Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

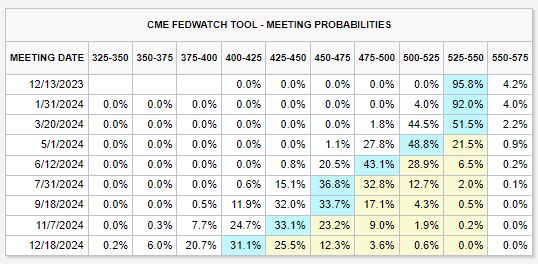

Futures are now showing a ~45% chance that FED rate CUTS begin as soon as March 2024

There's also a growing (but small) chance that rate cuts begin in January 2024, at 4%. Prior to the most recent CPI inflation data, the base case showed rate cuts beginning in June 2024. There was also a 50% chance of another rate HIKE in 2024. This has been a quick turnaround... Source: The Kobeissi Letter

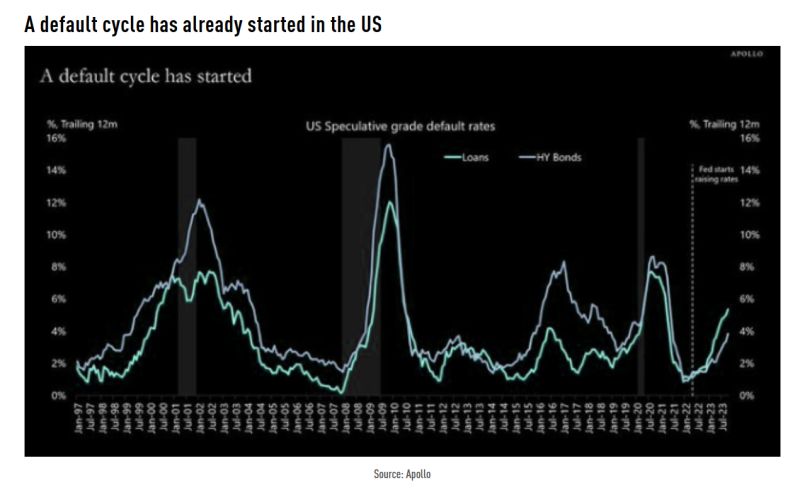

Since the Fed started raising rates in March 2022, default rates have gone from 1% to 5%+

Source: Apollo, TME

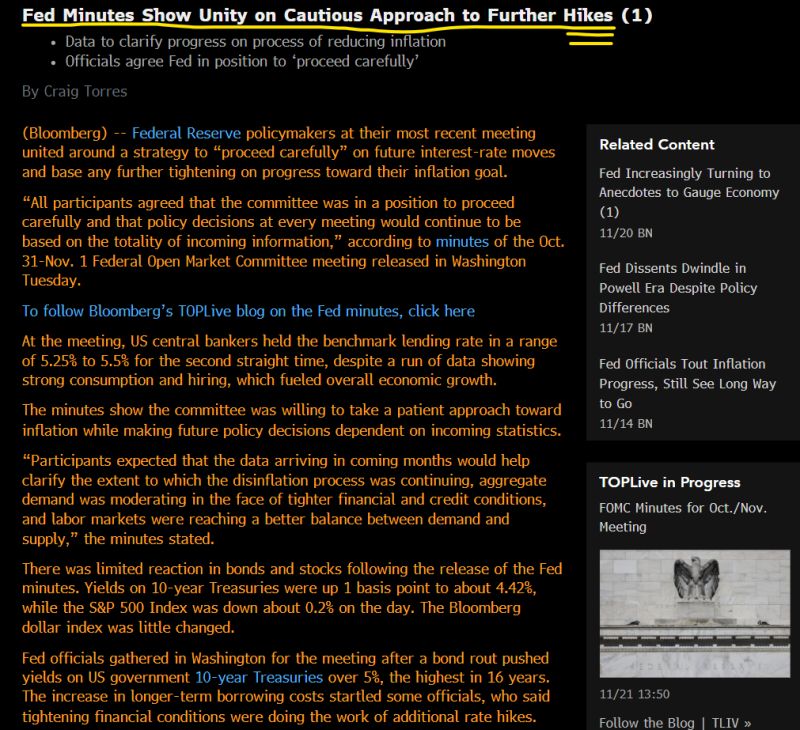

SUMMARY OF FED MEETING MINUTES (11/21/23):

1. All Fed Members agree to “proceed carefully” 2. Fed sees rates “remaining restrictive for some time” 3. Fed sees upside risks to inflation 4. Fed sees downside risks to growth 5. Meeting by meeting approach to resume It's amazing how US markets keep pricing cuts. When the Minutes reiterate, yet again, that while the Fed are cautious they still have a tightening bias.

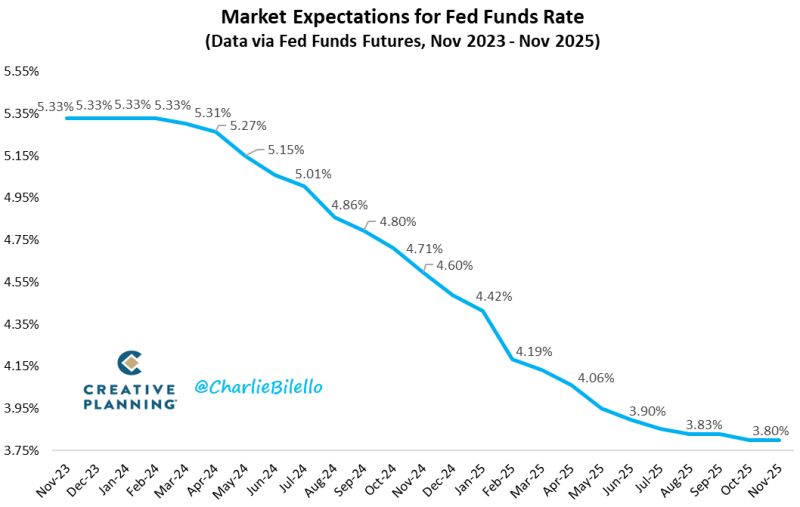

Ahead of Fed minutes... The market is now pricing in a 0% probability of a rate hike in December and rate cuts starting in May 2024

Source: Charlie Bilello

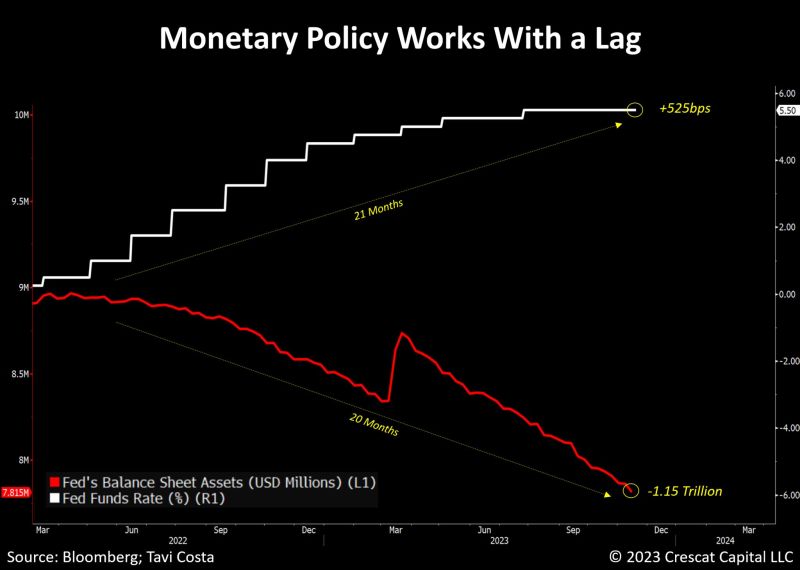

Fed monetary policy tightening (+525 basis points of interest rates hike + $1.15 Trillion of Fed balance sheet reduction) since 2022 has been quite brutal

2023 has been a miracle so far with headline inflation declining to 3% WITHOUT a recession and no increase in unemployment rate. But can it last? What could be the lagged effects of such a tightening? (chart courtesy of Tavi Costa)

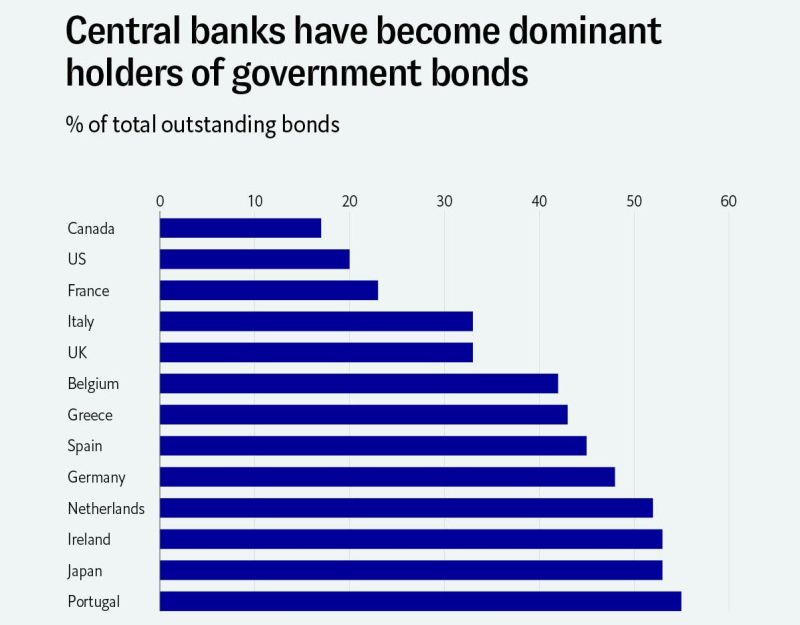

central banks have become dominant holders

Source: Michel A.Arouet

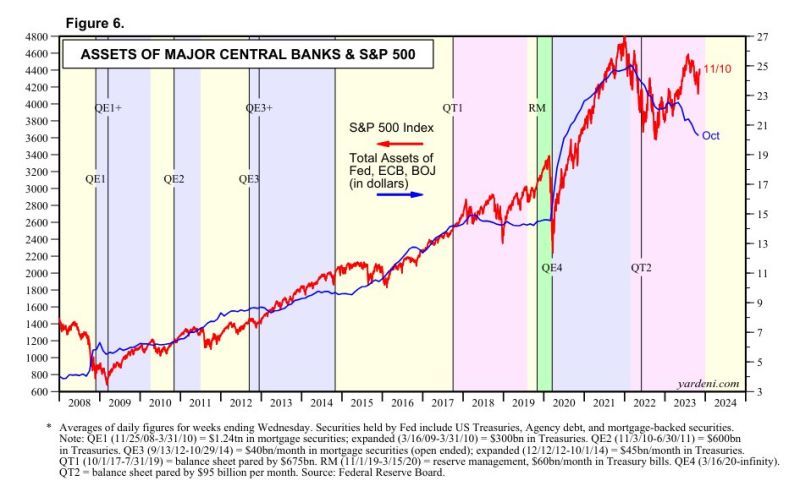

Central bank liquidity and the Sp500 are experiencing a rather large divergence. Will it matter?

Source: Markets & Mayhem

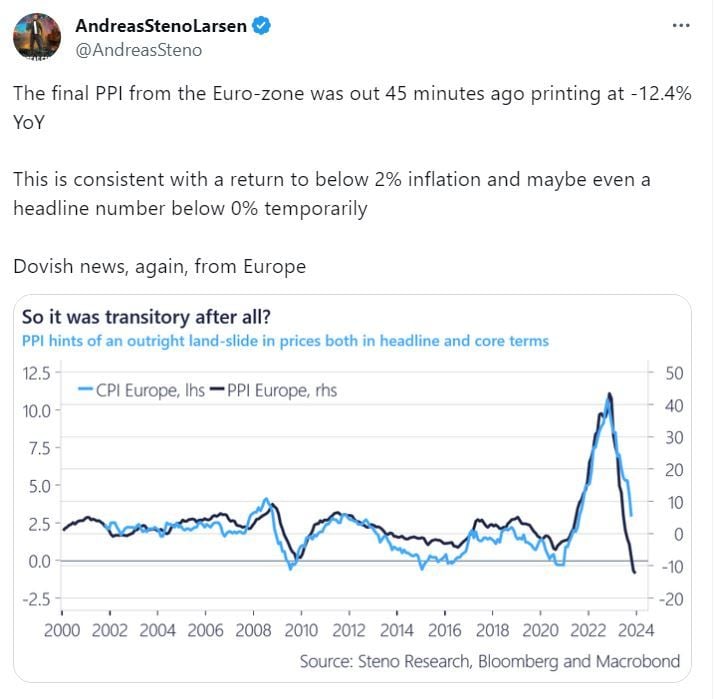

Will Lagarde / ECB cut rates sooner than anticipated ?

Source: AndreasSteno

Investing with intelligence

Our latest research, commentary and market outlooks