Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

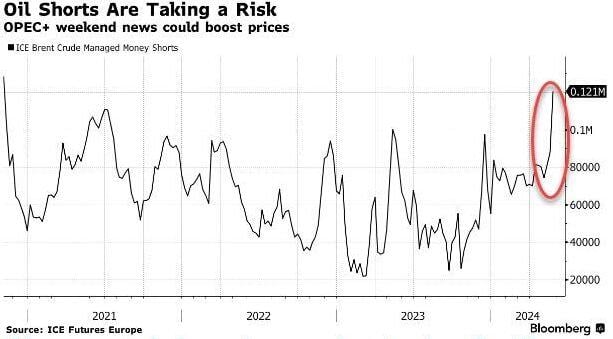

Speculators have built the largest Brent Oil short position since 2020

Source: Barchart, Bloomberg

The Orange Juice crisis is upon us 🚨 What will be the next fruit to get sent? Mango, Pineapple, Kiwi?

Source: Barchart, FT

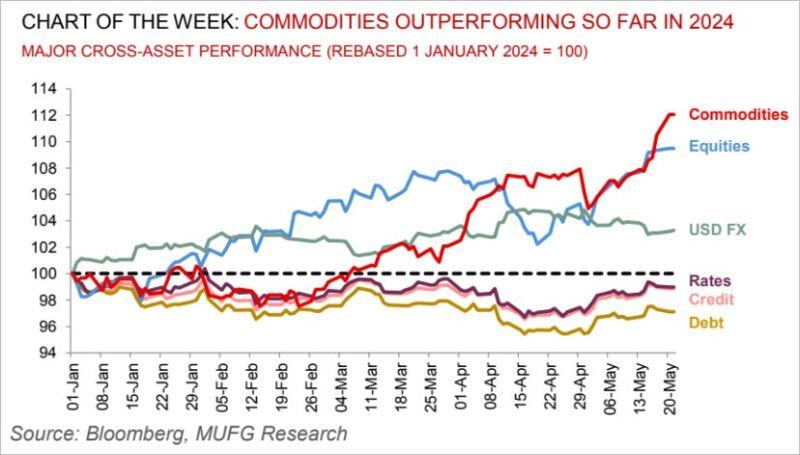

Commodities, the silent bull market that almost nobody cares about...

Source: Ronnie Stoeferle, MUFG

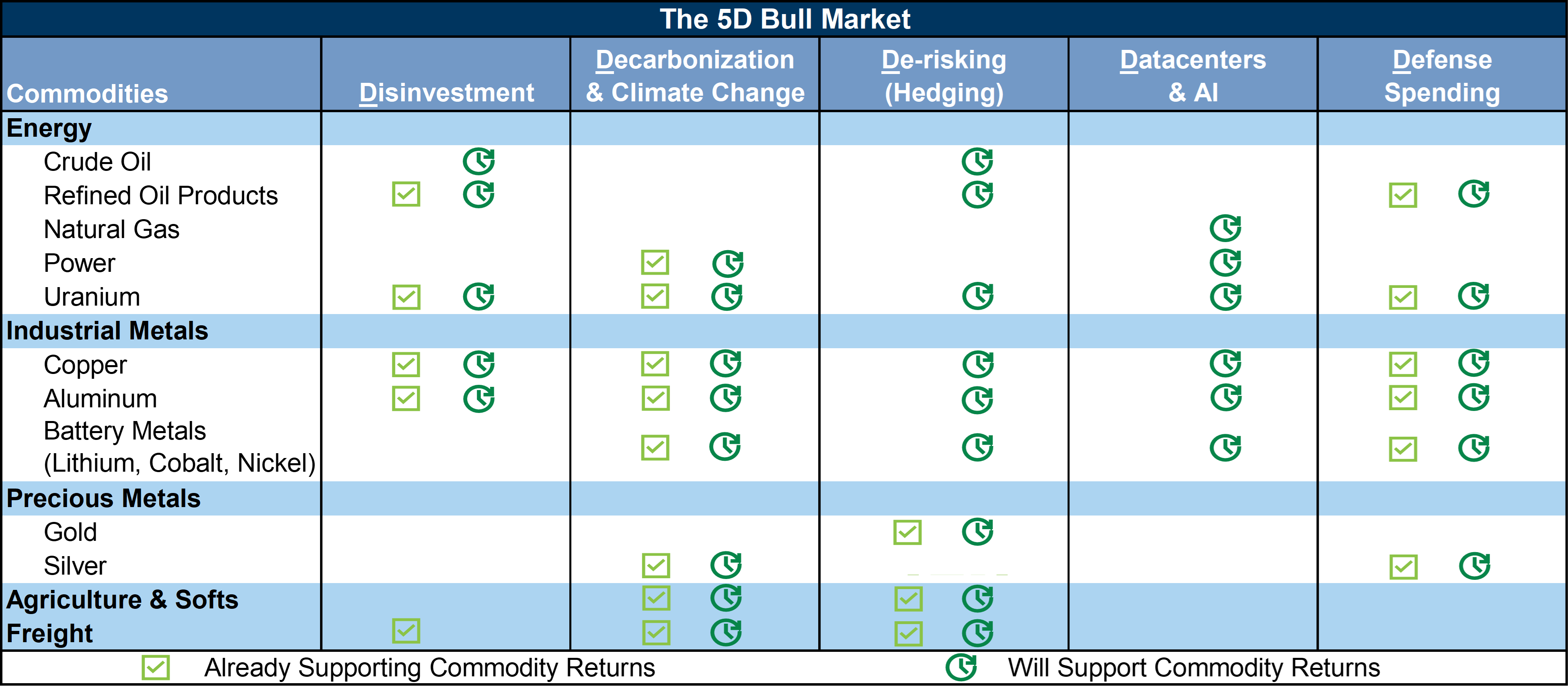

The 5D commodity bull market according to Goldman Sachs

Source: Goldman Sachs Global Investment Research

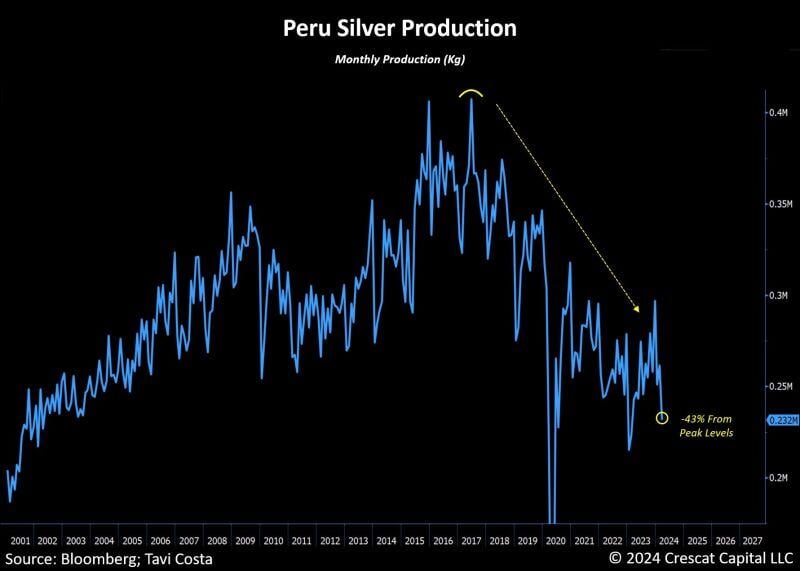

As highlighted by Tavi Costa ->

Silver production in Peru continues to fall severely, now down 43% from peak levels. Together with China, Peru is projected to be the second-largest producer of silver globally. Limited new supply paired with structurally higher demand is the perfect recipe for major price surges in any commodity. Source: Tavi Costa, Crescat Capital, Bloomberg

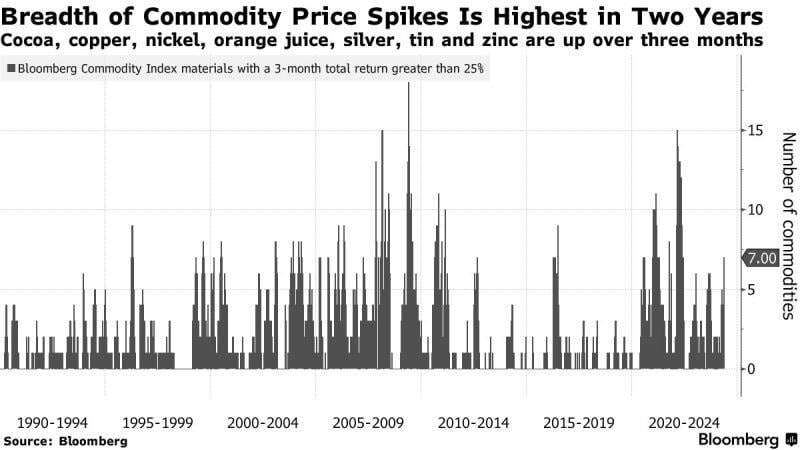

The breadth in commodity price spikes is the highest in two years

Source: Bloomberg

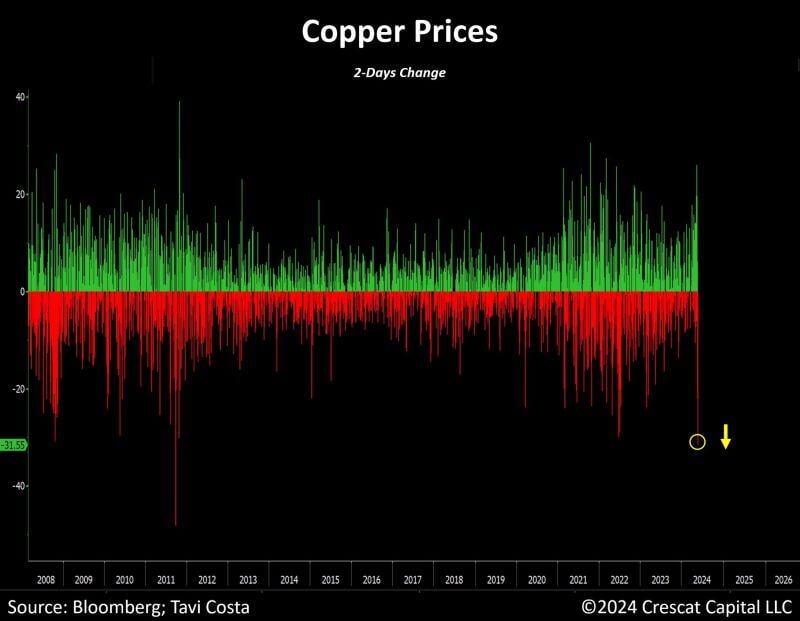

Copper just had its worst 2-day decline in 13 years.

A much-needed shake out to reset the sentiment. Source: Bloomberg, Tavi Costa, Crescat Capital

Investing with intelligence

Our latest research, commentary and market outlooks