Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

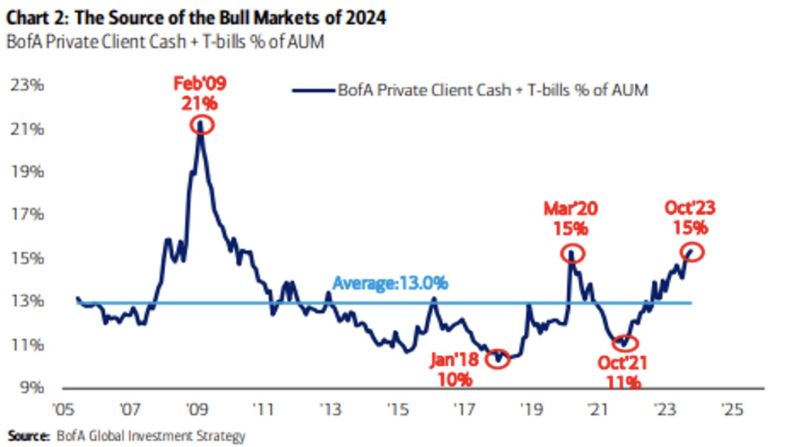

Cash + Treasury Bills now account for 15% of BoA's Global Wealth AUM, the highest level since the onset of the pandemic and one of the highest levels since the GFC

This could potentially limit the downside risk if that capital rotates back into stocks. Source: Barchart, BofA

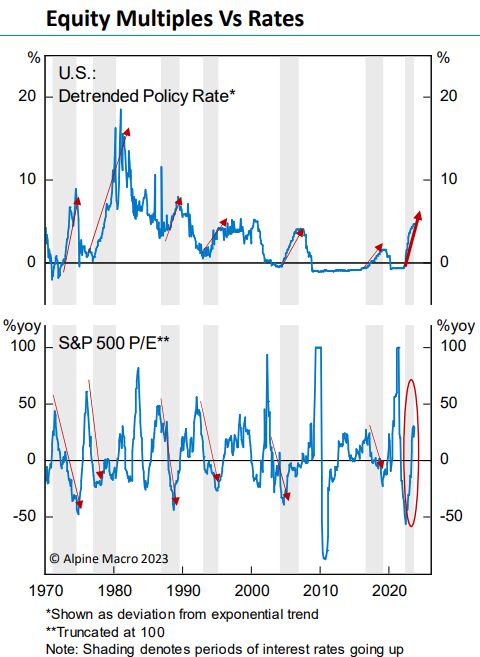

For the first time in the last 5 decades, rising interest rates have failed to cause Stock P/E multiples to contract

Source: Barchart

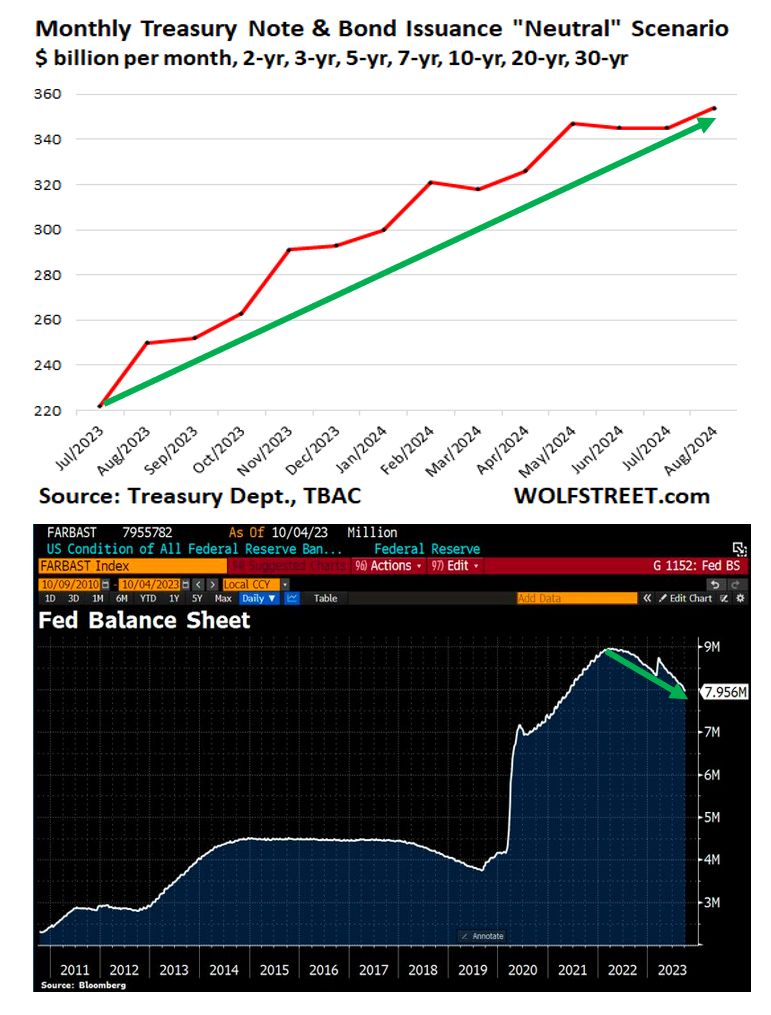

US Treasuries were bid this week due to the search of "safe havens" on the back of Middle East turmoil

However, ugly auctions on Thursday came as a harsh remainder of the unfavourable supply/demand situation faced by US Treasuries. On the supply side, there is a tsunami of notes and bonds that is going to flood the market. And it is occurring while the Fed, under its QT program, is letting about $60 billion a month in maturing Treasury securities roll off the balance sheet without replacement. With the Fed reducing its holdings, that tsunami of notes and bonds being issued will have to find buyers, and those buyers will have to be enticed by yields. Unless inflation and growth slow down meaningfully, yields are unlikely to drop aggressively. Source: www.wolfstreet.com, Bloomberg

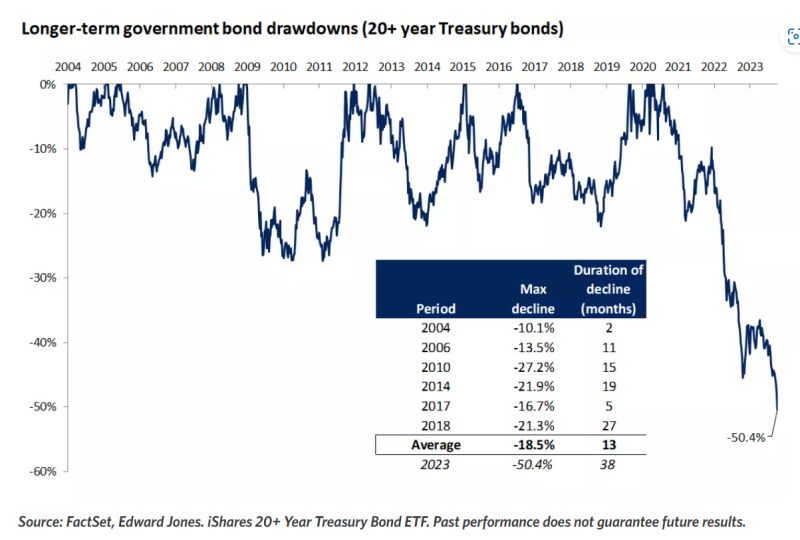

Big opportunities ahead for fixed income investors?

The past three years' pain in bonds could indeed be setting the stage for outsized gains ahead. To put the decline into perspective, long-term government bonds, with maturities greater than 20 years, have dropped 50% from their 2020 peak, a drawdown that is comparable to the 56% decline in stocks during the height of the Global Financial Crisis in 2008 Source: Edward Jones

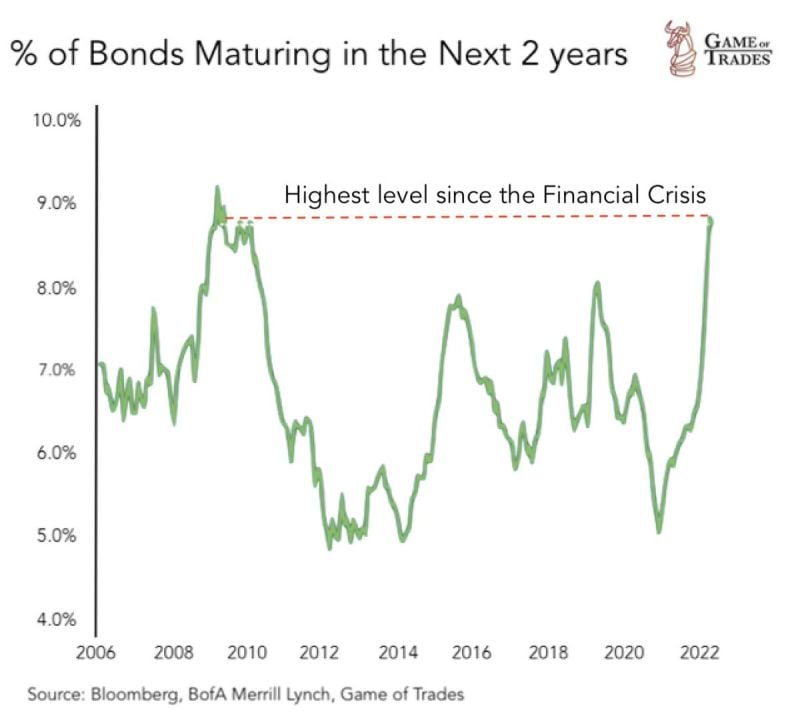

9% of bonds are set to mature in the next 2 years → The highest level since the Financial Crisis

High interest rates will make refinancing more difficult Source: Game of Trades

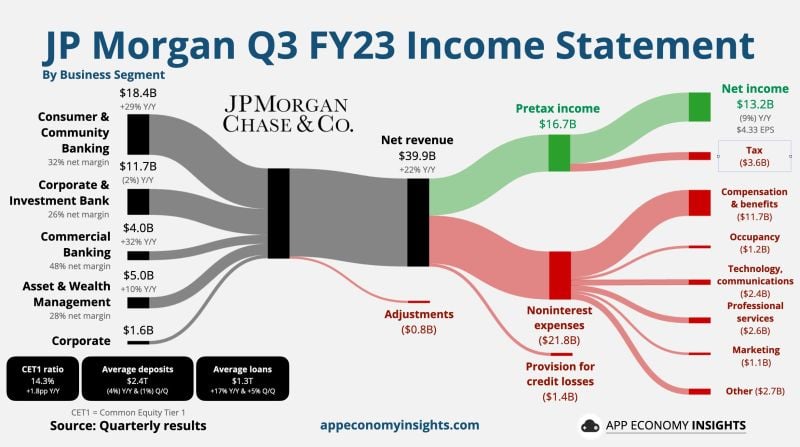

$JPM JP Morgan Chase Q3 FY23

CEO Jamie Dimon: "Now may be the most dangerous time the world has seen in decades." • Net revenue +22% Y/Y to $39.9B ($0.5B beat). • Net Income $13.2B. • EPS: $4.33 ($0.39 beat). • CET1 ratio of 14.3%. Source: App Economy Insights

Investing with intelligence

Our latest research, commentary and market outlooks