Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Below a chart of stocks $SPY (S&P 500) vs. bonds $TLT (iShares 20y+ US Treasuries), just as a reminder of the persistence and longevity of this relative trend

Source: David Keller

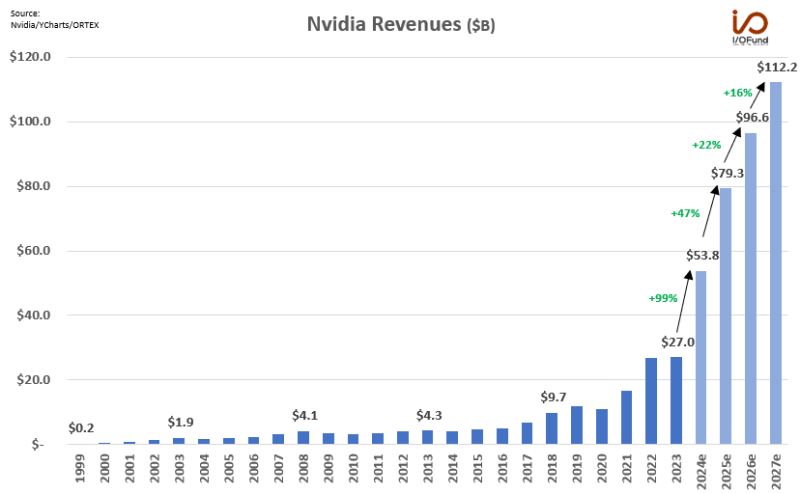

Through FY24 to FY27, Nvidia $NVDA is projected to generate a total of $342B in revenue

That forecasted total is more than double Nvidia’s lifetime revenues of $160.3B through the end of FY23. Source: Beth Kindig

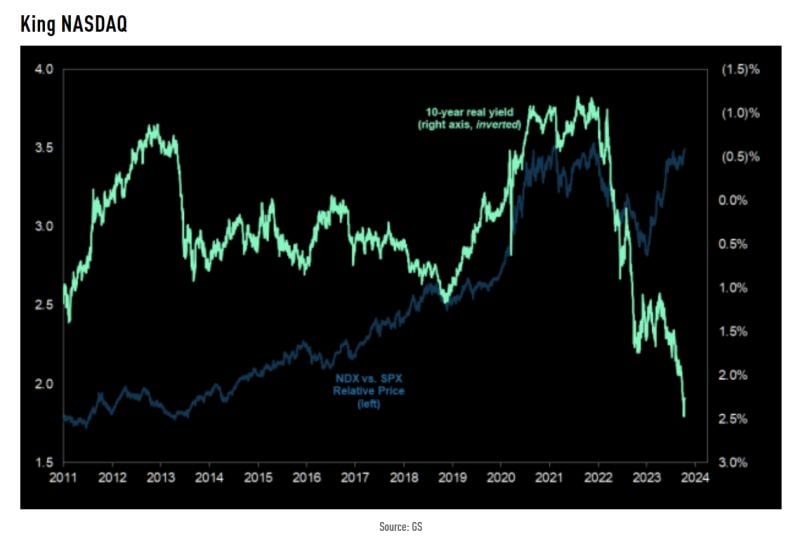

The relative Nasdaq 100 bull does not care about no rates moving higher...

Source: TME, Goldman Sachs

Wondering why high interest rates hasn't hurt sp500 performance so far?

Just have a look at the chart below courtesy of Linas Beliūnas. The S&P 500 heavy weights are full of cash and have been benefiting from the higher yield paid on short-term deposits. E,g Apple is making $1 billion on their cash holdings doing absolutely nothing...

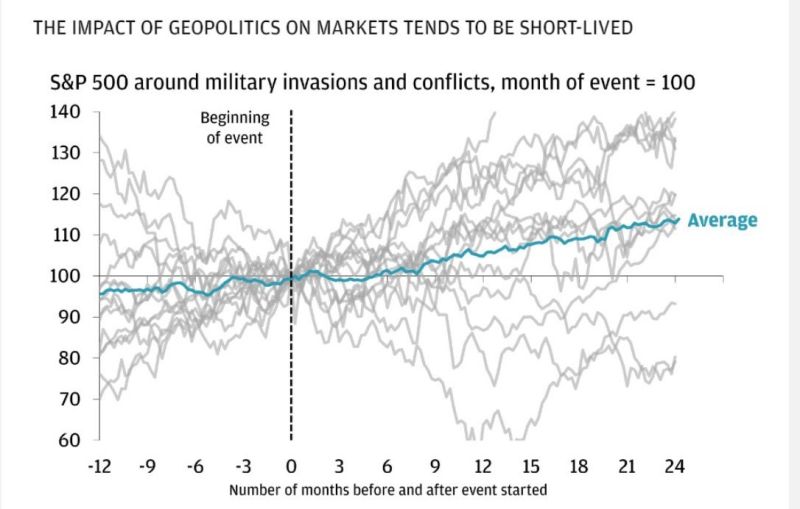

Nobody can predict at the moment how the Middle East situation will unfold, but if history is a guide market impacts of geopolitical scares are usually short lived

Will it be different this time? Source: Michel A.Arouet

The bull-market is one-year old and the leadership has been unusual

• Since 1980, every single end to a bear market and start of a new bull has been accompanied by a broad rally in stocks, with the Equal Weight Index and small-caps stocks outperforming the S&P 500. • This time is different: the S&P 500 is heavily influenced by the 10 largest companies, which have enjoyed outsized returns. The so-called "magnificent seven" (Amazon, Apple, Alphabet, Meta, Microsoft, NVIDIA and Tesla) are up 77% over the past 12 months. But the S&P 500 Equal Weight Index, which assigns the same weight to all the stocks that are included, is up a more modest 11% for the same timeframe. Small-cap stocks are up 5%. Source: Edward Jones

Investing with intelligence

Our latest research, commentary and market outlooks