Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

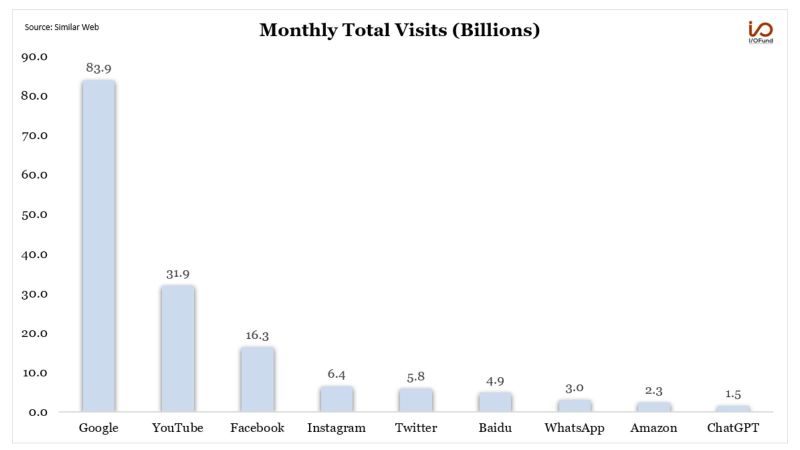

Google and YouTube continue to lead in internet traffic, amassing over 115 billion combined visits in the last month

This figure is more than triple the combined visits to Facebook's family of products, Twitter, Baidu, Amazon, and ChatGPT. Source: Beth Kindig $GOOGL $META $BIDU $AMZN $MSFT

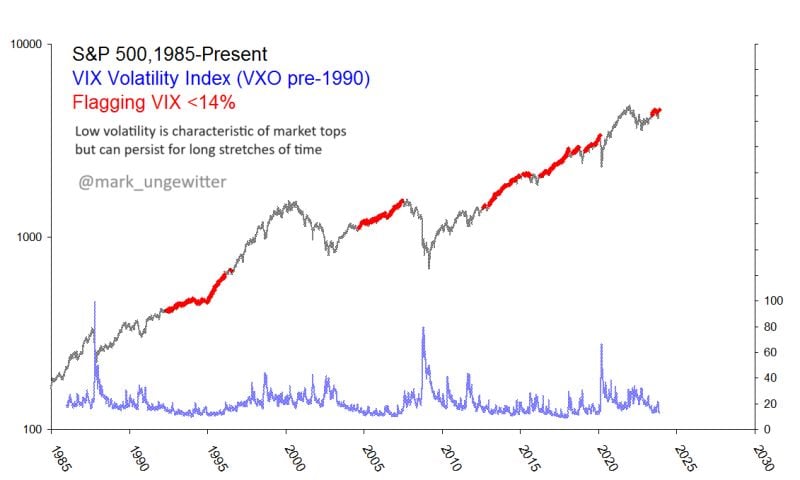

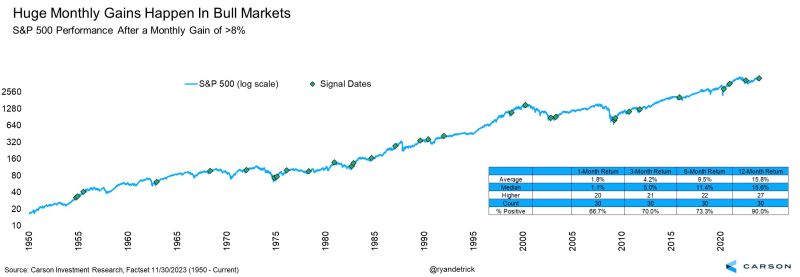

Some investors are worried about VIX index being too low, i.e markets are too complacent

The chart below is a good reminder that a "low VIX" is a normal part of bull markets. Investors seem to always forget this. Source: Mark Ungewitter, Ryan Detrick

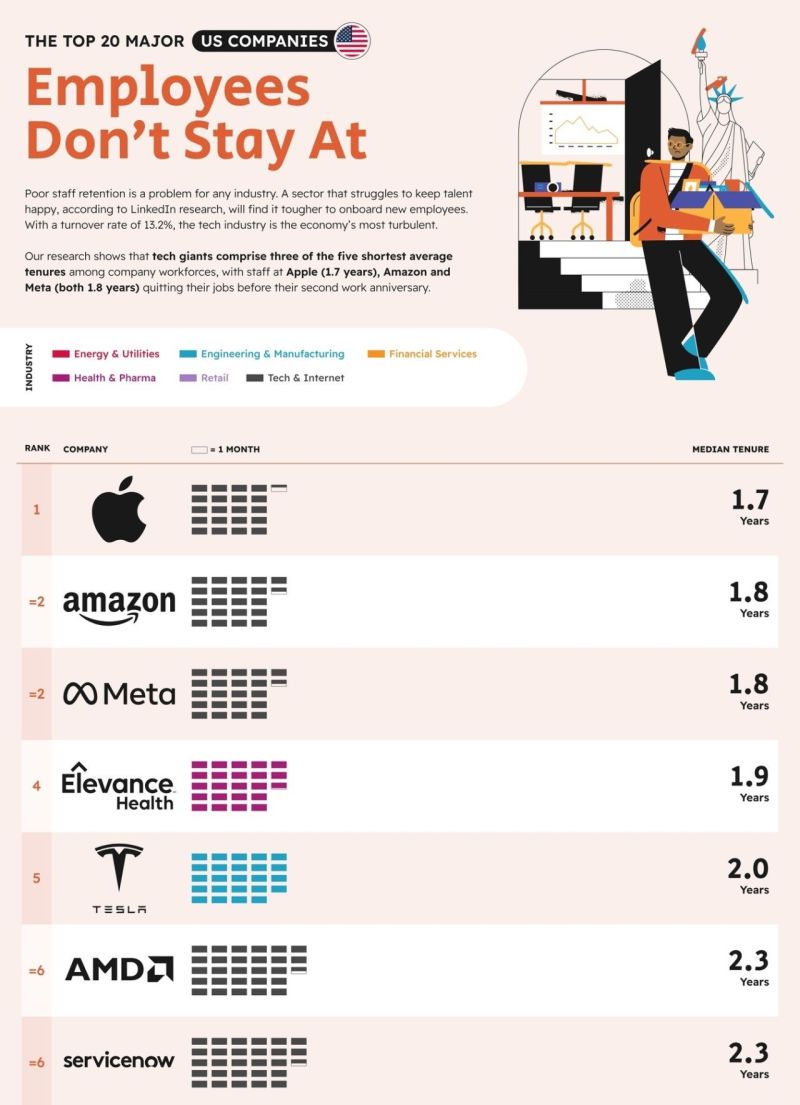

Ranked: Worst U.S. Companies for Employee Retention 💼

This graphic by NeoMam Studios is part of Visual Capitalist’s Creator Program, featuring work from the world’s top data-driven talent ✅

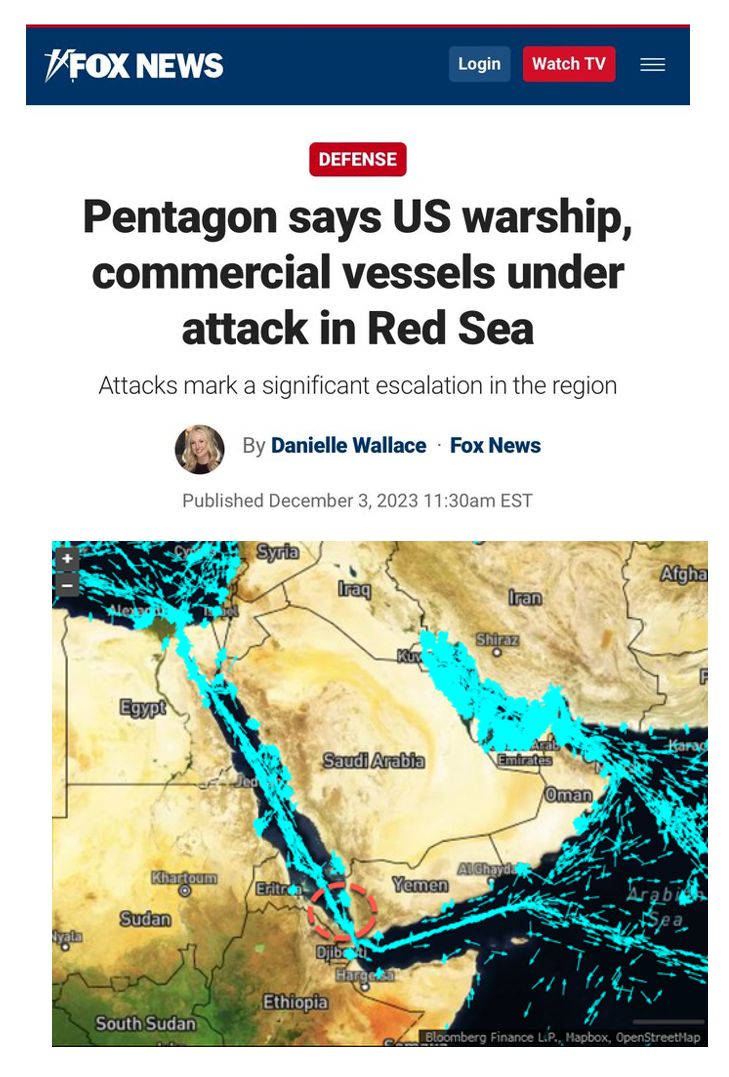

The Pentagon said Sunday a U.S. warship and multiple commercial vessels are under attack in the Red Sea.

‘We’re aware of reports regarding attacks on the USS Carney and commercial vessels in the Red Sea and will provide information as it becomes available,’ the Pentagon said, according to the Associated Press.” Meanwhile, "Gulf of Tonkin" is trending on X in the US. Source: Fox News, www.zerohedge.com

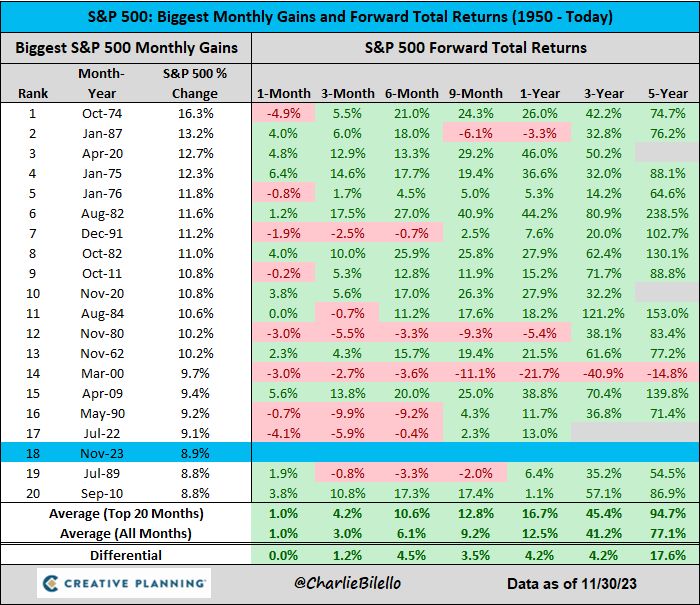

The S&P 500 gained 8.9% in November, the 18th biggest monthly advance since 1950. $SPX

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks