Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

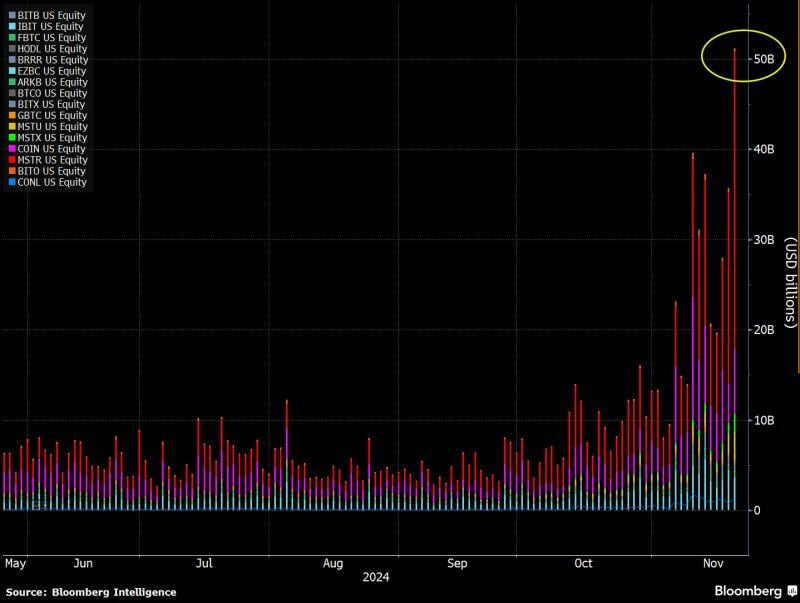

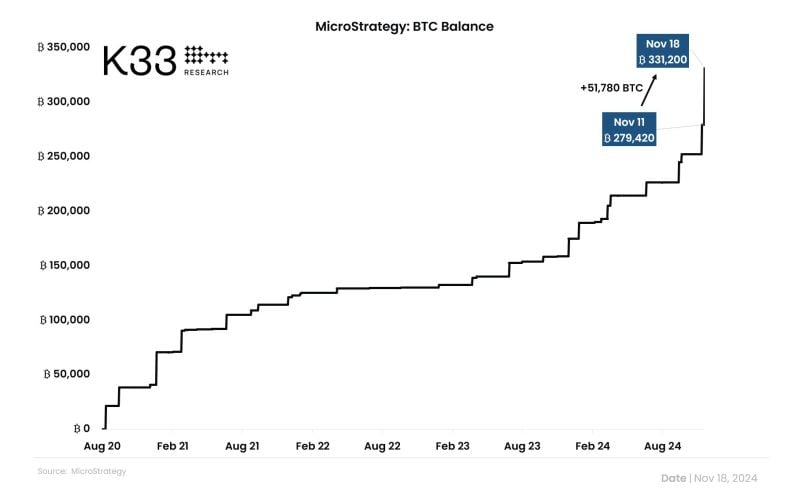

Microstrategy $MSTR is the most traded stock in America today.. even more than $TSLA and $NVDA...

Source: Eric Balchunas, Bloomberg

The Bitcoin Industrial Complex crushed their record yesterday with $50b in volume (for context that's same as ADV of entire UK stock market).

$MSTR alone was $32b of it. $MSTU and $MSTX combined for $6b (which is more than all the spot btc ETFs, which were also elevated). What a scene... Source: Eric Balchunas, Bloomberg

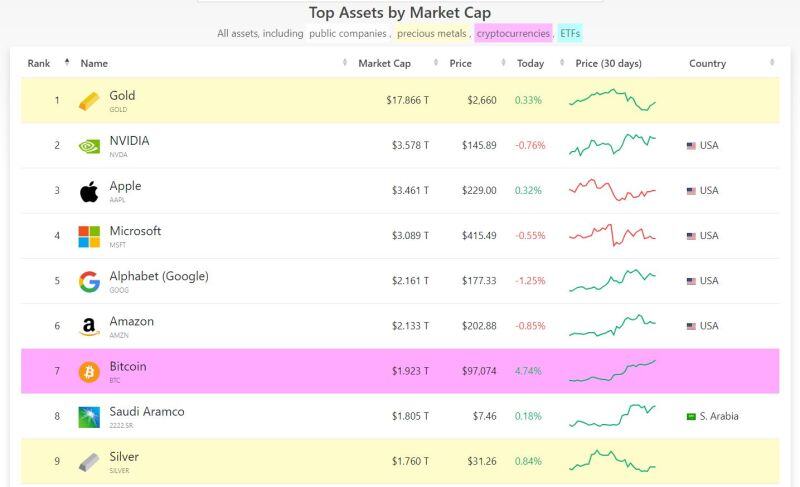

Bitcoin is trading at $97,000 this morning, very close to $100k.

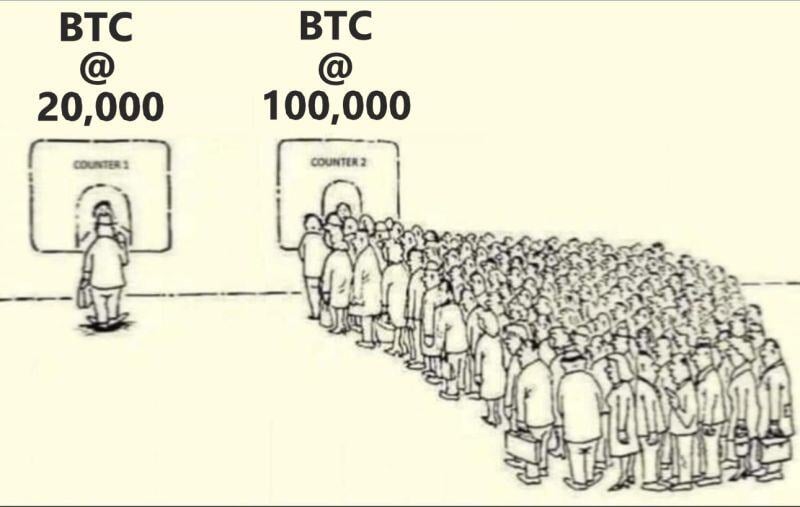

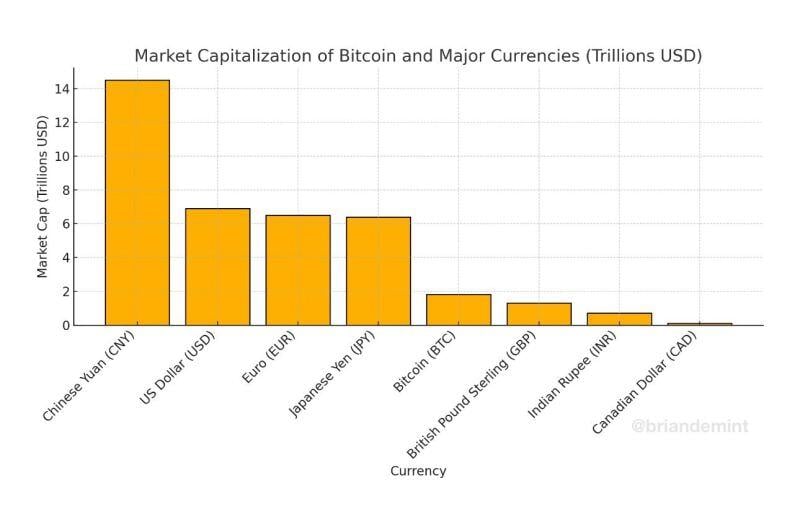

It is now the 7th largest asset in the world in terms of market cap, and could climb to #5 very soon. Meanwhile, the vast majority of individuals, pension funds and other institutional investors do not have any exposure to this asset. Where will the price go if they start to jump in?

Tyrone Ross, 401 Financial CEO:

“There is a frustration that the advisors typically cannot discuss [Bitcoin] with clients. They can't bring it up. They're admonished not to say anything at all, and they are embarrassed by that. It just makes them look silly.” Source: Bitcoin News BitcoinNewsCom

Investing with intelligence

Our latest research, commentary and market outlooks