Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The S&P’s price has diverged from the trend for EPS estimates recently

The rise in bond yields probably explains this dichotomy

Is the golden era of 60/40s coming to an end?

And if equities / bonds correlation stay positive, which asset classes should be added to portfolios? hard assets and commodities? alternatives (private debt, private equities, etc.)? cash on an opportunistic basis? Source chart: Tavi Costa, Bloomberg

Last month returns for the sp500 constituents in one chart

Source: Trading View

While mega-caps tech stocks are recording huge returns on their cash pile thanks to the rise of interest rates, this is not the case for the rest of the market

Small cap companies are paying the most interest expense ever recorded and unfortunately their interest income is not keeping pace. This will become an even larger problem when small companies are forced to refinance at significantly higher rates. Source: FT, barchart

This is not the chart of an AI or crypo

It is the chart of India BSE small & medium IPO index Source: Amit Jeswani

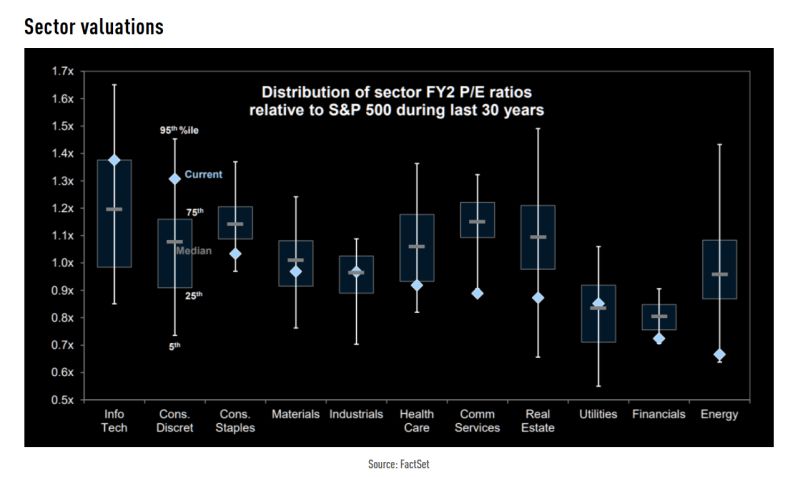

US equites sector valuations vs. history

>>> Energy as the standout cheap one< trades at a material discount to the S&P 500 due to lower growth characteristics and concerns about the duration of the cycle. Source: Goldman Sachs, TME

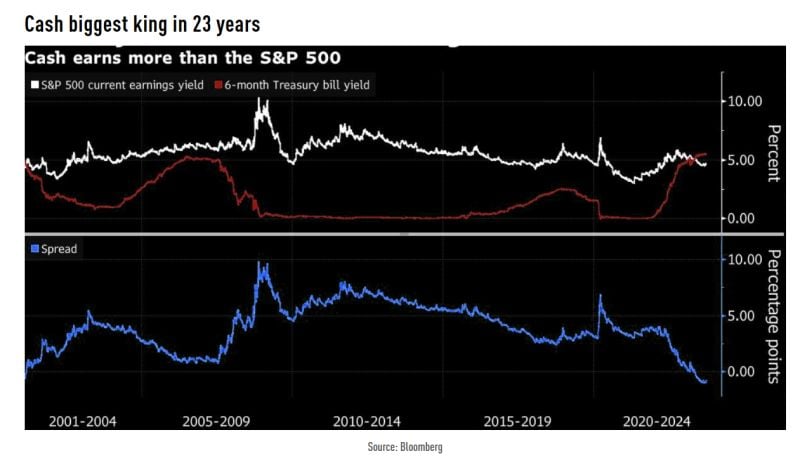

Cash now earns more than the S&P 500 by the largest margin in 23 years

Source: TME, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks