Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

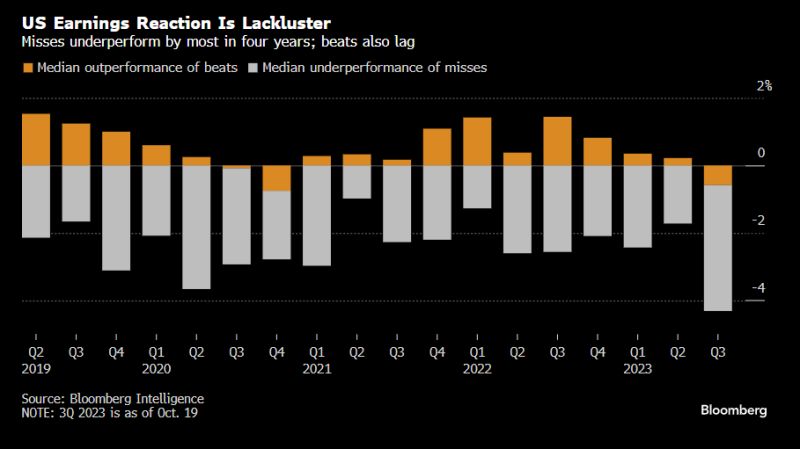

Shares of US firms that miss profit estimates are falling by the most in four years:

Bloomberg Intelligence

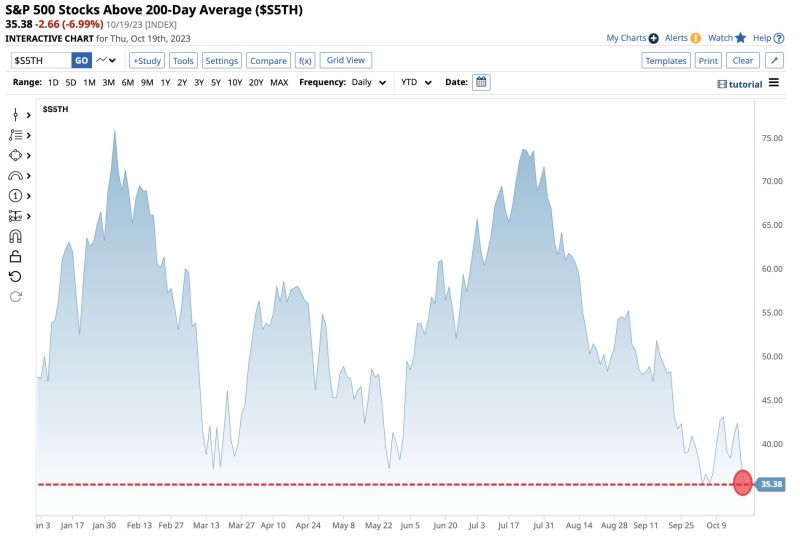

The SP500 has now lost $3.5 trillion in value since the Fed removed a recession from their forecast

The Fed marked the exact high in July 2023 with their "no recession" call. Since then, the S&P 500 is down 9% and just hit its lowest level since May 31st. We are also 1% away from entering correction territory just as earnings season begins. Source: The Kobeissi Letter

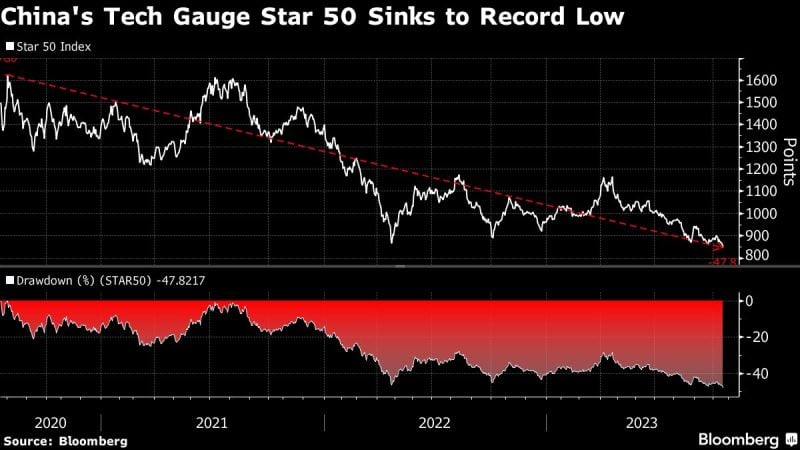

China’s Nasdaq-Style Index falls to record low:

Star 50 index, which tracks manufacturers, chipmakers & biggest comps on Star Board, falls to lowest since its inception >3yrs ago as investors’ confidence wanes. Set for 6 straight mths of decline. Source: HolgerZ, Bloomberg

MARKET BREADTH NEGATIVE ALERT >>>

SP500 Market Breadth drops to lowest level of the year as only 35.38% of Index Stocks are trading above their 200 Day Moving Averages Source: Barchart

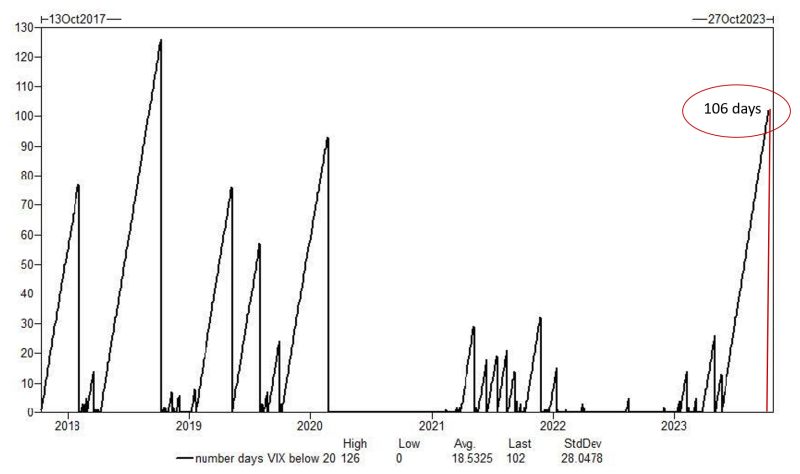

As stocks tumbled, the VIX soared

And after 105 consecutive days of closing below 20, the longest streak since 2019, the VIX index finally closed above 20 - in fact above 21 - breaking the streak on day 106. Source: www.zerohedge.com, Bloomberg

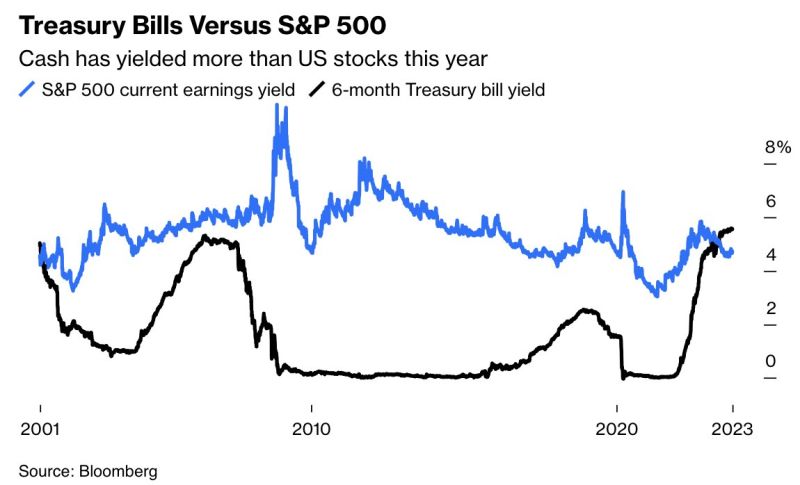

This is the first time since 2000 that Treasury Bills are yielding higher than the S&P 500 earnings yield

Even during the 2008 Financial Crisis, cash never yielded higher than S&P 500 earnings. And the gap between the SP500 earnings yield and cash is widening. Competition from cash and bond yields versus stocks keeps rising. For a USD-reference account investor, here's the median Return by Asset Class: 1. High Yield Savings Accounts: 5.5% 2. 6-Month Treasury Bill Yield: 5.0% 3. Investment Property Cap Rate: 4.5% 4. S&P 500 Earnings Yield: 4.2% Bottomm-line: Cash and Treasury Bills are now paying a HIGHER yield than real estate and the S&P 500. In other words, risky assets are paying less than risk-free assets, i.e taking a risk is compensated LESS than just holding cash. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks