Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

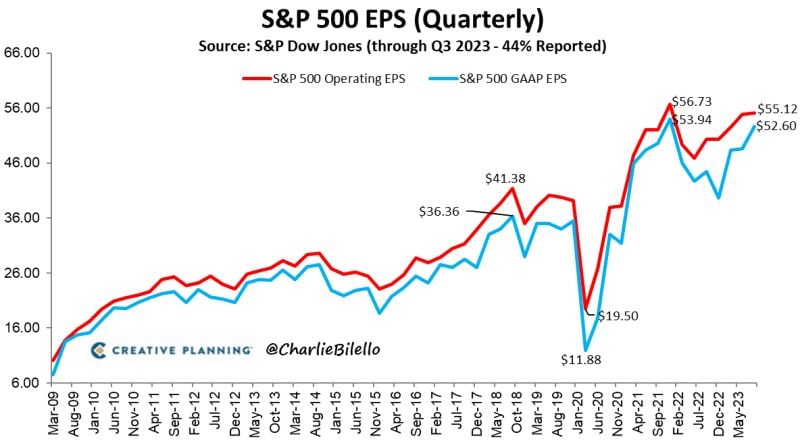

S&P 500 Q3 GAAP earnings per share are 18% higher than a year ago, the 3rd straight quarter of positive YoY growth. Quarterly earnings are now just 2% below the record high from Q4 2021

Source: Charlie Bilello

Elon Musk’s X is worth less than half of price he paid for Twitter

X is worth $19 billion a year after the $44 billion purchase. Employee restricted stock units are awarded at $45 a share. Source: Bloomberg, HolgerZ

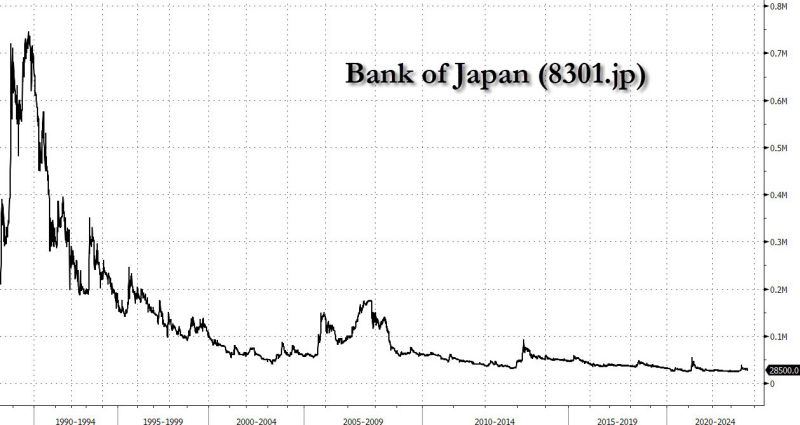

As a remainder, Bank of Japan (8301.JP) is a tradeable stock so you can buy some if you wish

Note that the chart does not look pretty... Maybe the market doesn't give much credibility to the management? Source: www.zerohedge.com

Getting cheaper...

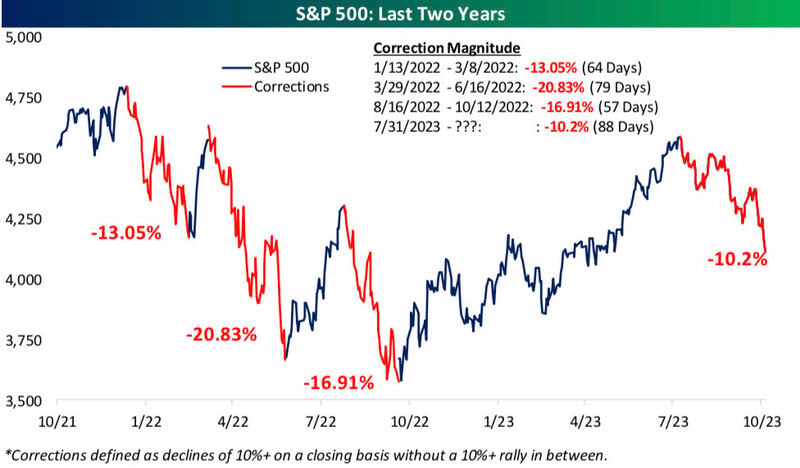

Global stocks have lost another $1.5tn in mkt cap this week on still-elevated US 10y yields and on not good enough earnings results. All stocks now worth $98.2tn, less than global GDP. This means that the Buffett Indicator is once again below the critical level of 100. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks