Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JUST IN: APPLE NOW PLANS CAR FOR 2028 WITH LESS AMBITIOUS AUTONOMY GOALS

Apple $AAPL reportedly now plans to launch its Apple Car in 2028 at the earliest back from 2026 and will now use a Level 2+ autonomous system down from its previously planned Level 4 - Bloomberg. source: Evan @ StockMKTNewz

ASML near all time high

ASML (ASML NA) confirmed once again the bull trend by breaking 700 to the upside. Next level to keep an eye is all time high 777.50. Source : Bloomberg

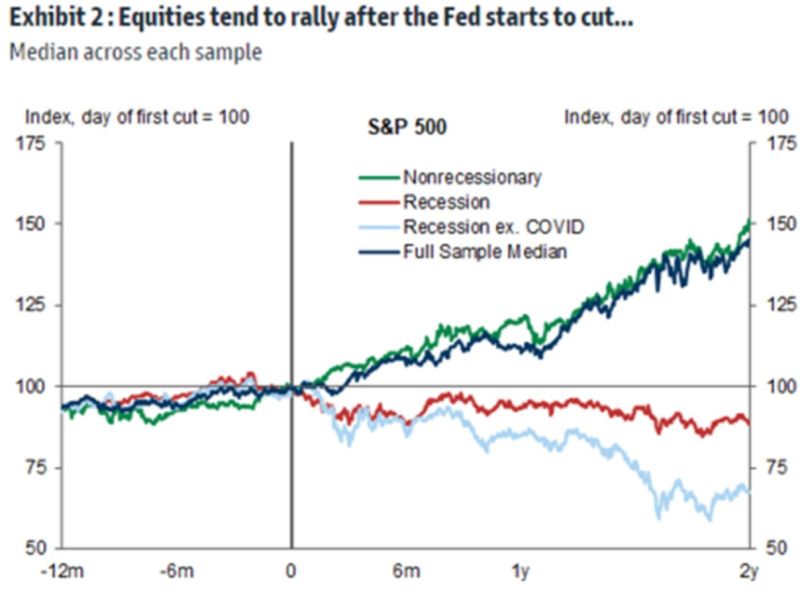

If we do not have a recession, stocks tend to rally after the Fed cuts

If we do, however, they tend to decline They say the economy isn't the market, but in this example it could have a measurable impact on the outcome Source: Markets & Mayhem

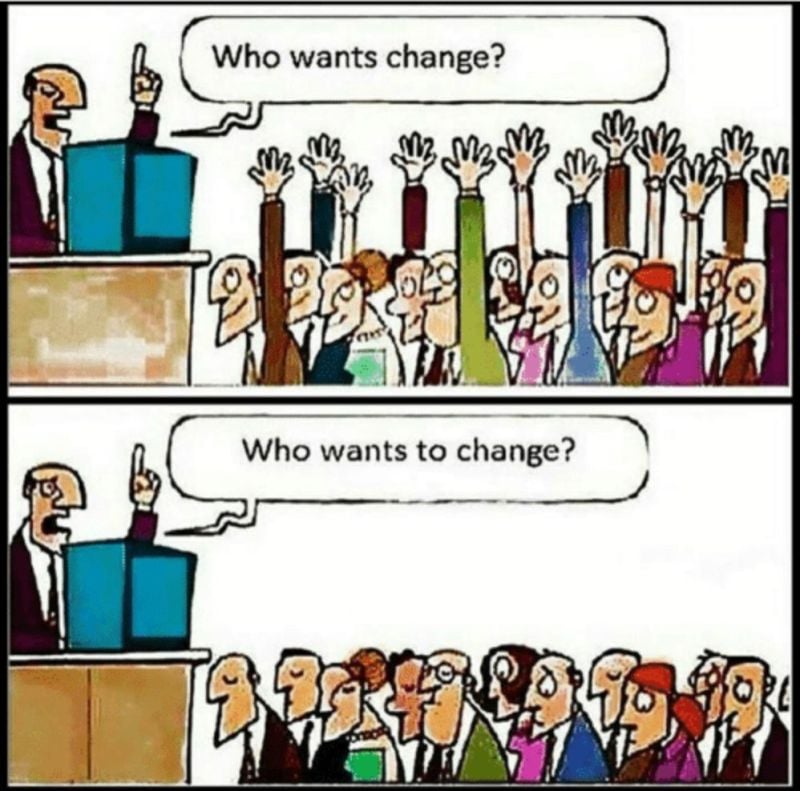

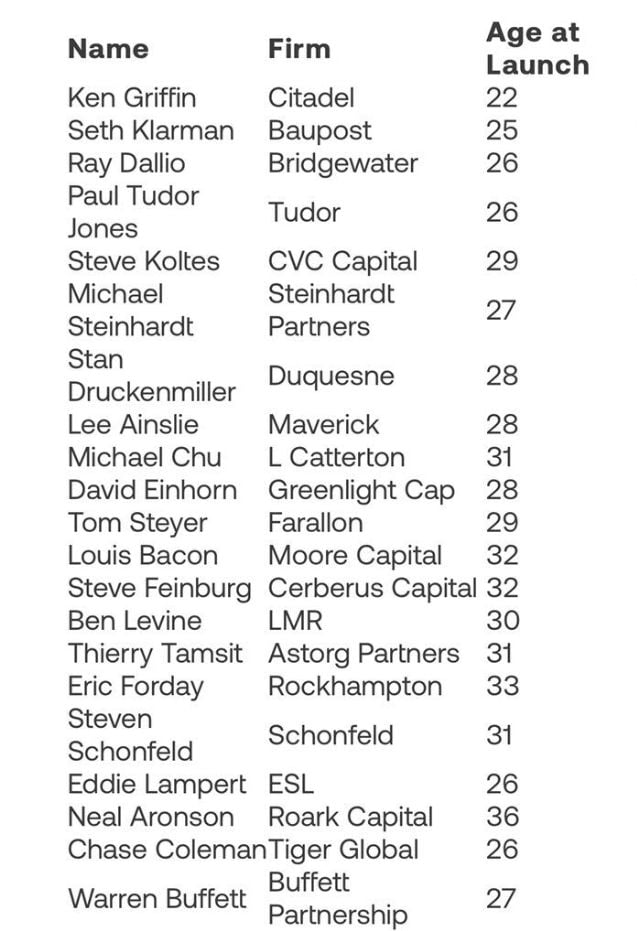

EXPERIENCE IS OVERRATED

Source: @createthisbiz on X, Martin Straub and Hrvoje PavisicHrvoje Pavisic on linkedin

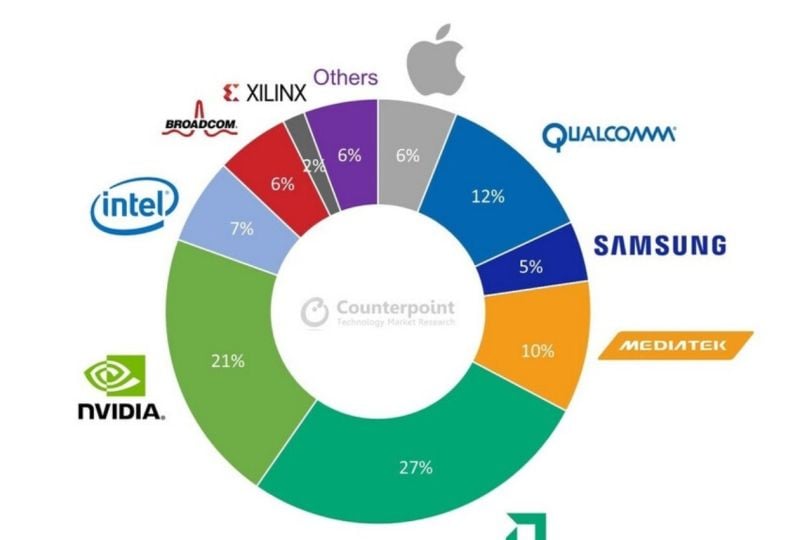

Taiwan semiconductor $TSM, the world's largest contract chip manufacturer, forecast 2024 revenue to grow more than 20% thanks to booming demands for high-end chips used in AI applications

Taiwan Semi's main customers include AMD $AMD, Nvidia $NVDA, Qualcomm $QCOM, Intel $INTC, Apple $AAPL, and Broadcom $AVGO. Source: Jesse Cohen

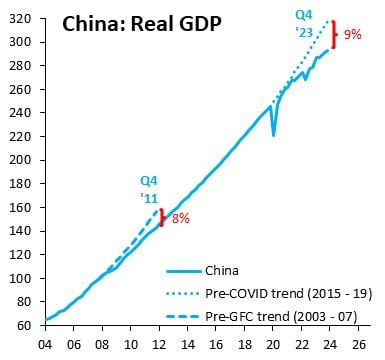

China's real GDP is now further below its pre-COVID trend than after the 2008 crisis

Will they be tempted to opt for more mercantilism (and expansionism)? Source chart: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks