Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

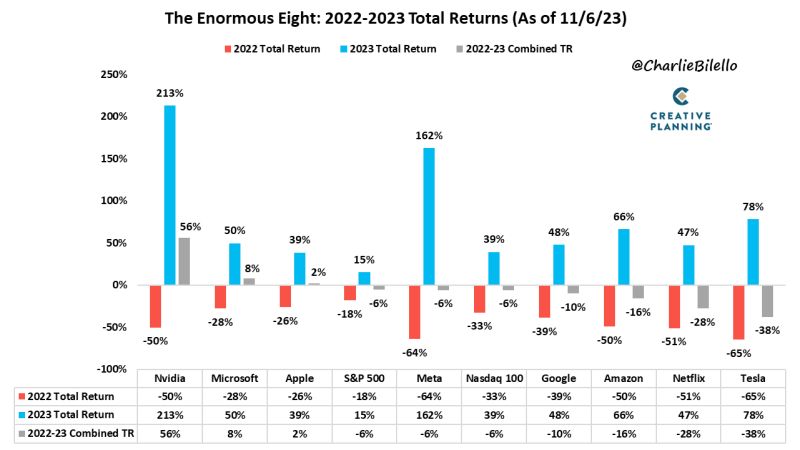

The ENORMOUS EIGHT 2022-2023 Combined Total Returns...

Nvidia $NVDA: +56% Microsoft $MSFT: +8% Apple $AAPL: +2% S&P 500 $SPY: -6% Meta $META: -6% Nasdaq 100 $QQQ: -6% Google $GOOGL: -10% Amazon $AMZN: -16% Netflix $NFLX: -28% Tesla $TSLA: -38%

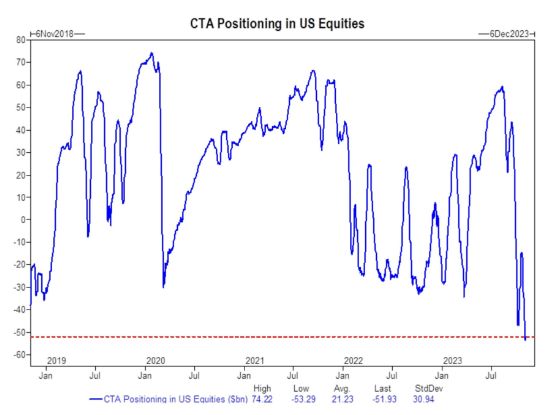

CTAs are currently short $52 billion in U.S. equities, the largest short position in AT LEAST 5 years

Source: barchart

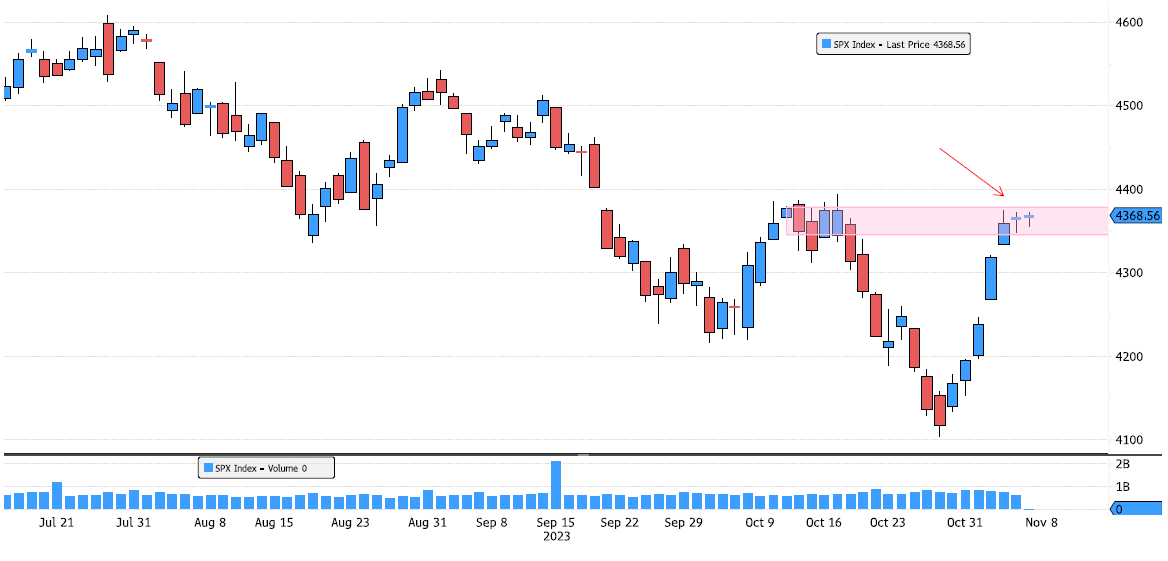

S&P 500 Index at resistance level

S&P 500 Index has made a 6.5% rebound since end of October lows. Trend remains bearish, keep an eye on last swing high resistance 4345-4378. Will it have enough strenght to break this level ?

Crude Oil approaching support

Crude Oil WTI has now consolidated 17% since September high ! It's approaching last swing low support. Keep an eye at 77.62 level.

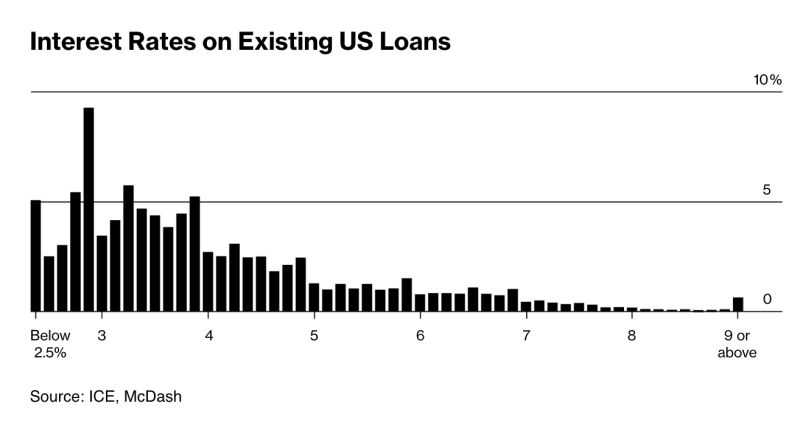

The chart below shows the distribution of interest rates on outstanding US mortgages

Over 30% of borrowers have rates below 3%, up from just ~5% of borrowers prior to the pandemic. Virtually no new mortgages are being taken out at 7%+ interest rates that we currently see. real estate market seems to be frozen Source: The Kobeissi Letter, ICE

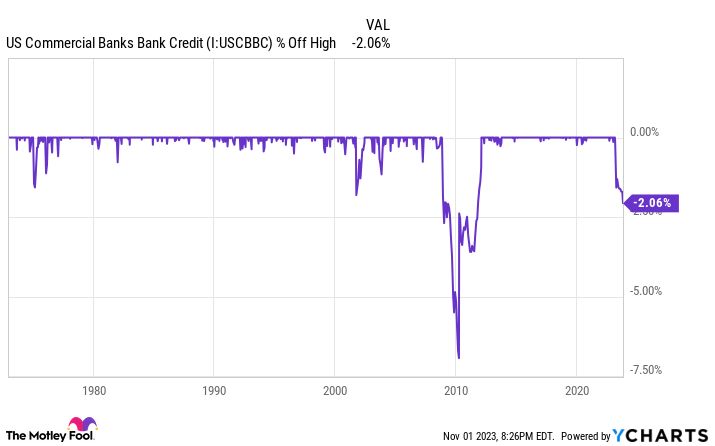

For only the 3rd time in the last 50 years, commercial bank credit has declined by more than 2%

The other 2 times were the peak of the Dot Com Bubble and the aftermath of the Global Financial Crisis. Source: barchart

China reported a worse-than-expected drop in exports in October, while imports surprisingly rose for the month from a year ago

China’s customs agency said exports in U.S. dollar terms fell by 6.4% in October from a year ago. That’s worse than the 3.3% drop predicted by a Reuters poll. Overall, China’s exports have fallen on a year-on-year basis every month this year starting in May. The last positive print for imports on a year-on-year basis was in September last year. China’s exports to Southeast Asia and the European Union fell by double digits in October, according to CNBC calculations of official data. Exports to the U.S. dropped by more than 8%, the analysis showed. Imports rose by 3% in U.S. dollar terms in October from a year ago. That’s in contrast to the Reuters’ forecast for a 4.8% drop from a year ago. However, China’s imports from the U.S. were down by 3.7% in October versus the year ago period, CNBC calculations of customs data showed. China’s imports from the European Union rose by more than 5%, while those from the Association of Southeast Asian Nations grew by 10.2%, the analysis showed. Source: CNBC

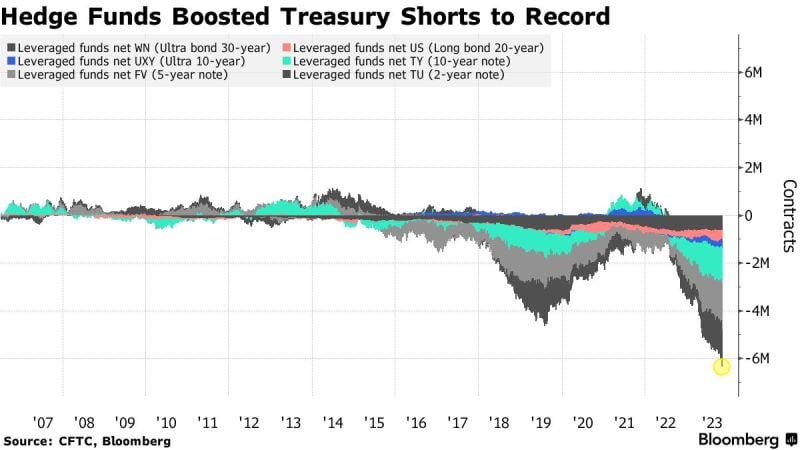

Hedge Funds extended short positions on Treasuries to a record just before smaller-than-expected US bond sales and weaker jobs data spurred a rally

Leveraged funds ramped up net short Treasury futures positions to the most in data going back to 2006, according to an aggregate of the latest Commodity Futures Trading Commission figures as of Oct. 31. The bets persisted even though the cash bonds had rallied the week before. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks