Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The e-commerce market is a winner-takes-almost-all industry in each country, with Amazon being the leader in terms of e-commerce revenue

JD follows Amazon in second place, generating significantly less e-commerce revenue. Source: Genuine Impact

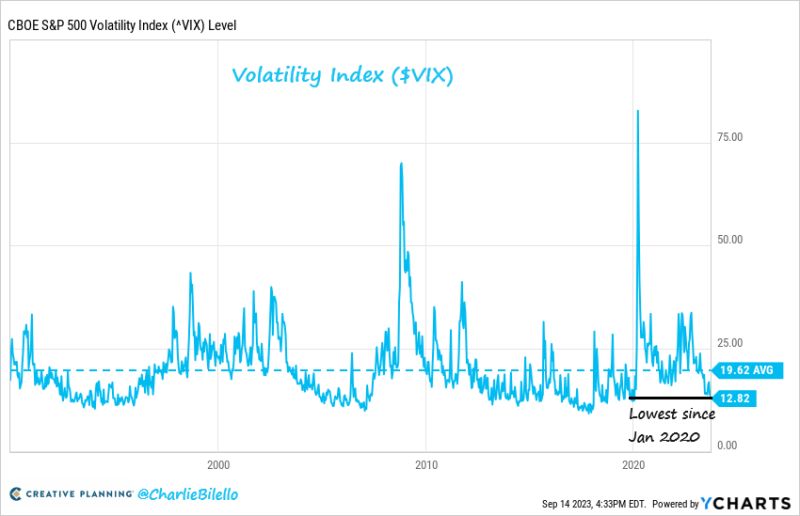

The $VIX ended the day at 12.82, its lowest close since January 2020

Source: Charlie Bilello

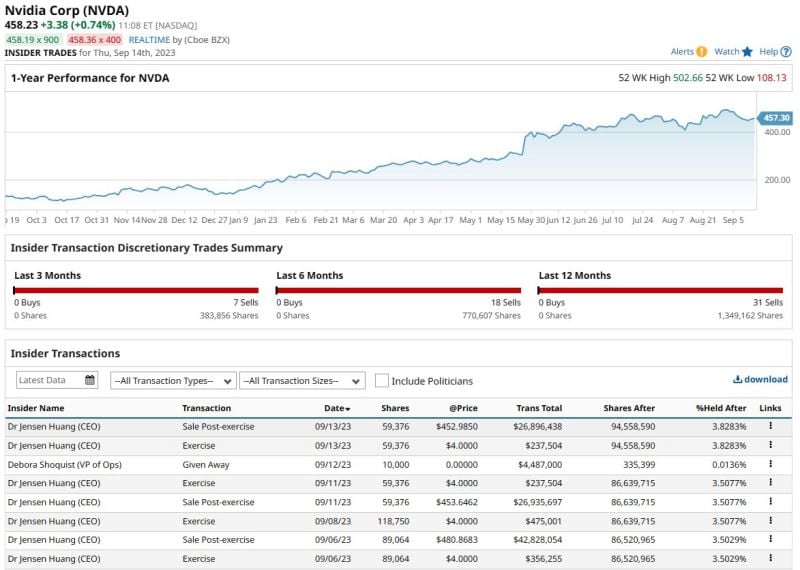

Nvidia Insider Trading Alert 🚨

Nvidia CEO Jensen Huang dumped another $27 million worth of $NVDA shares. He has now sold almost $100 million worth of shares over the last week. Source: Barchart

The top 10 companies in the S&P 500 with outstanding credit ratings

Among them, Microsoft and Johnson & Johnson stand out as the only two companies boasting the highest AAA rating. Source: Genuine Impact

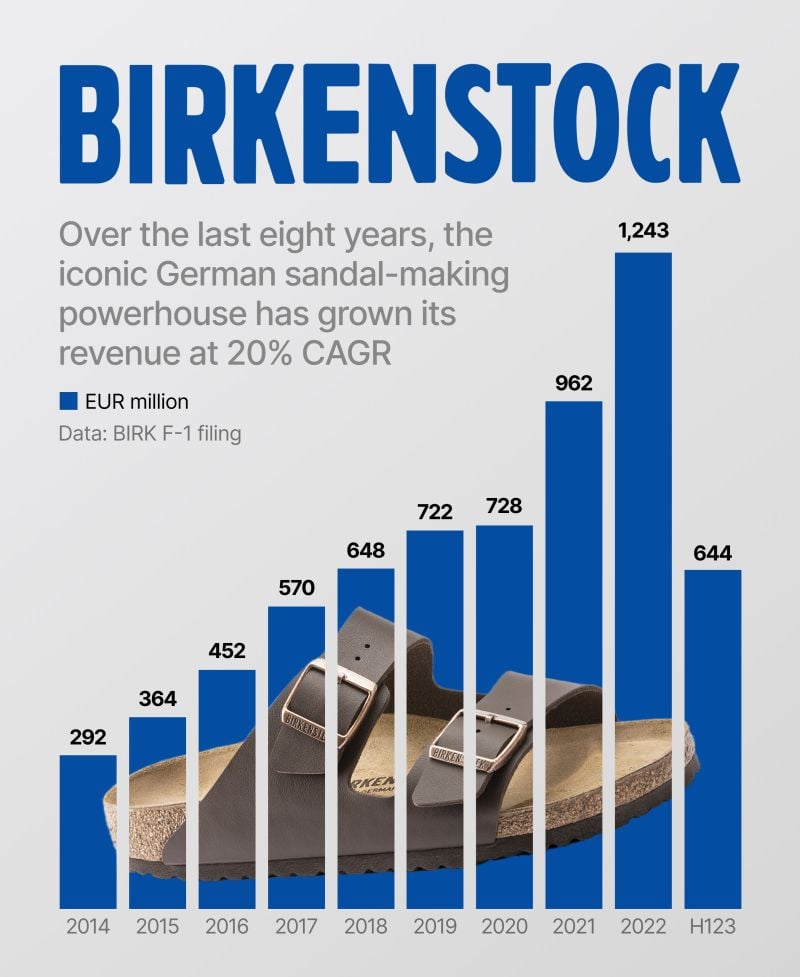

Yesterday, the $LVMH-backed iconic sandal-maker Birkenstock filed for its NYSE IPO!

With a 250-year history and a product that has been cheaply imitated for decades, $BIRK's 20% revenue CAGR over the last eight years is very impressive. Looking at profitability, Birkenstock actually has 60% gross margins, and its EBIT margins reached as high as 29% in FY22. In 2021, Birkenstock was acquired by the private equity firm L Catterton for $4.3B. Together with Bernard Arnault's family holding company Groupe Arnault, LVMH owns 40% of the ~$30B firm. The rumored valuation of ~$8B would imply an EBIT multiple somewhere around 20x, using the company's FY22 numbers. Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks