Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

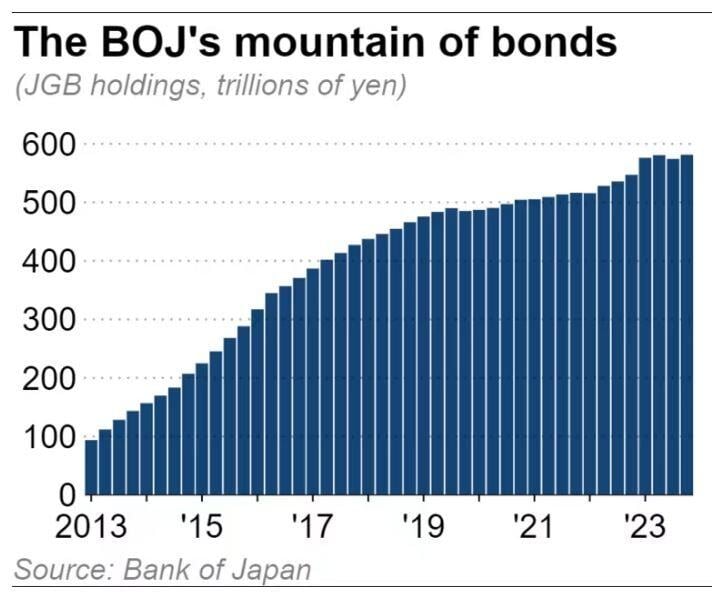

Bank of Japan owns ~80% of the country's ETFs and 7% of the entire Japanese stock market, according to Morningstar and the Tokyo Stock Exchange data.

Moreover, the BoJ holds ~55% of the Japanese government bonds. Huge distortions 👇 Source: Global Markets Investor

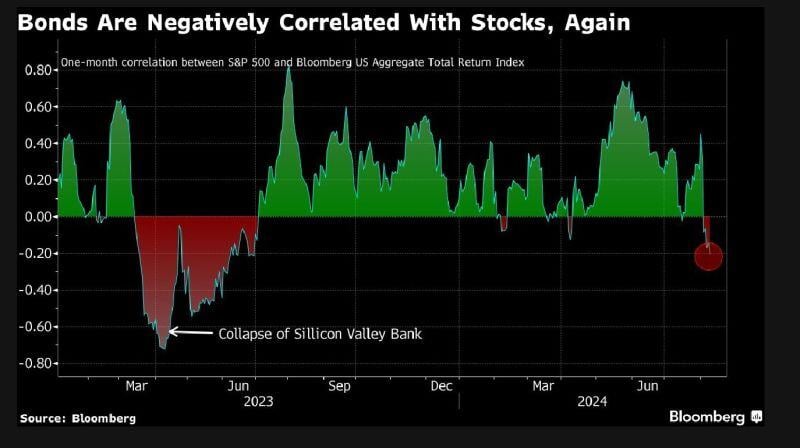

An important development for portfolio construction: bonds and equities are negatively correlated again.

Source: Bloomberg, Alessio Urban

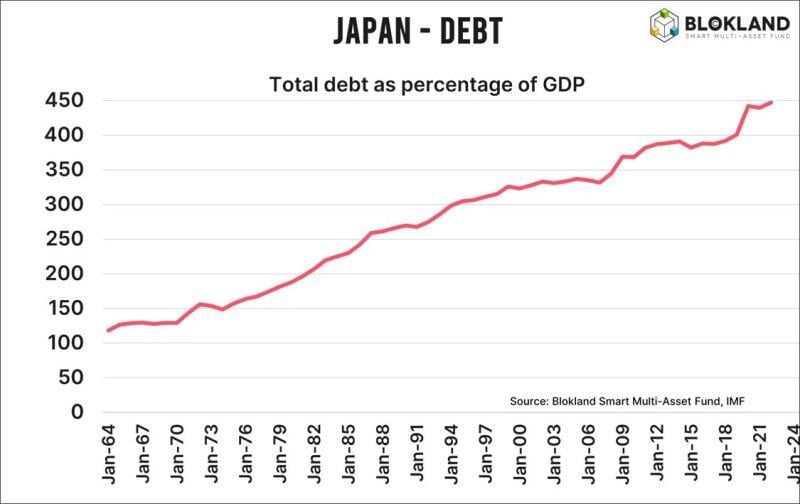

This is the ultimate reason why the Bank of Japan ‘needs to maintain monetary easing.’ DEBT

i.e the yen carrytrade is likely to resume sooner rather than later Source: Jeroen Blokland

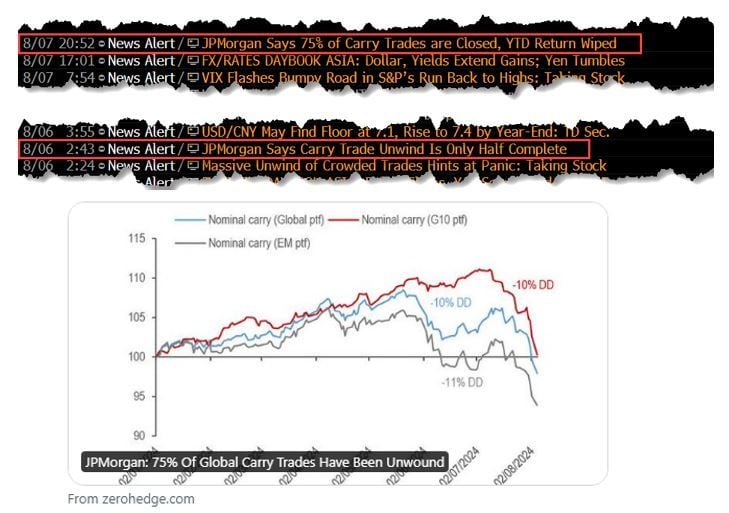

JPMorgan: 75% Of Global Carry Trades Have Been Unwound

(yesterday they said that the unwinding was only half completed...) Source: www.zerohedge.com

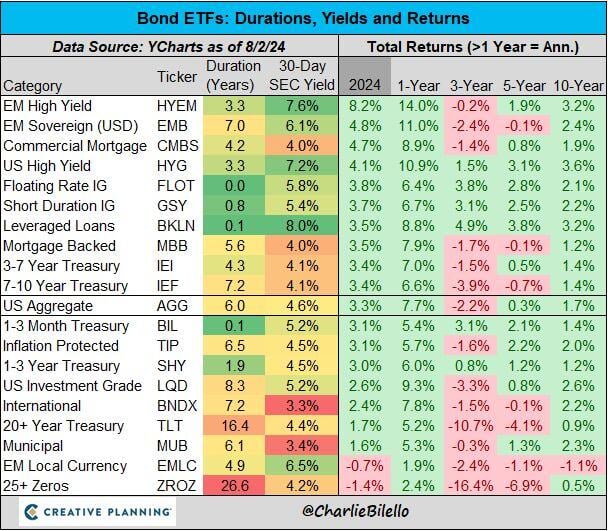

Bonds have surged higher with the collapse in interest rates and the US Aggregate Bond ETF is now up 7.7% over the past year, outperforming the Treasury Bill ETF ($BIL +5.4%)

Source: Charlie Bilello

BREAKING: The 10-Year Note Yield has dropped below 4.00% for the first time since February 2024.

This comes after the July Fed meeting and ISM manufacturing data came in weaker than expected. Markets expect the first Fed rate cut since March 2020 to come at their next meeting, in September 2024. Over the last week, the 10-Year Note Yield is now down over 30 basis points. Source: The Kobeissi Letter

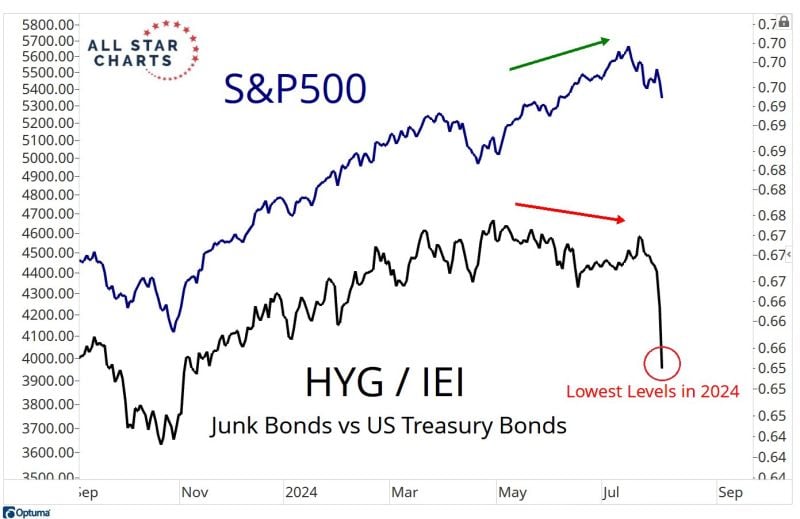

Junk bonds closed at an ATH (total return) last week $HYG

Source: Mike Z.

Investing with intelligence

Our latest research, commentary and market outlooks