Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

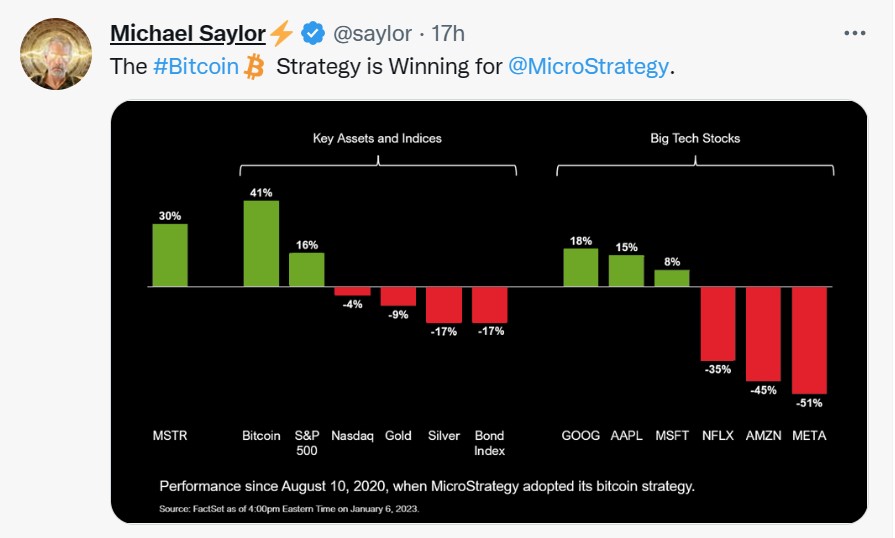

Michael Saylor Bitcoin strategy

Michael Saylor, CEO of Microstrategy, shows that his strategy of accumulating bitcoin (using Microstrategy Treasury money) since August 2020 is still doing better than investing in any other asset classes.

Bitcoin is growing faster than every financial company and bank in history

Source: Documenting Bitcoin

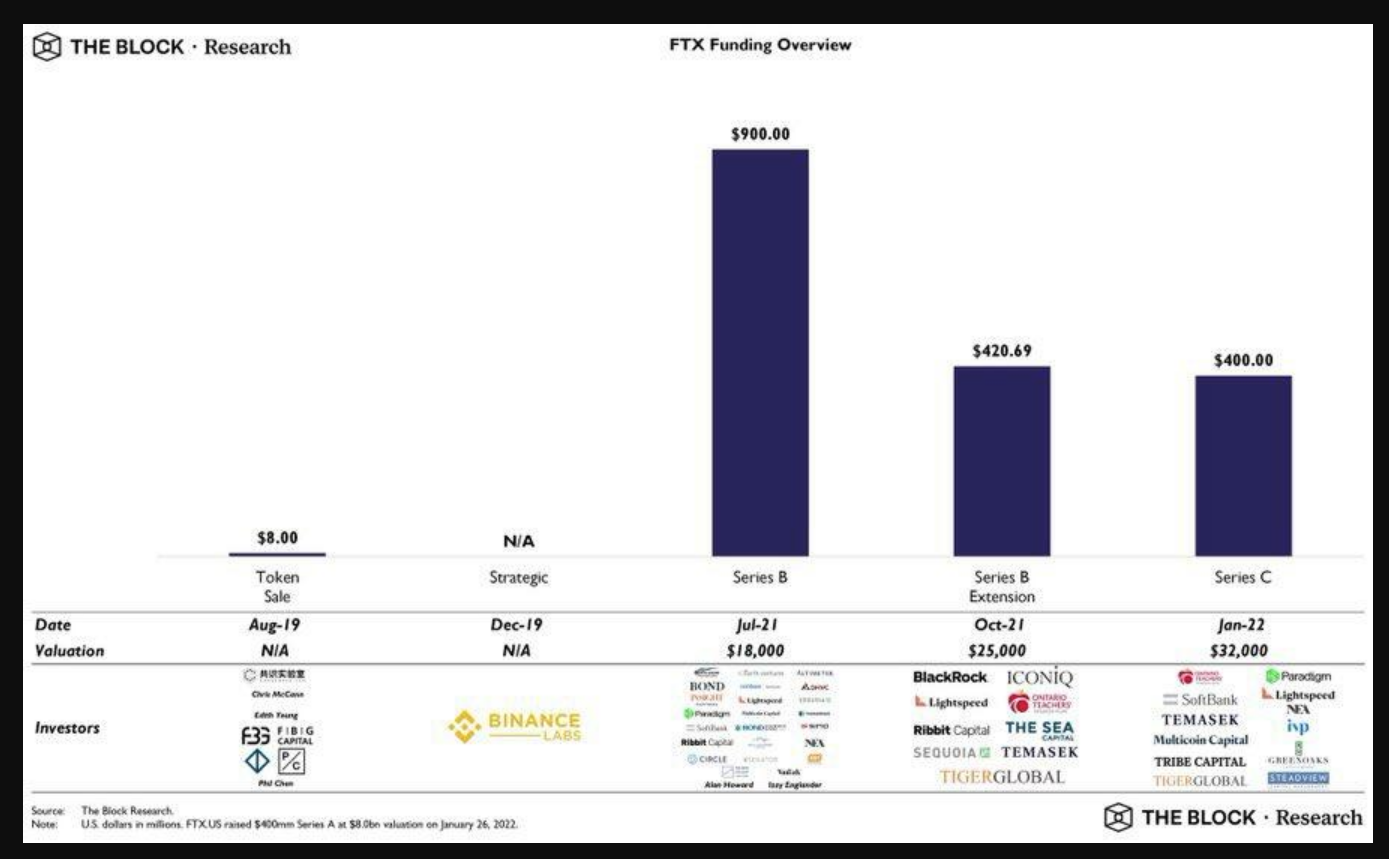

Here Are All The Funds That Are Losing Billions In FTX

Here is a list of the most prominent investors in FTX courtesy of The Block's Frank Chaparro: BlackRock, Ontario Pension Fund, Sequoia, Paradigm, Tiger Global, SoftBank, Circle, Ribbit, Alan Howard, Multicoin, VanEck, Temasek Source: www.zerohedge.com

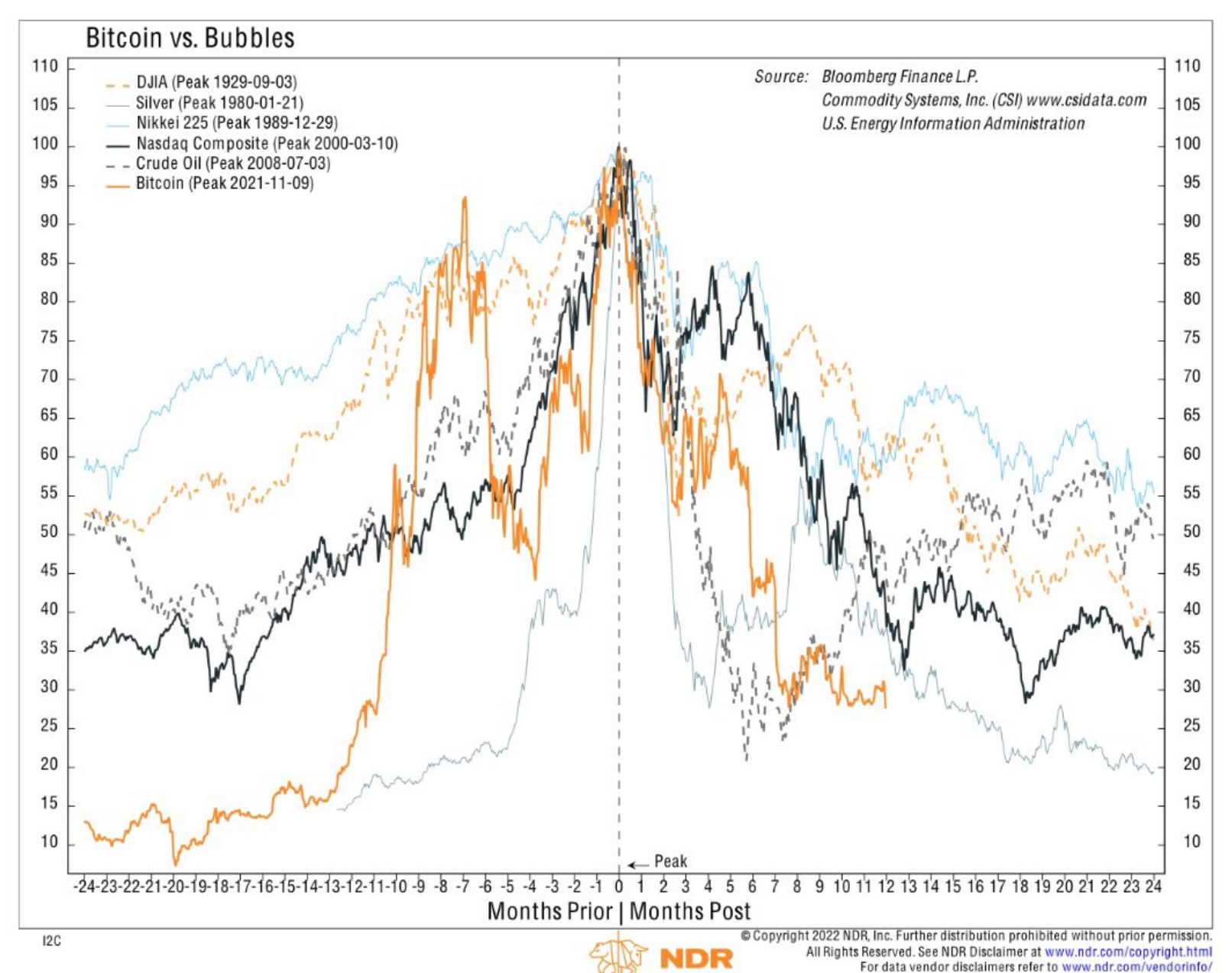

Bitcoin vs. Bubbles

It has been one year since Bitcoin peaked north of $65,000. Compared to other major bubbles, the 12-month gain leading up to the peak was second best behind silver in 1979/1980, while the 12-month drawdown post peak has been the most severe. Source: @NDR_Research

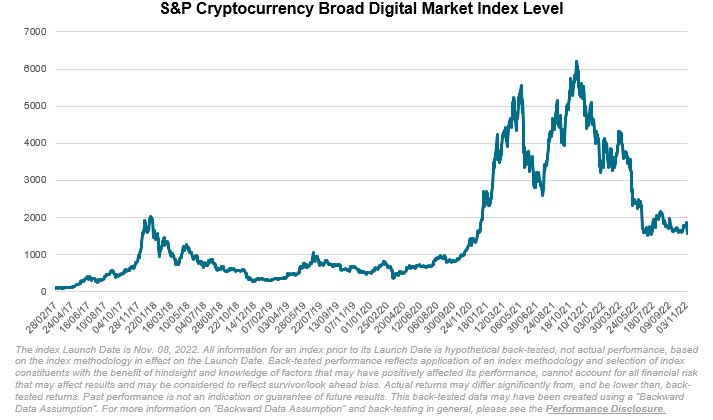

S&P Cryptocurrency Index has now lost 74% of its value over past 12m.

News of liquidity crunch, imminent collapse/subsequent takeover by rival of one of largest #crypto exchanges, FTX, with broad-based S&P Cryptocurrency Broad DMI tanking 14% (3rd worst day in 2022); has now lost 74% of its value over past 12m. Source; Liz Ann Sonders

FTX Token is now down 92% from its All-Time-High

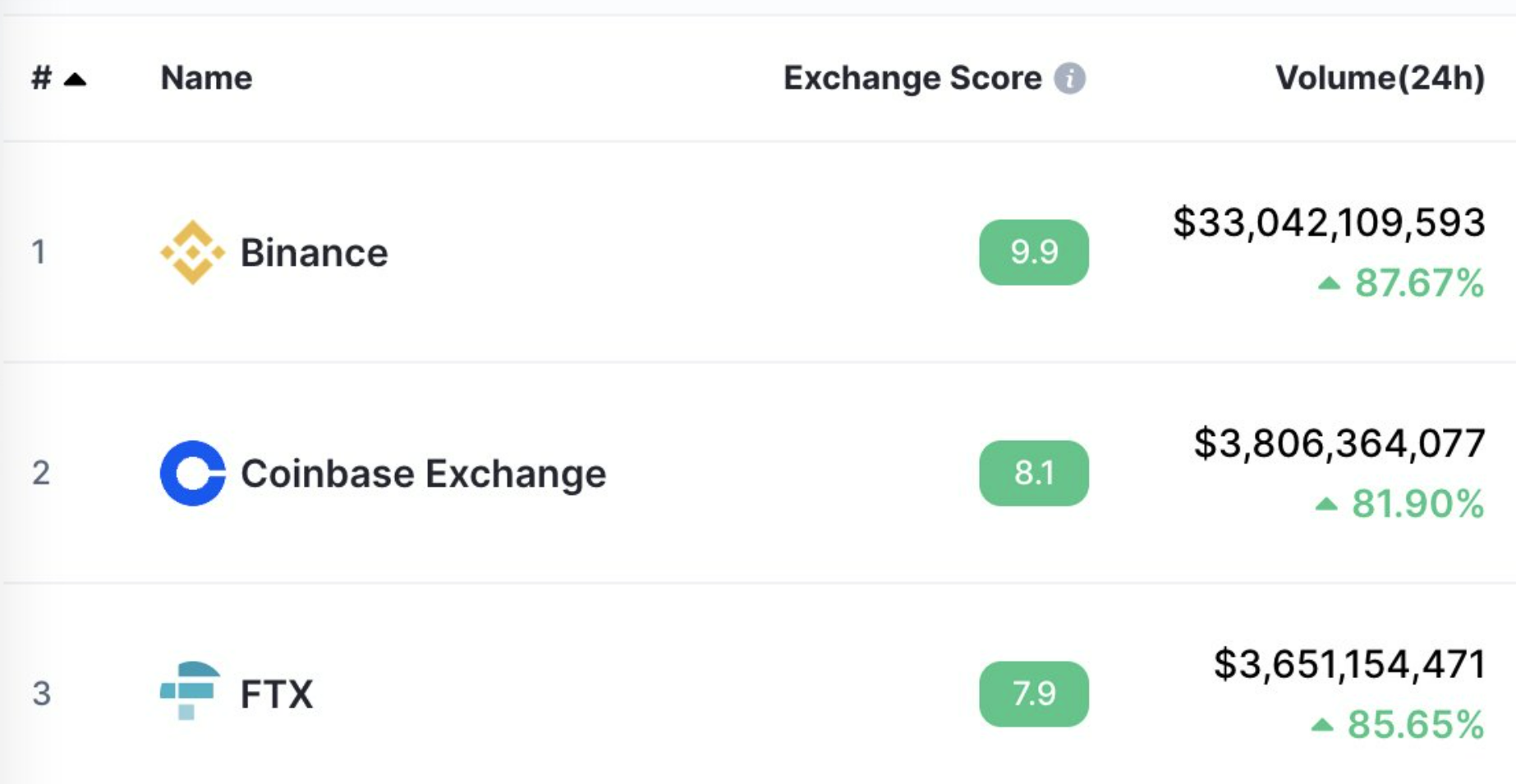

FTX was rocked by the collapse of FTX Empire & the drama over potential acquisition of FTX by Binance. FTX was a huge player. According to CoinGecko, FTX was the 4th-largest crypto exchange by volume. Source: Bloomberg, FTX

FTX was the third-largest crypto exchange in spot volume.

How other exchanges can survive and compete against Binance? Source: Ki Yong Lu

Investing with intelligence

Our latest research, commentary and market outlooks