Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

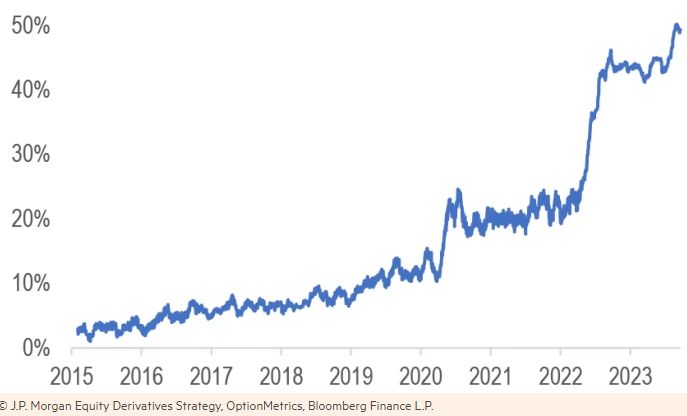

Zero Day Options (0DTE) now account for half of total SP500 options volume

Source: Barchart

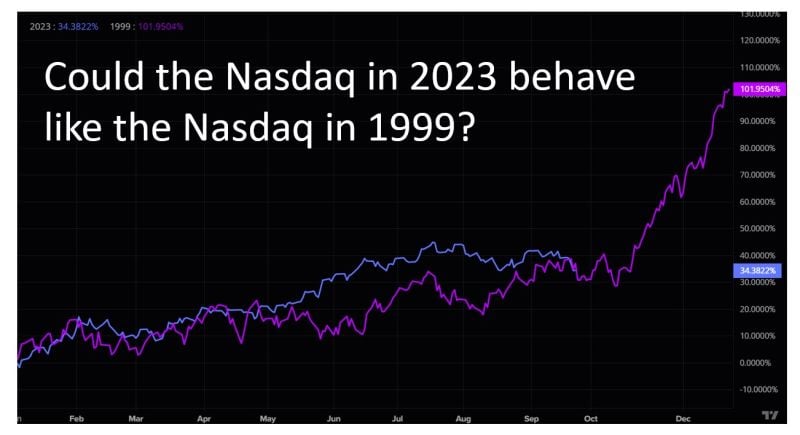

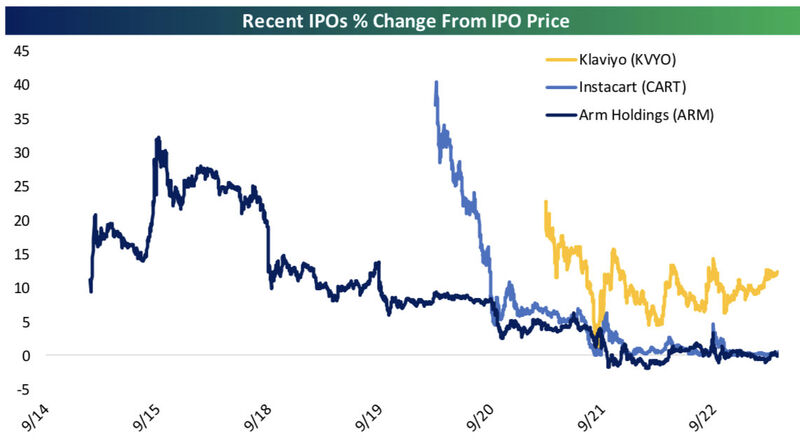

NASDAQ's 1999 analogy chart isn't perfect but given the amount of shorting by hedge funds and short gamma selling by dealers, a squeeze in Q4 (the historically strongest quarter) is a possibility

Source: TME

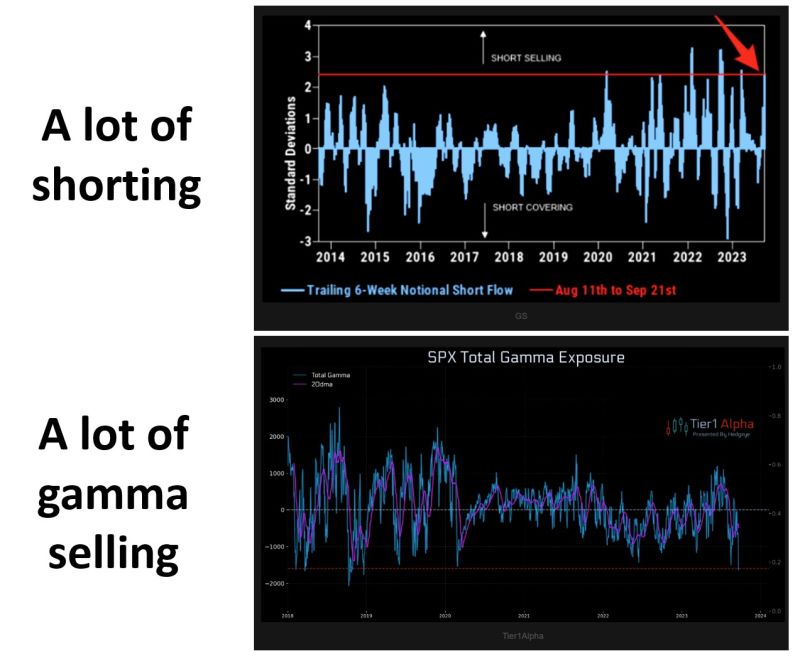

Is the US equity market ripe for a short squeeze?

As highlighted by Goldman Sachs PB: "the amount of shorting in US equities since mid-August is the largest in six months and ranks in the 98th percentile vs. the past decade." Meanwhile, the level of short gamma is the highest in a long time. Dealers have been forced to sell deltas as we have moved lower (chart by Tier1Alpha). This has pressured the market. But we need to keep in mind that gamma works both ways, so a possible bounce from here would force dealers to buy back all that delta they sold recently. Source: The Market Ear

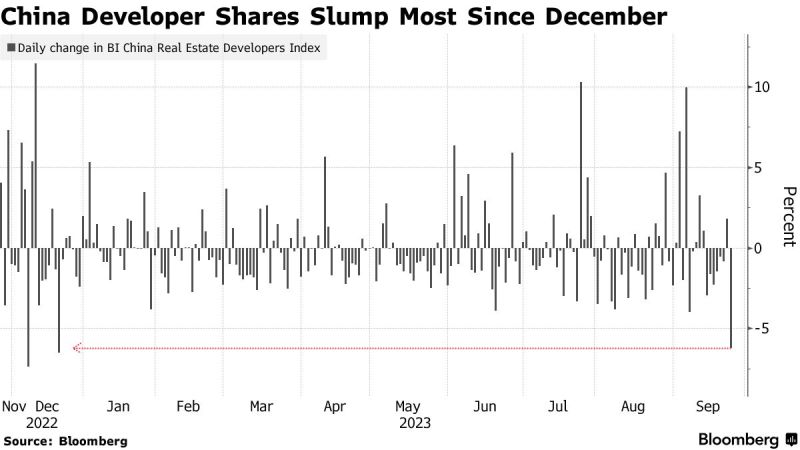

Chinese property stocks tumbled the most in nine months as concern over a possible China Evergrande Group liquidation added to fresh signs of stress across the industry

A Bloomberg Intelligence gauge of developer shares fell as much as 6.4% Monday, taking its loss in valuation this year to $55 billion. Evergrande, which scrapped key creditor meetings at the last minute and said it must revisit its restructuring plan, dived 25%. China Aoyuan Group Ltd. was the biggest drag on the gauge, slumping by a record 76% after shares resumed trading. Sentiment has worsened dramatically in recent days as investors brace for years of pain from the ailing sector, with policy support failing to resolve liquidity woes. While developers are pinning their hopes on the upcoming Golden Week holiday period to revive home sales, a rapid cooling of a late-August rally in property shares shows any relief may be short lived. Source: Bloomberg

The main driver for stock returns

Source: BCG, Morgan Stanley Research thru Compounding Quality

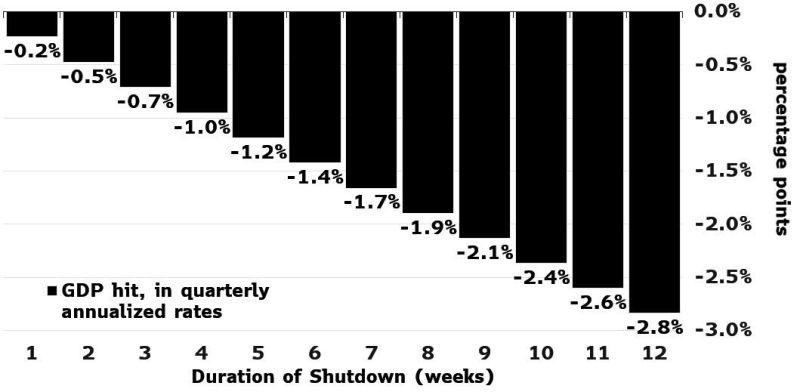

According to Bloomberg chief economist Anna Wong, online betting markets see a 69% chance of a federal government shutdown starting Oct. 1st

So what could be the effects on the US economy and job market? Below chart shows the effects on GDP depending on the duration of the shutdown. - According to Goldman, a government-wide shutdown would reduce quarterly annualized growth by around 0.2% for each week it lasted after accounting for modest private sector effects. Goldman's baseline is that a shutdown could last for 2-3 weeks (the Trump government shutdown, the longest in history, lasted 35 days, from Dec 22, 2018 to Jan 25, 2019). - Meanwhile, Bloomberg also speculates that in an extreme tail event, the maximum hit to 4Q GDP would be a drag of 2.8% if the shutdown lasts for the entire quarter. Source: Goldman Sachs, Bloomberg, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks