Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

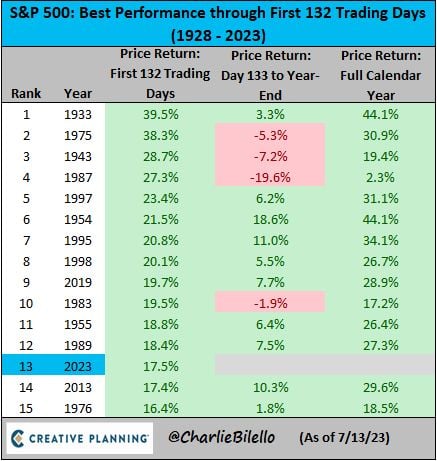

The S&P 500 is up 17.5% year-to-date. In the last 20 years only 2019 had a better start. $SPX

Source: Charlie Bilello

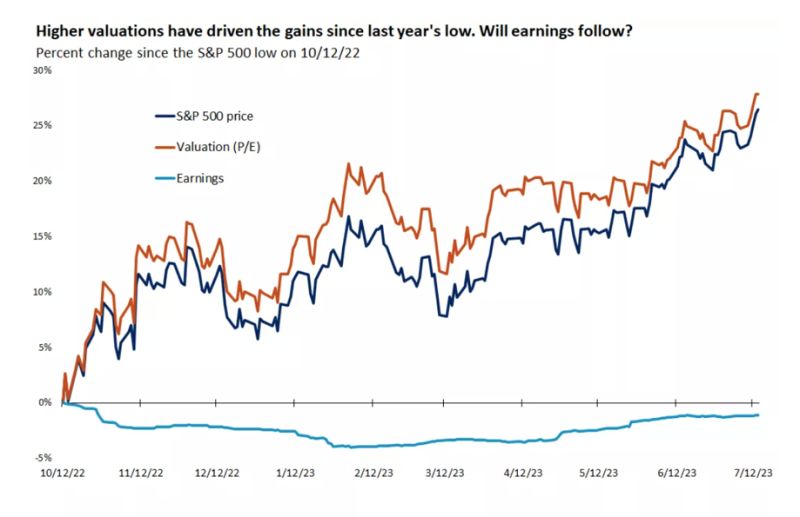

The S&P 500's 25% gain since last year's low has been driven by valuation expansion rather than rising earnings

The S&P 500's 25% gain since last year's low has been driven by valuation expansion rather than rising earnings. There is hope that earnings will start recovering in Q3 and through 2024. Source: Edward Jones

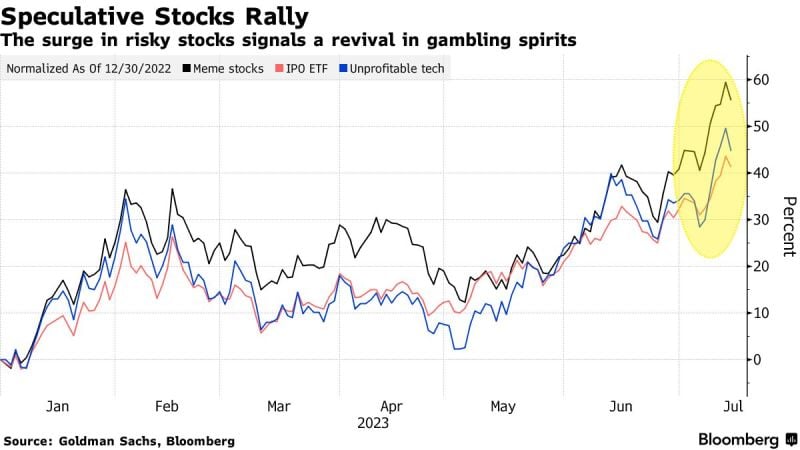

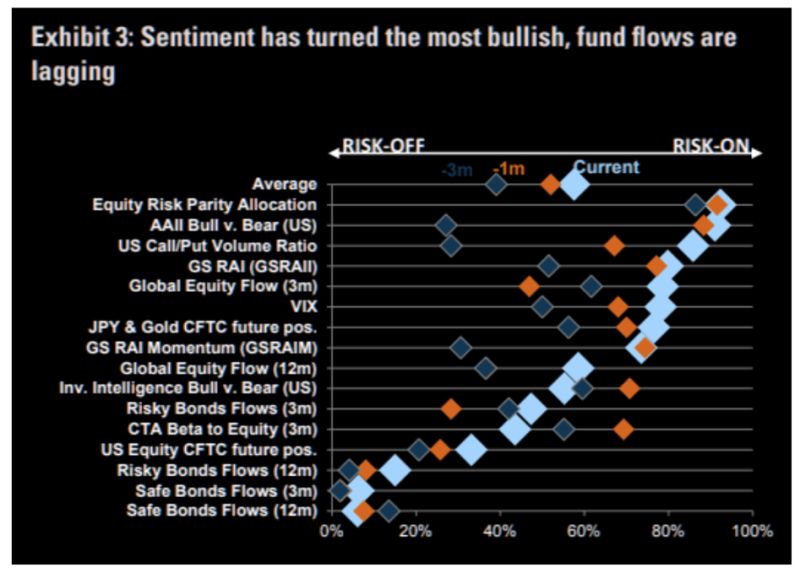

Bullish sentiment on equities is getting even more bullish

Bullish sentiment on equities is getting even more bullish. Source: TME, Goldman Sachs

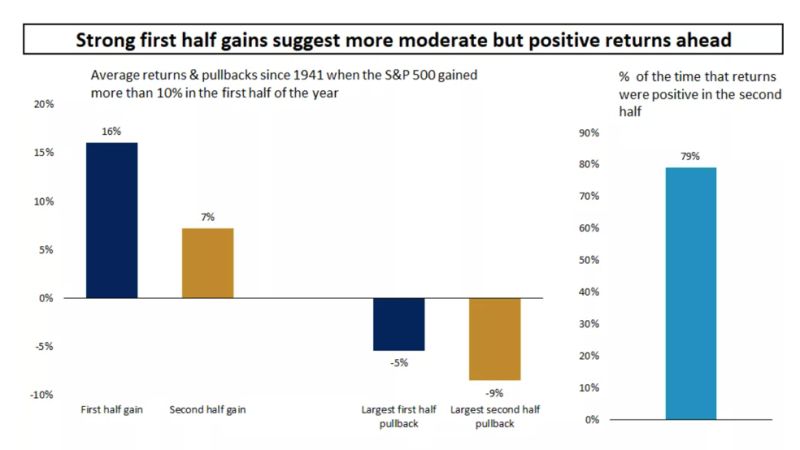

Since 1941 strong first half S&P 500 performance has been associated with further gains in the second half of the year, though with more volatility

Since 1941 strong first half S&P 500 performance has been associated with further gains in the second half of the year, though with more volatility. Past performance does not guarantee future results... Source: Edward Jones

The S&P 500 is currently trading ~12.5% above its 200-day Moving Average

The S&P 500 is currently trading ~12.5% above its 200-day Moving Average. We haven't seen $SPY this far above its 200-day since August of 2021, nearly two years ago. While it looks over-extended, it is not unsustainable. For instance, study the left side of the chart from Nov '20 - Aug '21 Source: Grayson Roze

NASDAQ is trading in the upper part of the steep trend channel

NASDAQ is trading in the upper part of the steep trend channel. Note the shooting star candle today, a classical candle that should be observed closely post strong short term trends. One candle doesn't make a "case", but watch for a possible confirmation session. Source: TME, Refinitiv

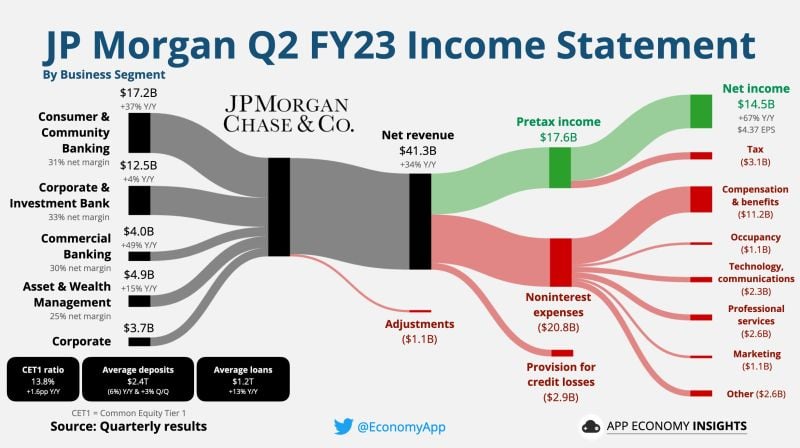

$JPM JP Morgan Chase Q2 FY23 numbers

$JPM JP Morgan Chase Q2 FY23 numbers • Net revenue +34% Y/Y to $41.3B ($2.5B beat). • Net Income $14.5B. • EPS: $4.37 ($0.61 beat). • CET1 ratio of 13.8%. $2.7B First Republic bargain purchase gain in Corporate. Source: App Economy Insights

Investing with intelligence

Our latest research, commentary and market outlooks