Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

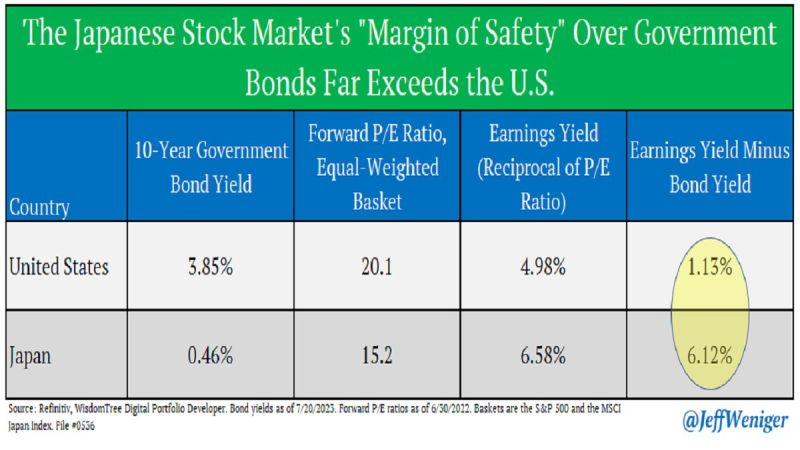

Japanese stocks have an earnings yield that is 612bps above the yield on 10-year Japanese government bonds

Put that in context; in the US, the gap is only 113bps. Little room for error in the US, plenty of room in Japan. This is a margin of safety concept. Source: Jeff Weniger

Fun fact is that Japanese inflation is now higher than that in the US for the first time since October 2015.

Source: Bloomberg, www.zerohedge.com

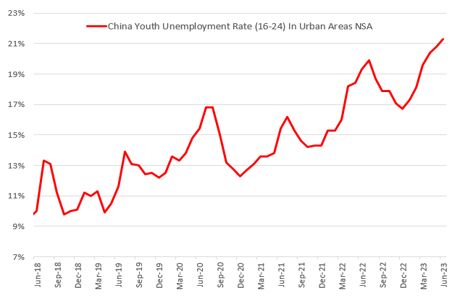

In China, the unemployment rate among young people ages 16 to 24 was 21.3% in June

A new record.

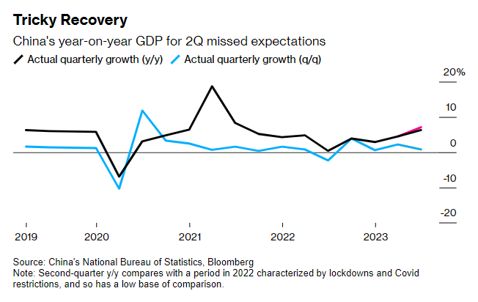

China reports Q2 GDP miss, fueling calls for more stimulus

China said Monday that 2nd quarter gross domestic product grew by 6.3% from a year ago, missing expectations (+7.3%). This marked a 0.8% pace of growth from the first quarter, slower than the 2.2% quarter-on-quarter pace recorded in the first three months of the year. The unemployment rate among young people ages 16 to 24 was 21.3% in June, a new record. Retail sales for June rose by 3.1%, a touch below the 3.2% expected. Industrial production for June rose by 4.4% from a year ago, better than the 2.7% forecast. So far, Beijing has shown reluctance to embark on greater stimulus, especially as local government debt has soared. A Politburo meeting expected later this month could provide more details on economic policy. Source: Bloomberg, CNBC

Chinese money trends are improving

M1 and M2 growth 3% and almost 2% on the month. Japan & China are the only places with positive money growth... Source: Andreas Steno Larsen

According to Goldman, India is poised to become the world’s second largest economy by 2075 behind China but ahead of the US

Source: CNBC

China's Inflation Rate Eases to Zero

Deflation in China? China's Consumer Price Index (CPI) year-on-year growth rate in June dropped to 0% (prev. 0.2%). Producer Price Index (PPI) year-on-year growth rate dropped to -5.4% (prev. -4.6%). Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks