Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

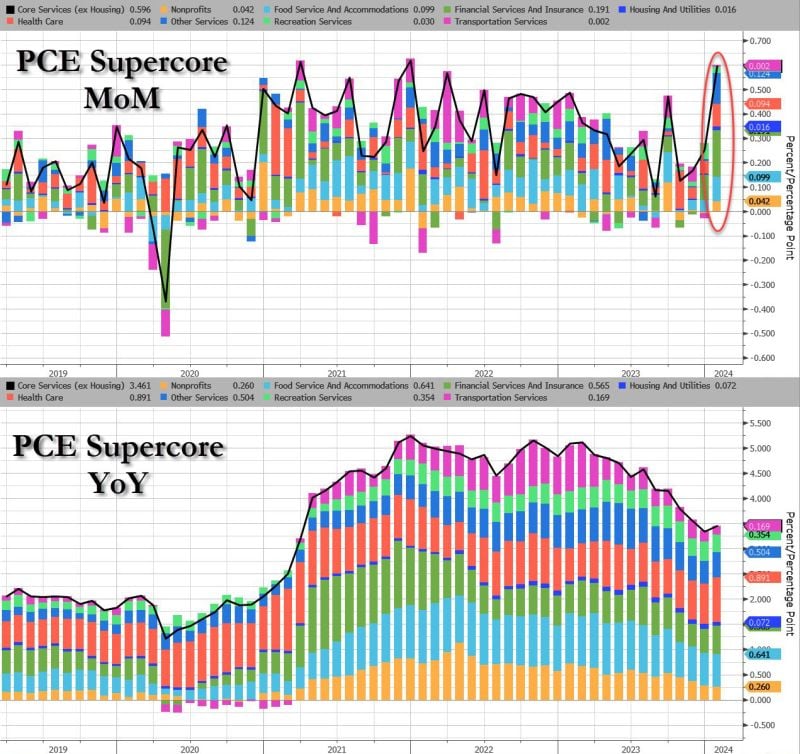

Supercore PCE MoM exploded, highest since Dec 2021

Source: www.zerohedge.com, Bloomberg

Today's report unveiled the largest positive surprise in US personal income since the surge in consumer prices began in 2021

Source: Tavi Costa, Bloomberg

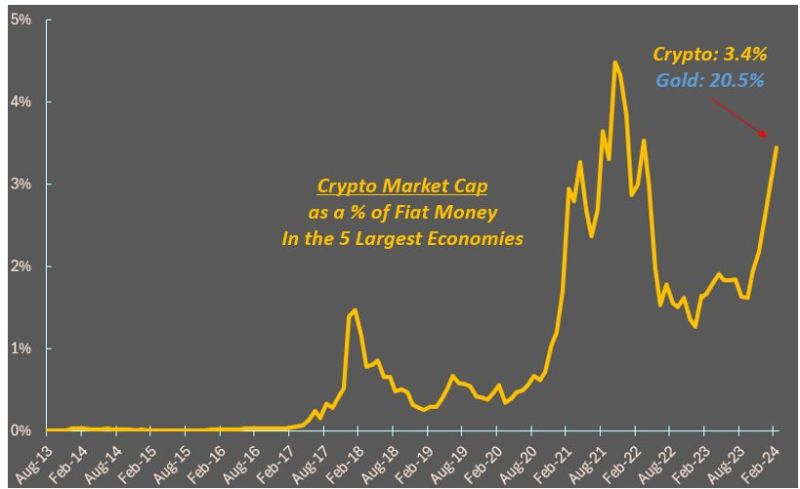

Interesting chart by TheMacroCompass.com

cryptos and gold are impossible to value but they are in some extent comparables in the role they play as an alternative to the fiat money system. Currently, Gold is 20.5% of the Fiat money in the 5 largest economies. After recent rally, the total cryptocurrencies market cap is just 3.4%. If you think teh gap between gold and cryptos should continue to narrow, there might be further upside. NB: this is NOT an investemnt recommendation

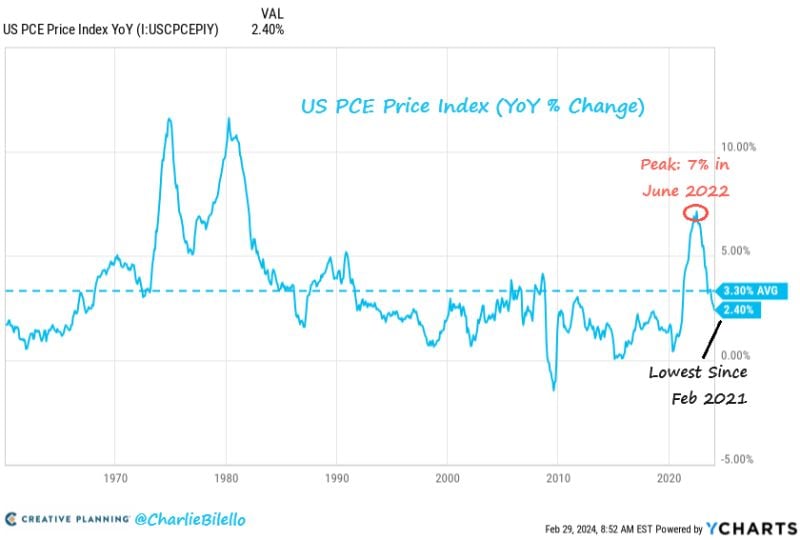

More evidence of a decline in US Inflation...

The PCE Price Index moved down to 2.4% in January, its lowest level since February 2021. Cycle peak was 7% in June 2022. Source: Charlie Bilello

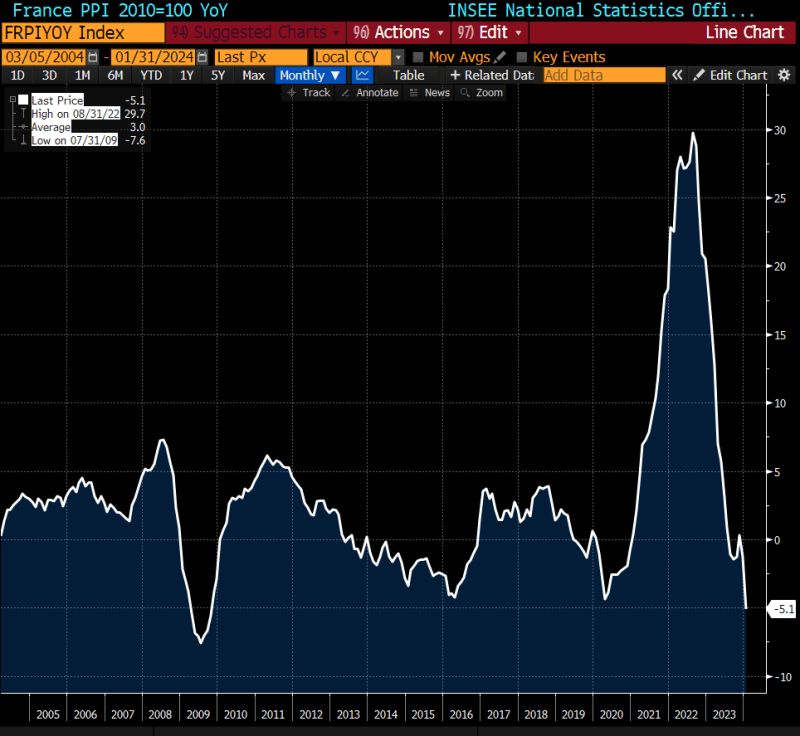

France PPI YOY is the lowest since 2009...

Source: Bloomberg, Alessio Urban

Is Nivdia $NVDA - cheap? Via Bear Traps: "NVDA is now trading at a lower multiple than the NDX: fwd P/E is ~29 vs 32x for the NDX

NVDA is expected to grow earnings at 78% y/y for the current year and the Nasdaq 100 EPS growth is an estimated 17%." Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks