Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

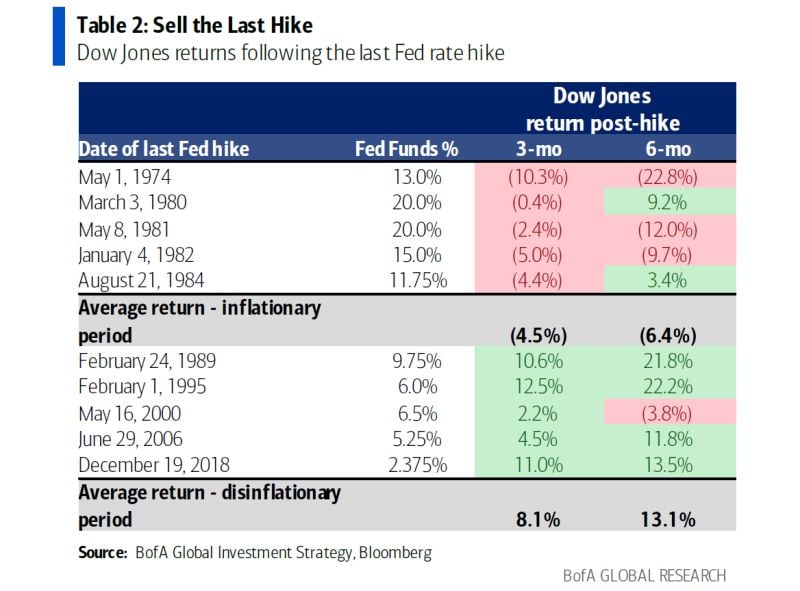

How to trade equity markets following the LAST FED rate hike?

BofA Harnett says it depends whether the economy is in inflationary or an inflationary period. When monetary policy needs to work harder to slow economy in inflationary era (e.g. 1970s/1980s), Dow Jones returns were most of the time negative in the 3 months and 6 months that followed the last Fed hike... However, in disinflationary period, markets returns were quite strong. So do you believe we are in an inflationary or disinflationary period? Source: BofA Global Research

The S&P 500 index dropped 2.9% over the week

That marked the third straight negative week and worst weekly performance since March. Is the Head & Shoulders pattern in the S&P 500 playing out? Source: barchart

The worst weekly performance since March for the sp500...

Markets like clarity and hate confusion. The first half of the year was about disinflation + AI buzz. Now the markets are not sure about what's next. And some of the confusion seems to be coming from central banks... This week we got a very confusing message from the #fed: a pause in rates, higher dot plots in 2024 but also calling a soft landing NOT a base line expectation, hence sharing fears that keeping real rates for a long period of time creates some downside risks for the economy and the markets... The combo higher inflation risk + downside growth risk is not a great value proposal for Mr Market at the time you can nicely paid by keeping your assets in money markets funds... Source chart: Bloomberg

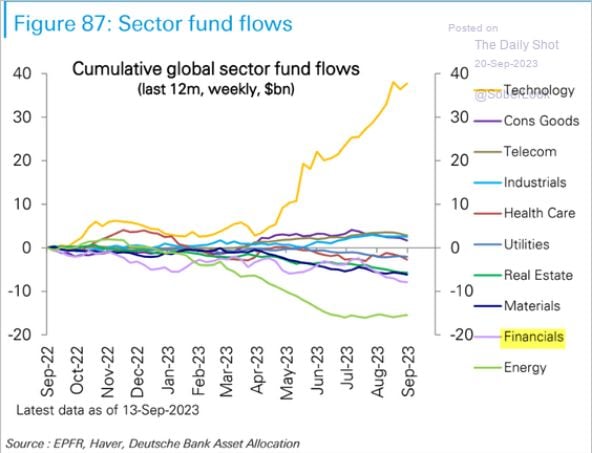

Sector fund flows

Long-only institutional & retail investors are all-in overweight tech and meaningfully underweight energy. Will elevated tech valuations, rising long-end yields, and rising oil prices trigger a squeeze in positioning? Source: The Daily Shot, EPFR, DB

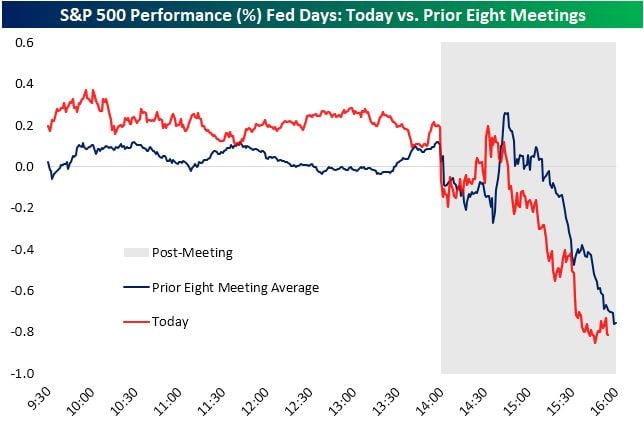

Another Powell Fed Day

Incredible how closely today's action tracked the average. Source: bespoke (read "today" red line as yesterday)

Is the US IPO market coming back to life?

Instacart sold 22 million shares at $30 each in an initial public offering on Monday, raising $423 million in the process. The offering, which values the grocery delivery company at around $10 billion, is the second high-profile IPO in a matter of days, after British chipmaker Arm had made its trading debut on the Nasdaq stock exchange last Thursday. With Klaviyo, a marketing automation company, also planning to raise up to $550 million in its initial public offering on Tuesday, this week is a clear sign of life from the U.S. IPO market, which had dried up completely in 2022 after a record-breaking 2021. According to Dealogic data analysed by EY, IPO activity already picked up slightly in the first half of the year, as companies raised $10.1 billion in 63 initial public offerings in the U.S., compared to $4.7 billion in 51 IPOs in the first six months of 2022. With inflation looking likely to have peaked, rate hikes nearing an end and equities having rebounded from last year’s lows, the market backdrop looks more positive now that it did at any time in the past 18 months. Source: Statista

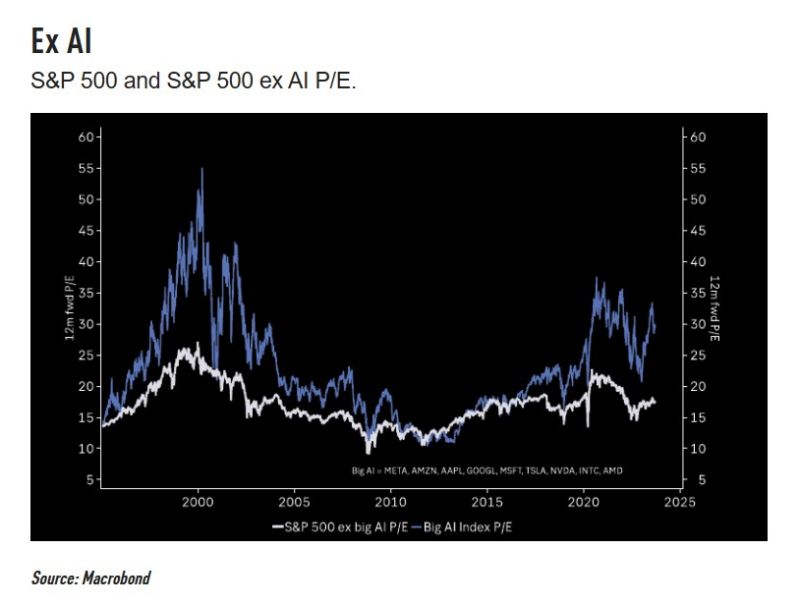

A tale of 2 markets: S&P 500 "big AI" stocks 12-month forward P/Es vs. S&P 500 "ex-big AI" stocks 12-month forward P/Es

Source: TME, Macrobond

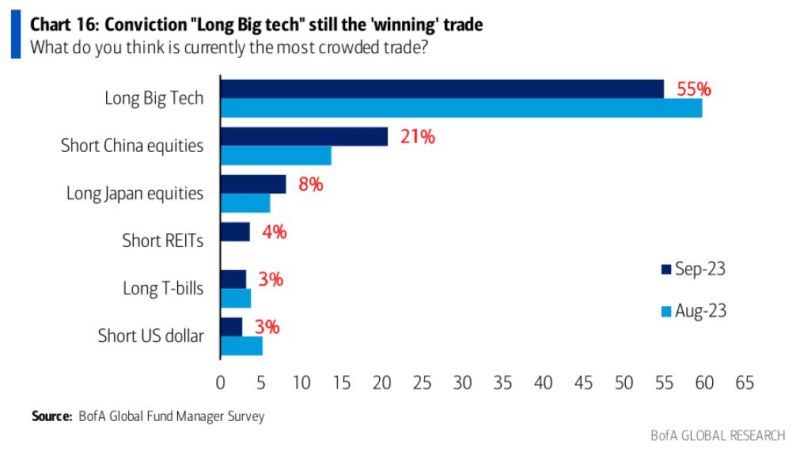

Long Big tech is now the most crowded trade in the latest Global Fund Manager Survey by BofA

Short China equities comes next.

Investing with intelligence

Our latest research, commentary and market outlooks