Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

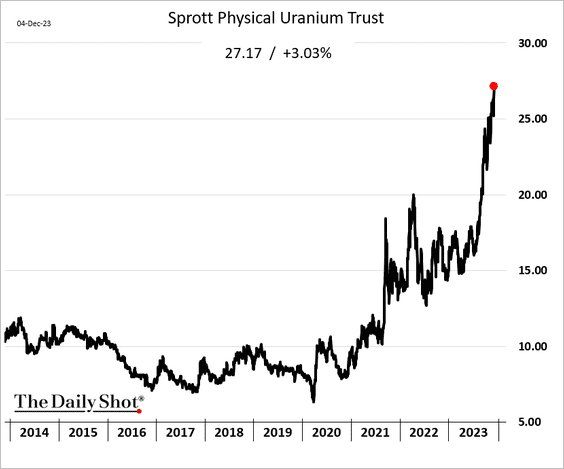

The bull market none is talking about. Uranium prices are surging as nuclear is seen as one of the only "clean" energy source to move away from fossil fuels

Source chart: (((The Daily Shot)))

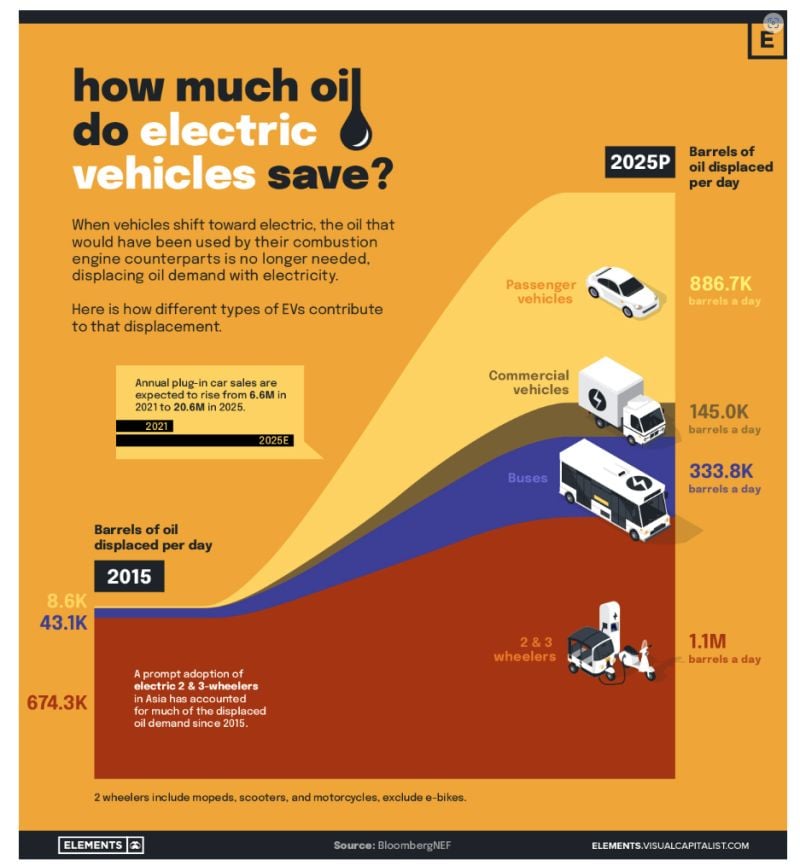

The EV Impact on Oil Consumption by E`LEMENTS / Visual Capitalist As the world moves towards the electrification of the transportation sector, demand for oil will be replaced by demand for electricity

To highlight the EV impact on oil consumption, the above infographic shows how much oil has been and will be saved every day between 2015 and 2025 by various types of electric vehicles, according to BloombergNEF. Link to full article: https://lnkd.in/eYm5iJ8d

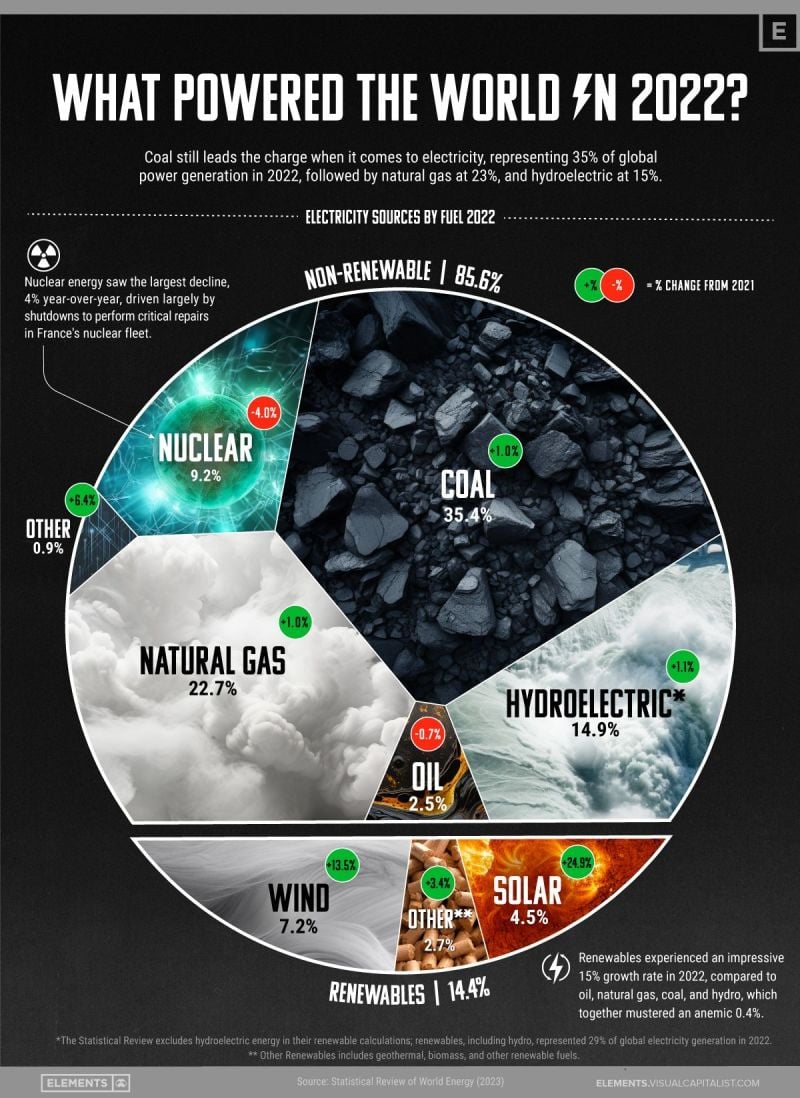

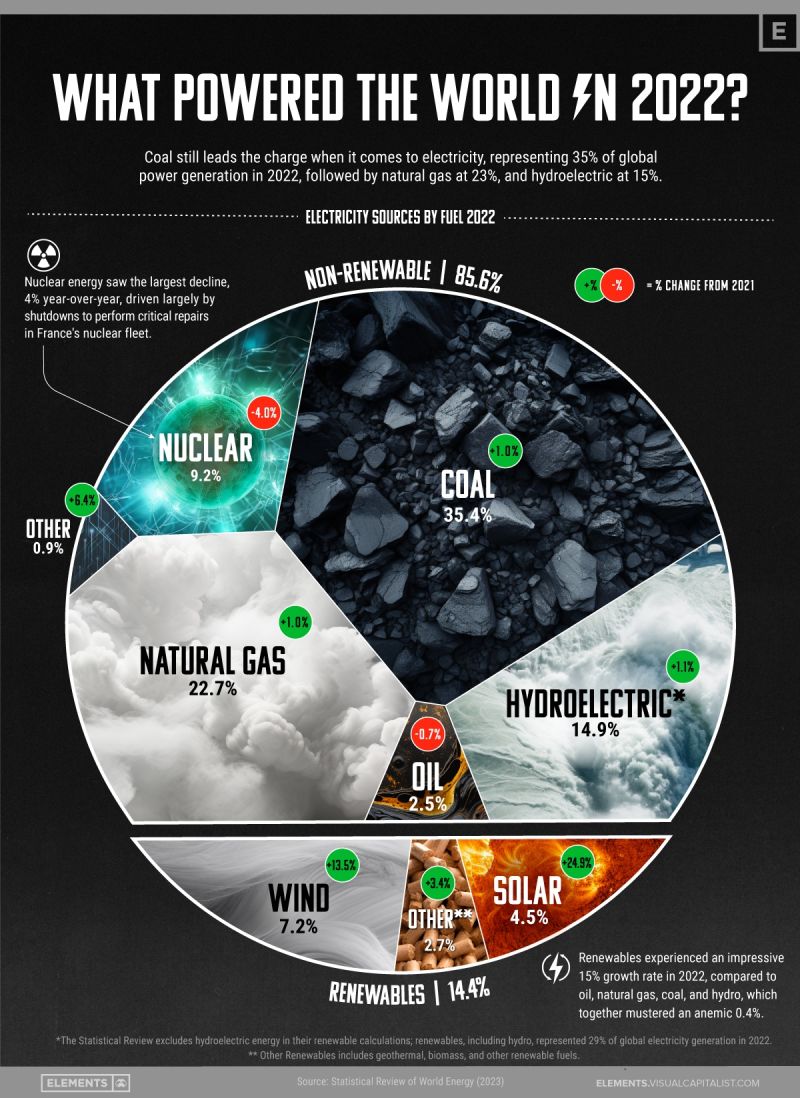

What powered the world in 2022?

Coal still leads the charge when it comes to electricity, representing 35% of global power generation, followed by natural gas at 23% and hydroelectric at 15%. Source: Elements, Visual Capitalist

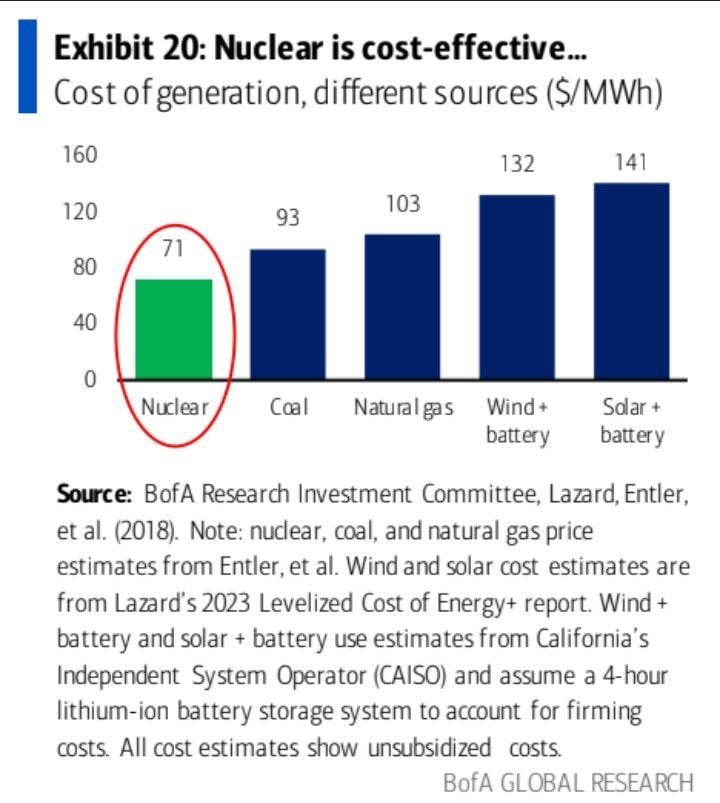

Bank of America research:

"Industry research suggests that, after accounting for efficiency, storage needs, the cost of transmission, and other broad system costs, nuclear power plants are one of the least expensive sources of energy." Source: BofA Global Research, Gustavo Philippsen Fuhr

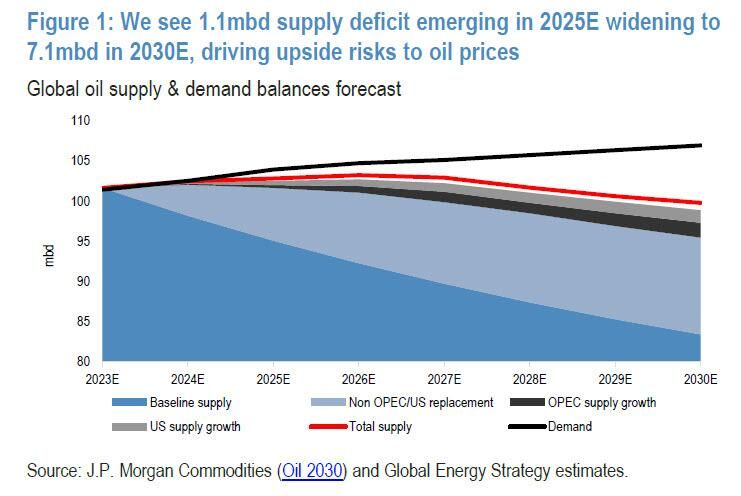

JP MORGAN is making a big bullish call on oil and energy stocks.

The largest US bank expects the global oil deficit hitting a record 7mmb/d in 2030, a staggering shortfall which would require prices to rise higher... much higher. In a nutshell: JPM is reiterating their $80/bbl LT target and their view framed in Supercycle IV that the upside risk to oil is $150/bbl over the near to medium term term and $100/bbl LT. The primary drivers of their structural thesis are : 1) higher for longer rates tempering the flow of capital into new supply, 2) higher cost of equity driving elevated Cash Breakevens of >$75/bbl Brent (post buybacks) as companies return structurally more cash to shareholders, in turn, pushing the marginal cost of oil higher, 3) Institutional and policy led pressures driving an accelerated transition away from hydrocarbons and peak demand fears. Taken together, their corollary is a self-reinforcing ‘higher-for-longer’ energy macro outlook as the industry struggles to justify large investments beyond 2030. Consequently, they forecast a 1.1mbd S/D gap in 2025 widening to 7.1mbd in 2030 driven by both a robust demand outlook and limited supply sources.

Investing with intelligence

Our latest research, commentary and market outlooks