Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

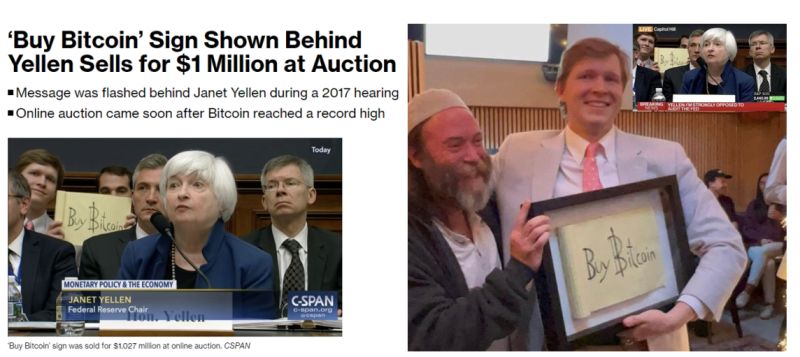

The guy who photobombed Janet Yellen with a “Buy Bitcoin” sign back in July 2017, just auctioned off the notepad for 16 Bitcoin (over $1 million!) to Justin, A.K.A. Squirrekkywrath!

Source: Neil Jacobs, Bloomberg

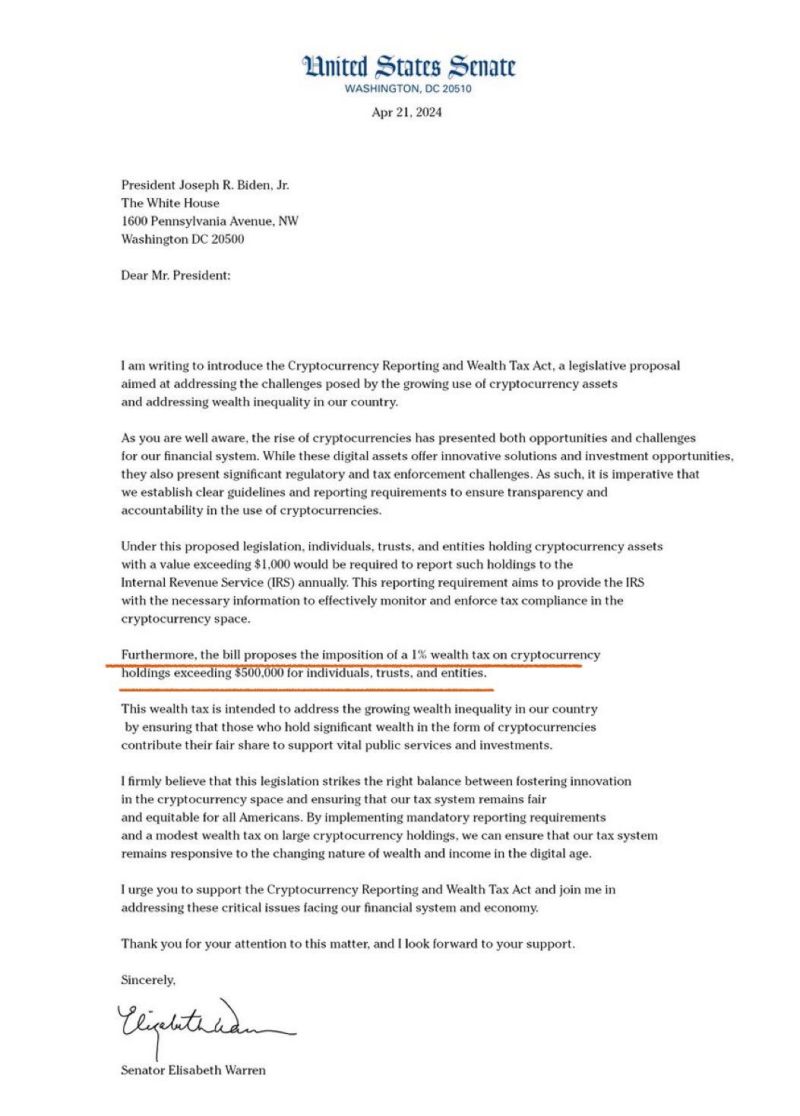

🚨BREAKING: US senator Elizabeth Warren has proposed a 1% WEALTH TAX on Bitcoin holdings that exceed $500,000.

Source: Simply Bitcoin (as we can not find any link to this document on Mrs Warren website, there is still some likelihood that this is a fake - currently checking in)

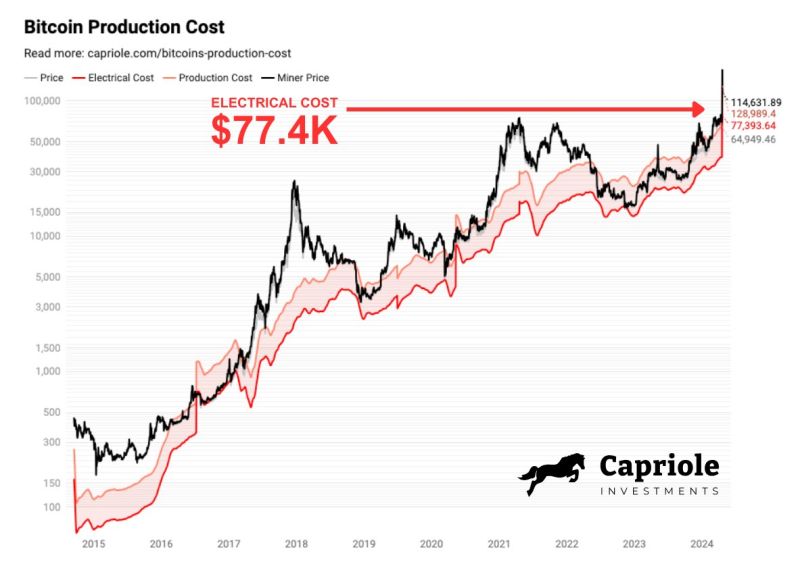

Welcome to a new paradigm... Bitcoin Electrical Cost is now a whopping $77.4K.

This is the raw electricity cost to power the network, per Bitcoin mined. Bitcoin Miner Price hit $244K on Saturday! This is the block reward + fees per Bitcoin mined. It boomed as transaction fees hit $230+ (about 4X the prior ATH of $68 set in 2021). This means Bitcoin is trading at a DEEP DISCOUNT. Price under Electrical Cost typically lasts just a couple days every 4 years. This means 1 of 3 things happens now: 1) Price skyrockets 2) ~15% of miners shut down 3) Transaction fees remain a lot higher on average Source: Charles Edwards

The first post-halving block generated 37.626 BTC (worth $2.4M) in fees 1 Bitcoin block gets mined about every 10 minutes.

On average, each of these blocks contains 2,000+ transactions. And whenever a Halving happens, everyone races to get their transactions in the first post-halving block. It’s the crypto equivalent of saying ‘I was there’. Well, check it out. The first block ended up generating $2.4M in fees - a new record. Source: Milk Road

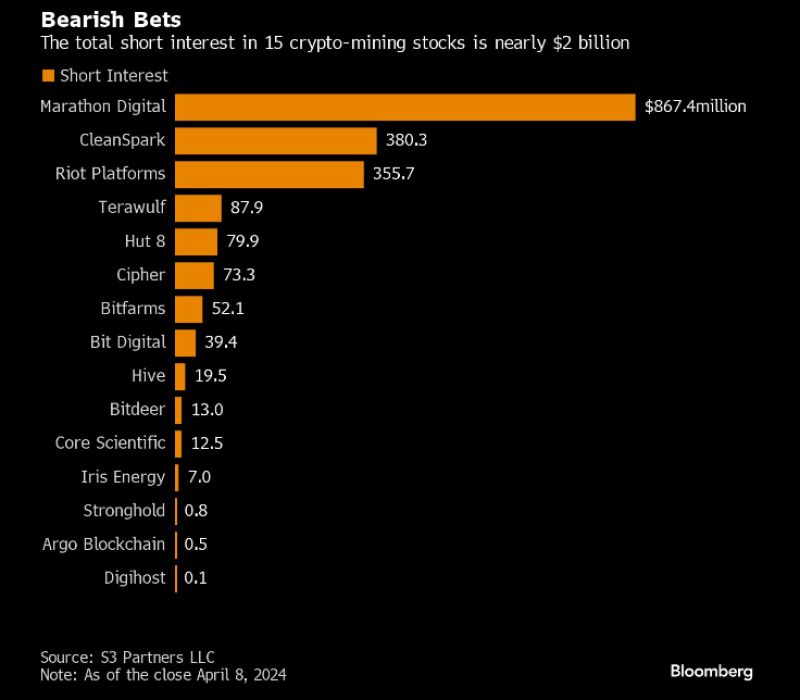

Bitcoin ‘halving’ will deal a $10bn blow to crypto miners.

Cryptocurrency’s update will slash new supply in late April. Competition for favourable electric rates is growing from AI firms. Some traders are thus betting that mining stocks will fall. Total short interest, dollar value of shares borrowed & sold by bearish traders, stood at ~$2bn. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks