Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

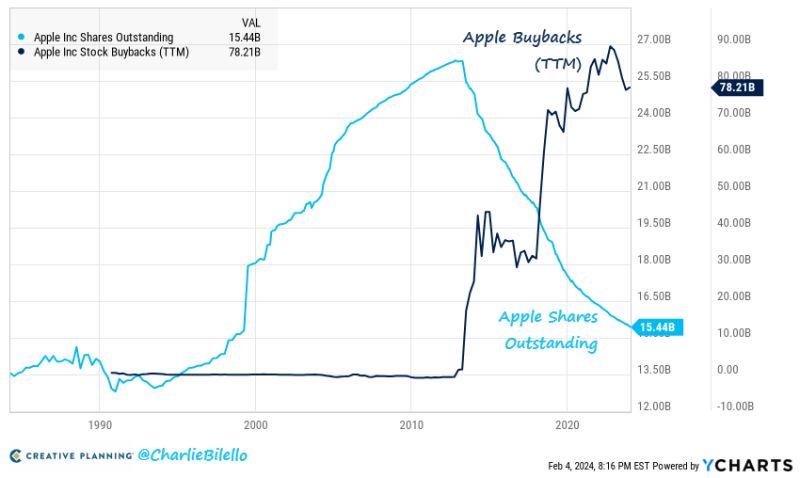

Apple has bought back $619 billion in stock over the past 10 years

Which is greater than the market cap of 492 companies in the S&P 500. $AAPL Source: Charlie Bilello

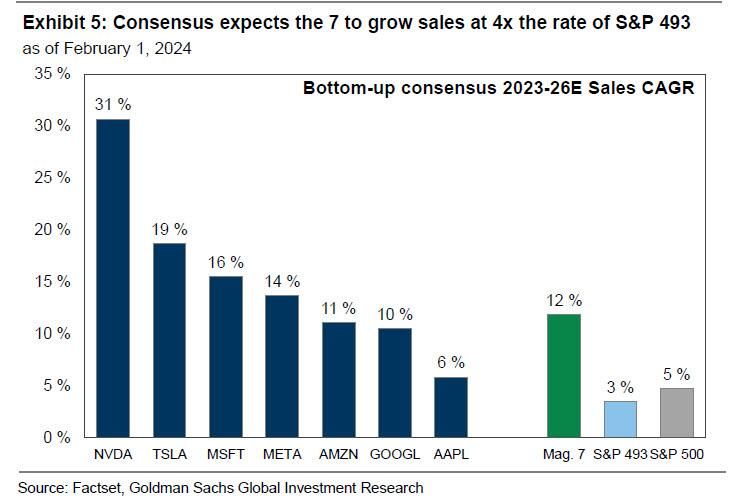

Expensive for a reason...

Since December 2019, the Magnificent 7 stocks collectively delivered a 28% annualized return. Of this, approximately 27% is attributable to earnings growth (21% sales growth and 6% margin expansion) with only 1% due to multiple expansion. In contrast, earnings drove only 13% of the S&P 500’s 17% annualized return since 2019. Looking forward, Goldman expect revenue growth will be the key driver of returns for the Magnificent 7 stocks. Bottom-up consensus expects the seven companies will collectively grow sales at a 12% CAGR through 2026 compared with an 3% CAGR for the remaining 493 companies in the S&P 500 index.

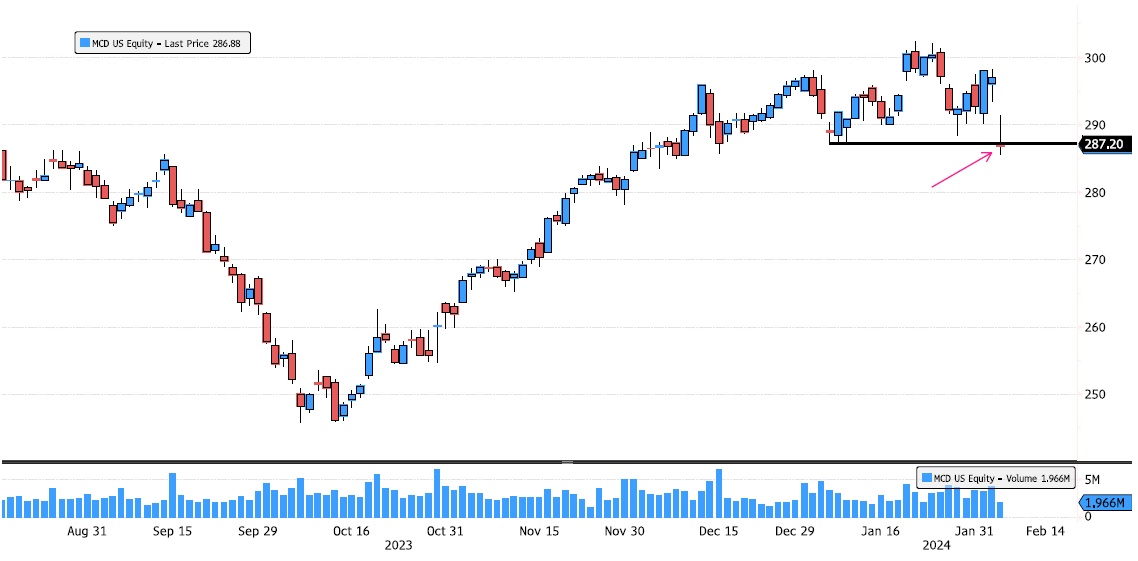

MacDonald's the end of the trend ?

MacDonald's is testing swing support 287.20. Keep an eye at this level, musn't close below if not risk of change in trend. Source : Bloomberg

Playing Monopoly

It's getting harder and harder to own anything... source : wallstreetsilver, david henning

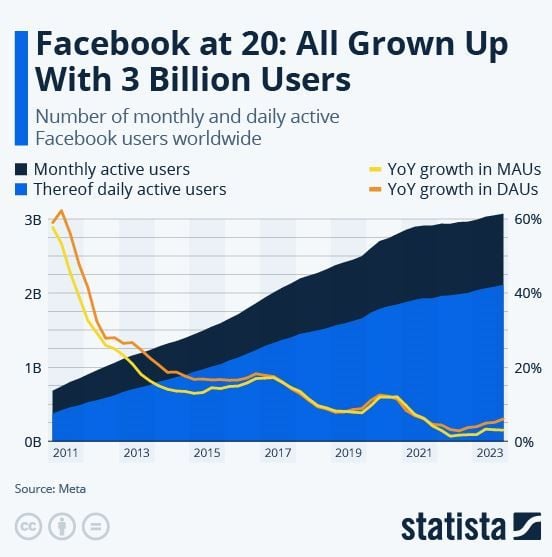

Happy 20th birthday, Facebook

To this day, Facebook has never seen a year-over-year drop in active users and once it happens, we won't know, because the company announced that it won't be reporting Facebook user numbers going forward. Instead, the company will focus on metrics that are more relevant to its advertising business, such as changes in ad impressions and the average price per ad at the regional level. source : statista

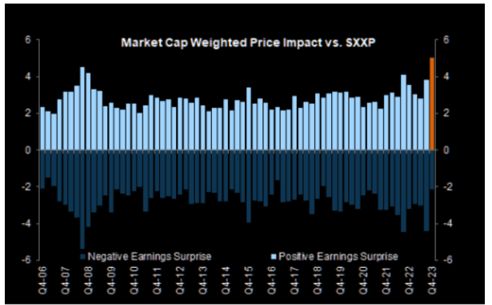

US Earnings season UPDATE

Q4 GAAP EPS +16% higher than a year ago after 46% of S&P 500 companies have reported. Note that Beats are rewarded like never before. We have seen sharp moves for positive surprises led by large cap constituents. Source. Factset, TME

Investing with intelligence

Our latest research, commentary and market outlooks