Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

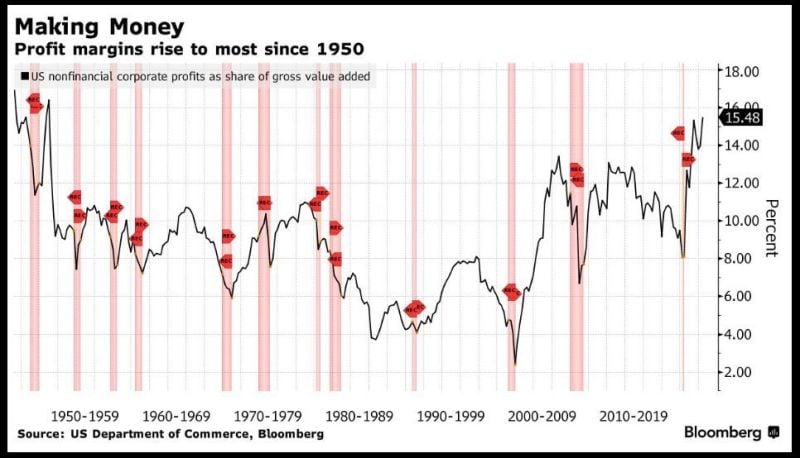

Corporate profit margins jump to highest level in 73 years 👀

Source: Bloomberg, Barchart

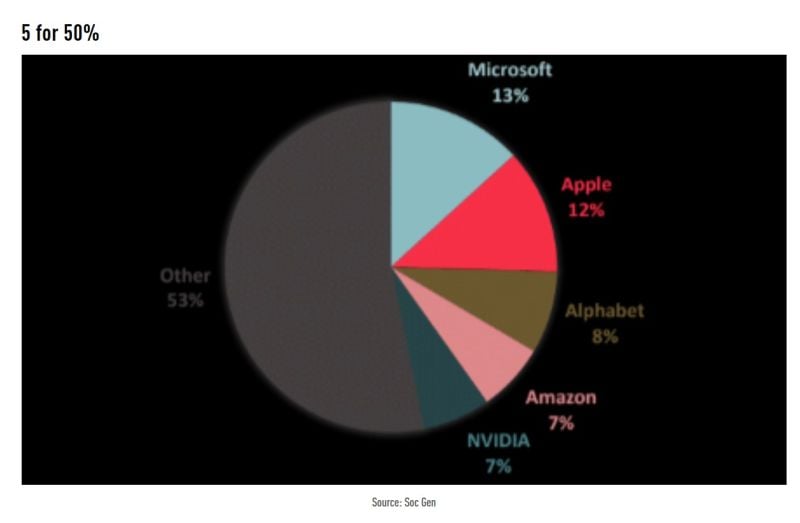

The 10 largest companies in the S&P 500 now make up 34% of the index with an average P/E ratio of 50x

This is the highest percentage since 2001 during the Dot-com bubble. Even in the 2008 bubble, this percentage peaked at ~26%. These same 10 companies have accounted for ~80% of the Nasdaq's entire rally this year. Markets are increasingly held up by a few stocks, particularly in the technology sector. Source: The Kobeissi Letter, Apollo

Investing with intelligence

Our latest research, commentary and market outlooks