Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

P/E Forward for the largest US companies - Magnificent 7

$TSLA Tesla 62 $AMZN Amazon 58 $NVDA NVIDIA 40 $MSFT Microsoft 30. $AAPL Apple 28 $GOOGL Alphabet 24 $META Meta 23 Source: Vlad Bastion

Nasdaq 100 dropped 1.9%, now down 11% from Jul high, so Big Tech now in correction territory

It looks like some P/E air is being let out of the Magnificent 7 bubble... Source: HolgerZ, Bloomberg

Amazon reports better-than-expected results, as revenue jumps 13%

Amazon said fourth-quarter sales will be between $160 billion and $167 billion. Analysts were expecting revenue of $166.6 billion, according to LSEG. At the mid-point of its guidance range, revenue of $163.5 billion would represent growth of 9.6% from $149.2 billion a year earlier. Revenue climbed 13% in the third quarter, a sign that the business is seeing some acceleration after a difficult 2022 that was marred by soaring inflation and rising interest rates. Amazon has been in cost-cutting mode for the past year as it became clear that it expanded too quickly during the pandemic. The company has laid off 27,000 employees since last fall, and it’s axed some of its more unprofitable bets.

US stocks now account for 61% of the $60 Trillion MSCI All-Country World Index, the highest level in history

Source: FT, Barchart, Bloomberg

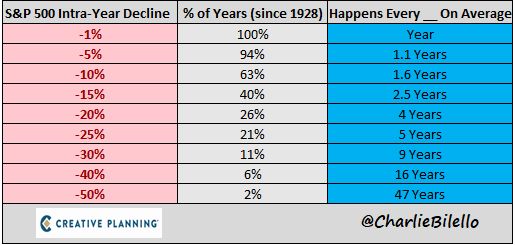

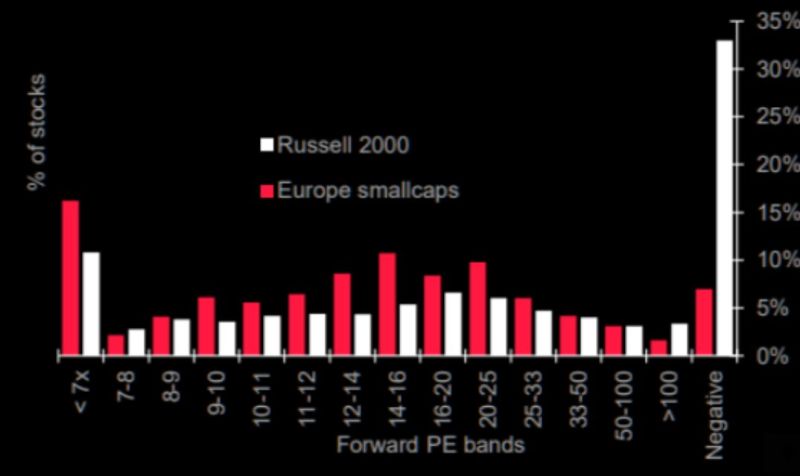

Welcome to Zombie Land

"There are some serious problems in small-caps, especially in the US. Good luck paying interest without profits. Great chart via Soc Gen showing the distribution of stock forward P/E valuations in the MSCI Europe small cap and Russell 2000 index. Source: SG, Themarketear, Lance Roberts

Bitcoin has outperformed equities, gold and USD year-to-date It has increased by more than 100% this year, despite:

- War Conflict - Elevated inflation - Rising oil prices - High-interest rates This is what happens when institutions like Blackrock jump on board Institutional adoption is going to be a major theme for this asset class. Source: Game of Trades

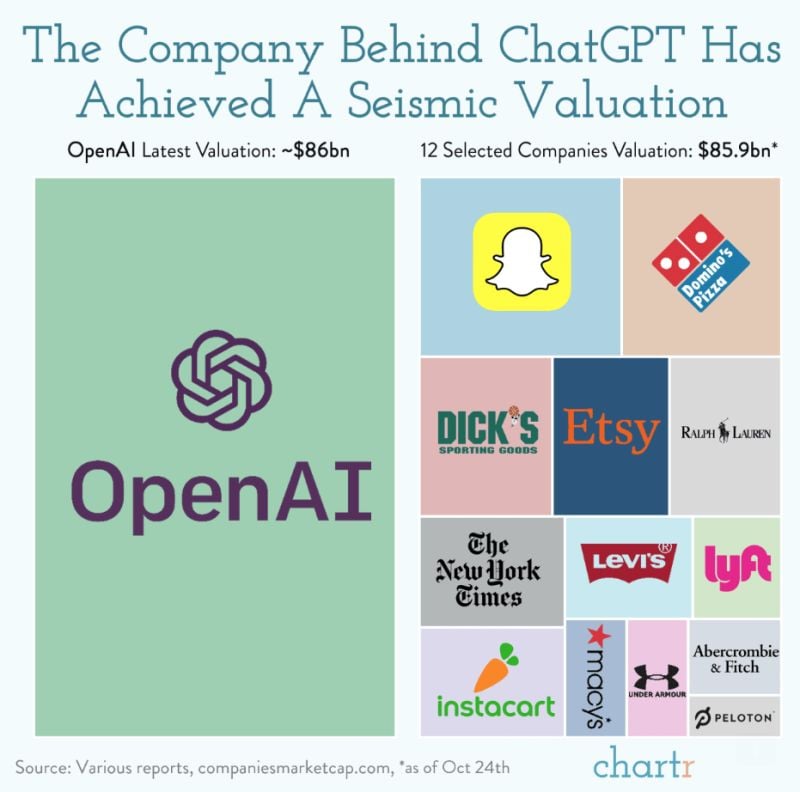

OpenAI valuation in perspective - chart by Chartr

Talk is meant to be cheap, but OpenAI, the force behind the viral hit ChatGPT, has turned it into an absolute goldmine, with the company currently in discussions to sell shares at a valuation of $86 billion. That's a remarkable three-fold increase from just 6 months ago, with the WSJ reporting an initial range of $80-90bn, before Bloomberg narrowed the figure to around $86bn, citing sources familiar with the matter. That would place OpenAI among the most valuable tech startups in the world, only behind giants like ByteDance (TikTok owner) and SpaceX. For context, it’s also roughly equivalent to the value of 12 of the biggest consumer brands in America combined — a theoretical corporate frankenstein including SNAP, The New York Times, Etsy, Domino’s and 8 others.

Investing with intelligence

Our latest research, commentary and market outlooks