Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

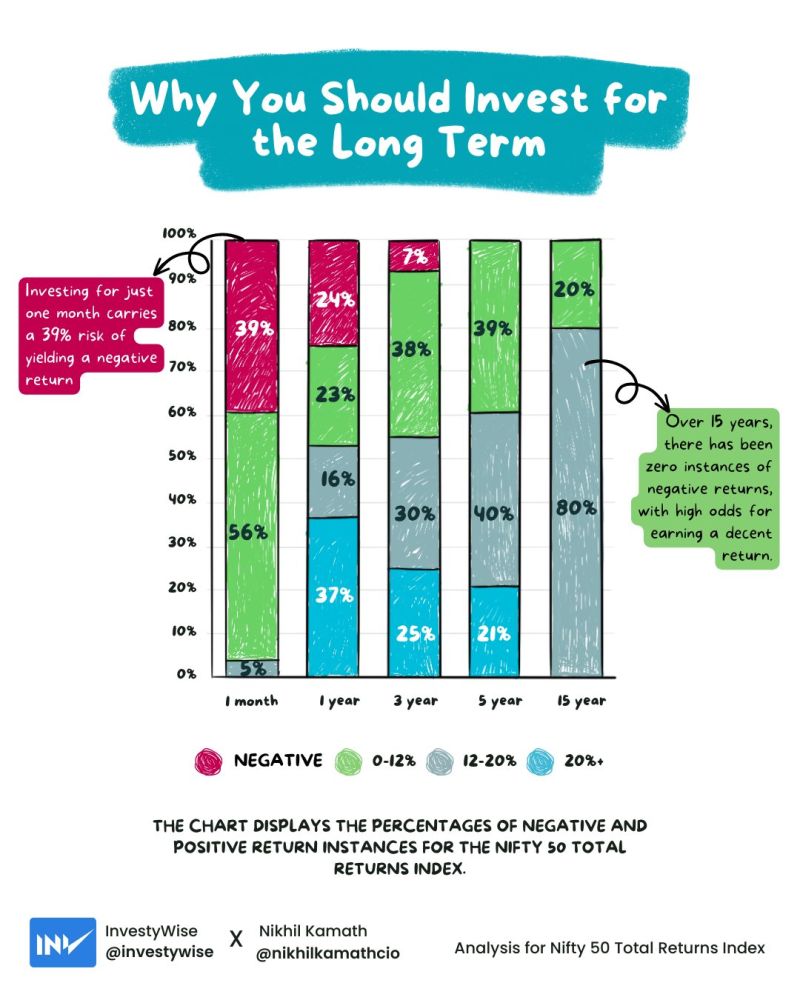

Why you should invest for the long run - Nikhil Kamath / InvestyWise Nikhil Kamath

(Stats are for Indian hashtag#stocks but the principle remains the same for most equity markets in the world) "Someone's sitting in the shade today because someone planted a tree a long time ago." - Warren Buffet

U.S. Banks have fallen to an all-time low against the S&P 500

Source: FT, Barchart

For the first time in years, crypto markets are beginning to see tons of new liquidity

Since November 2022, crypto markets have added $600 billion in value. That's a +75% jump in one year while Bitcoin is up +120% over the last year. This comes after years of consistent outflows from crypto markets. Source: The Kobeissi Letter

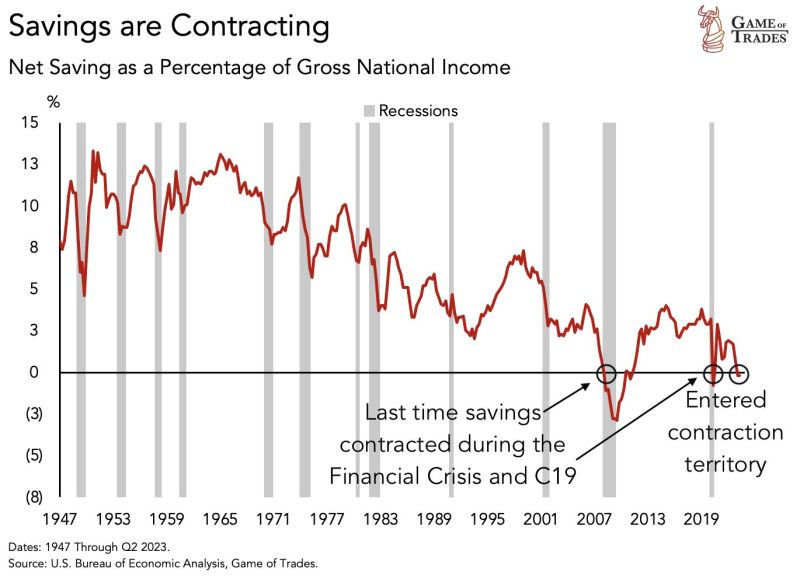

This has happened ONLY 2 times in the last 75 years. In the US, savings as a % of income is now contracting, indicating that people are find it VERY hard to save

The last 2 contractions happened in: - 2008 - 2020 High interest rate + high debt is a MAJOR problem for people Source: Game of Trades

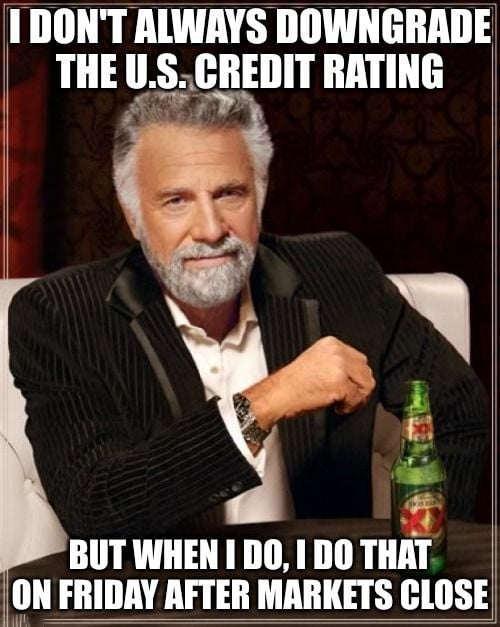

Moody’s cuts U.S. credit outlook from stable to negative. Will markets just shrug it off on Monday?

Source: Trend Spider

Taiwan Semiconductor 2nd attempt

Taiwan Semiconductor (TSM US) is trying to breakout June downtrend resistance for the second time. This time volume is very strong. Source : Bloomberg

Diageo looking for support

Diageo (DGE LN) down 15% today, under a lot of pressure. Next support level is the 2009 uptrend support around 2660. There is also another support at 2500. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks