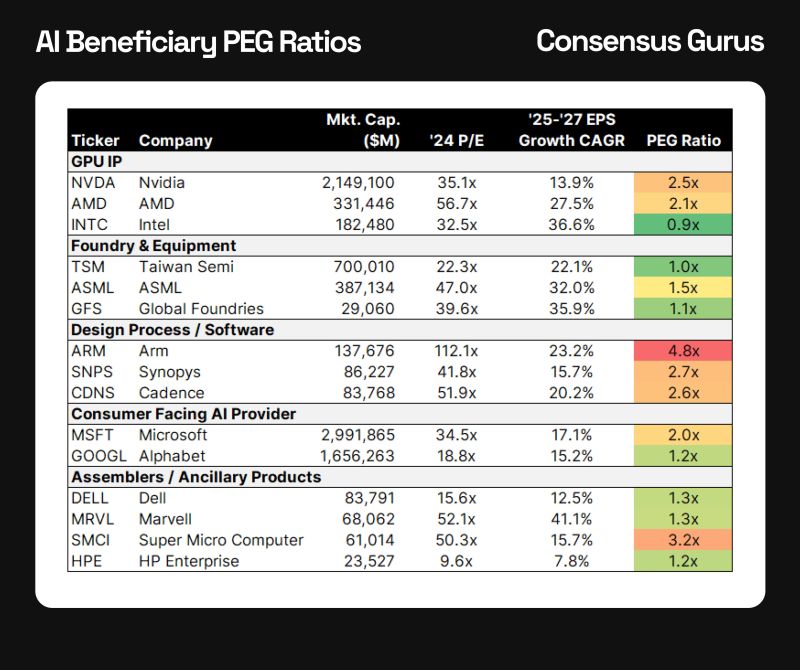

AI Beneficiary PEG Ratios - Locating the Value

Will nvidia $NVDA really plateau at 14% earnings growth after this year? Will arm $ARM come back to earth or will earnings rocket? Source: Consensus Guru

ouch... too bad... a sign that we are late-cycle?

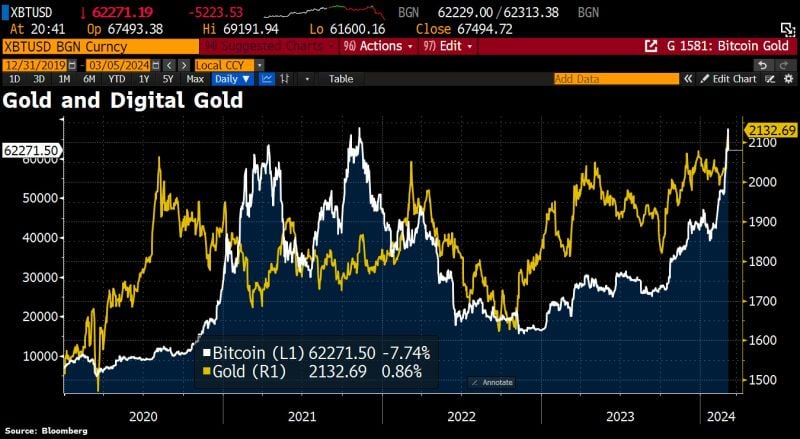

A bitcoin effect? Or just a remainder of the power of scarcity ?

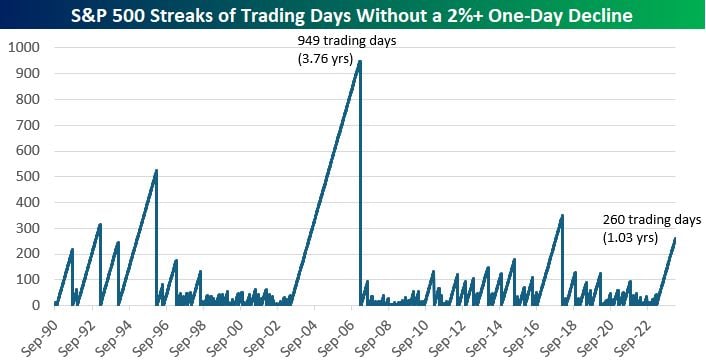

It has now been over a year since the S&P 500 had a one-day drop of 2%+.

- 3rd longest streak since 2000. - The S&P went 949 trading days (3.76 years!) from 5/19/03 to 2/26/07 without a one-day drop of 2%+. Source: bespoke

Investing with intelligence

Our latest research, commentary and market outlooks