Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

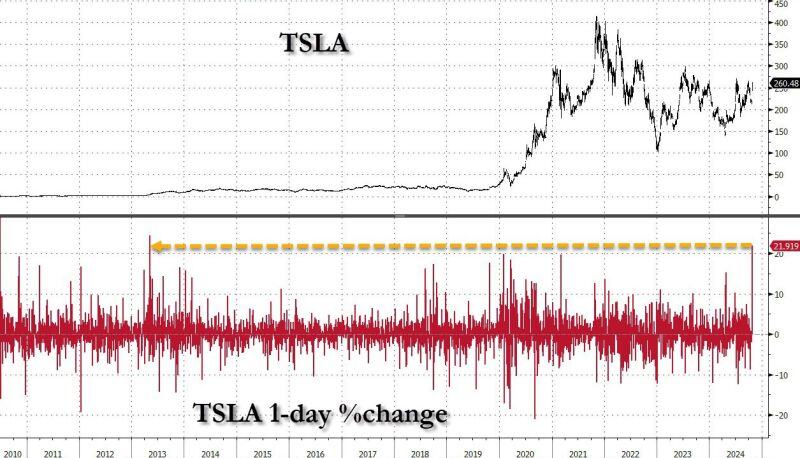

Yesterday was the second biggest jump in Tesla $TSLA stock on record (+22%)

Only May 9, 2013 was bigger: that's when Tesla reported its first ever quarterly profit. Elon added $26BN to his net worth. Source: Bloomberg, zerohedge

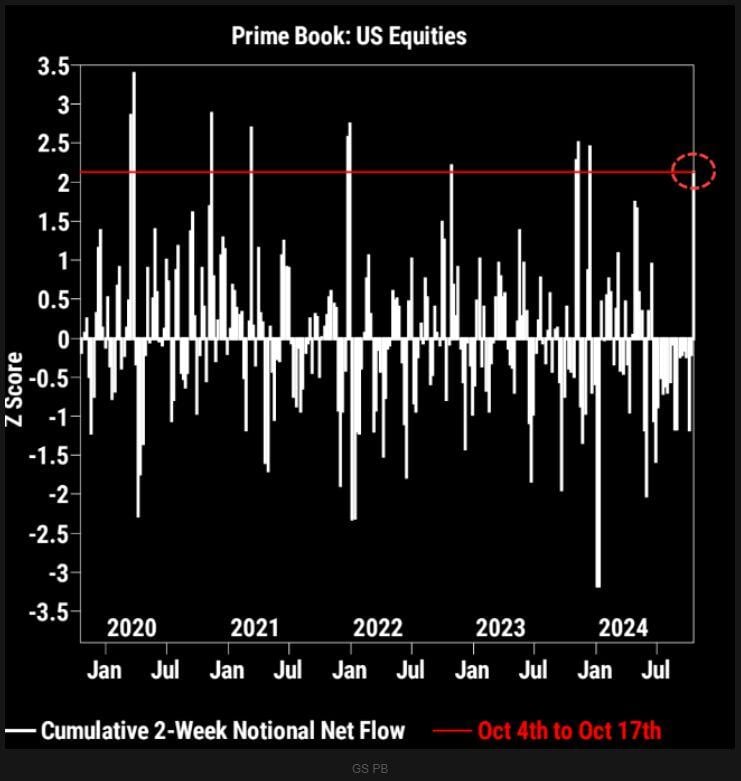

Hedge Funds are buying U.S. Stocks at the fastest pace this year 🚨

Source: Barchart

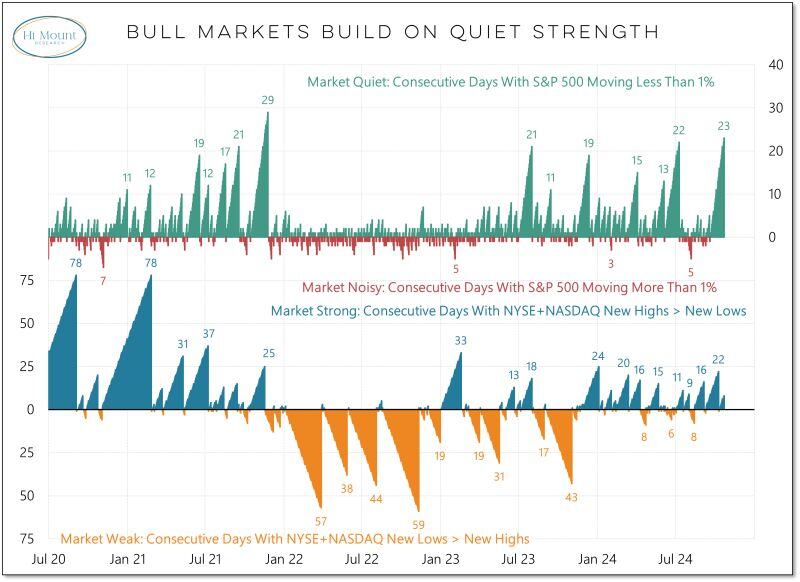

Finally some red on the S&P 500 index heat map...

US stocks plummeted yesterday as 10-year treasury yields and us dollar have risen for the last couple of weeks. Gold and Silver dropped sharply as well. Performance today: S&P 500 -0.9% Nasdaq -1.6% Russell 2000 -0.9% Dow Jones -1.0% Bitcoin -1.6% Bank Index +0.3% VIX +6%, front mth futures VIX +5% Gold -1.1% Silver -3.5% WTI Crude Oil -1.0% Source: Global Markets investor

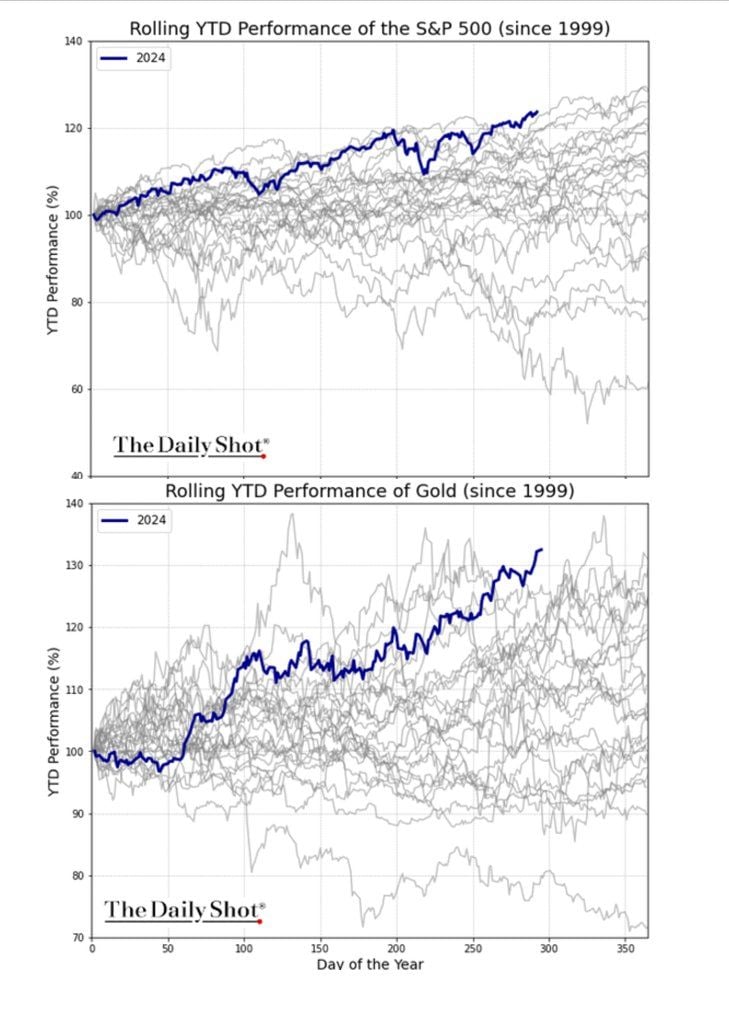

Gold and stocks *both* with their best YTD performance in 25yrs this year.

Not really the sort of market action that is aligned with an aggressive easing cycle... h/t @thedailyshot thru Bob Elliott on X

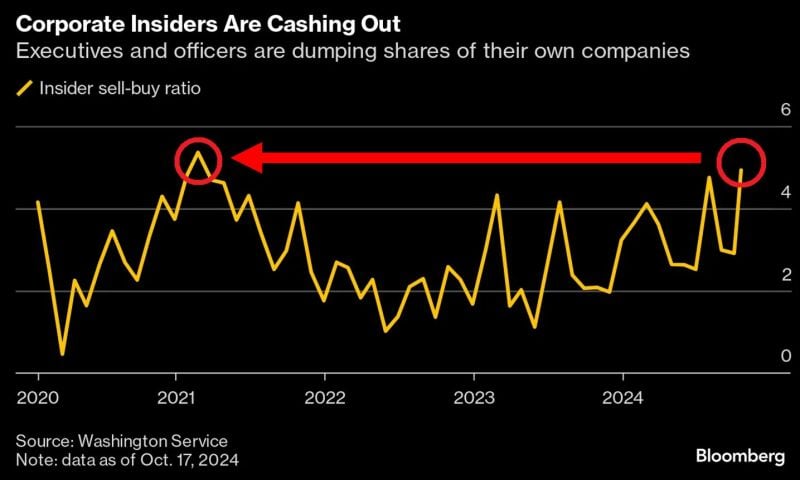

😱 US EXECUTIVES ARE SELLING STOCKS 😱

The insider sell-to-buy ratio jumped to the highest level since 2021. Source: Global Markets Investor, Bloomberg

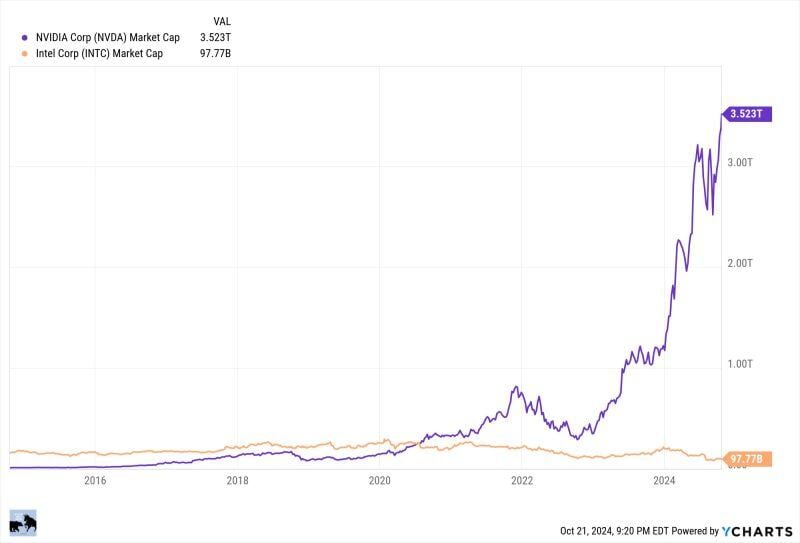

Nvidia $NVDA is now more than 36 times larger than Intel $INTC

Intel was 16 times larger than Nvidia a decade ago Source: Y charts, Ervan on X

Investing with intelligence

Our latest research, commentary and market outlooks