Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

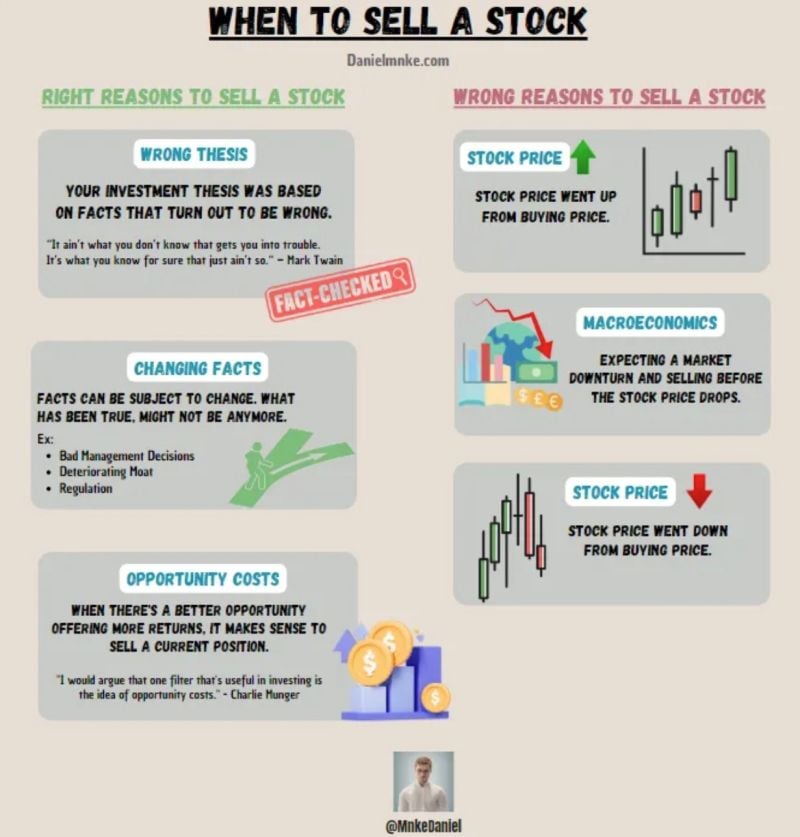

Nice infographic about the right and wrong reasons to SELL a stock

Source: Danielmnke.com

Vietnamese EV maker VinFast is now worth more than Ford and GM after Nasdaq debut - CNBC article

VinFast’s shares jumped some 270% after its U.S. trading debut, vaulting its total market value past some of the world’s largest automakers. On Tuesday, the Vietnamese #electricvehicle maker listed on Nasdaq following the completion of its merger with the U.S.-listed #SPAC (special purpose acquisition company) Black Spade Acquisition. Shares of VinFast closed at $37.06 on Tuesday — 270% higher than Black Spade Acquisition’s IPO price of $10. Following the market debut, VinFast is now currently worth $85 billion, according to CNBC calculations. The SPAC merger previously valued VinFast at approximately $23 billion, according to a June filing with U.S. securities regulator. Source: CNBC

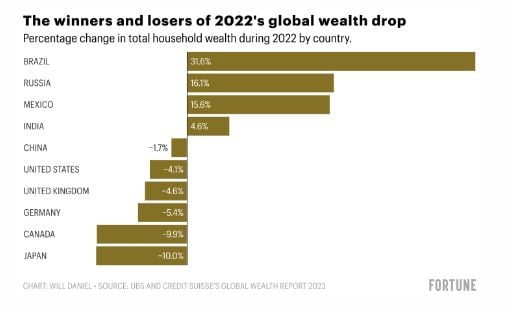

Global Wealth declined by $11.3 trillion last year, the first annual drop since the Global Financial Crisis

Here are the biggest winners and losers Source: Barchart, Fortune

Warren Buffett's Berkshire Hathaway invested a total of $814 million in 3 home builder companies during the 2nd quarter. Those investments include D.R. Horton $DHI, Lennar $LEN, and $NVR

Warren Buffett’s Berkshire Hathaway on Monday unveiled an $814mn investment in three US housebuilders, a bet on a sector that has benefited from dearth of supply. Berkshire disclosed it had purchased 6mn shares of DR Horton, worth about $726mn at the end of the second quarter, as well as 152,572 shares in Lennar and 11,112 shares of NVR. Shares of housebuilders and companies who service the industry have rallied this year after a difficult 2022 during which higher interest rates crimped demand. However, while higher mortgage rates have cooled the pace of existing homes sales, new homes sales have remained surprisingly robust owing to the limited supply.

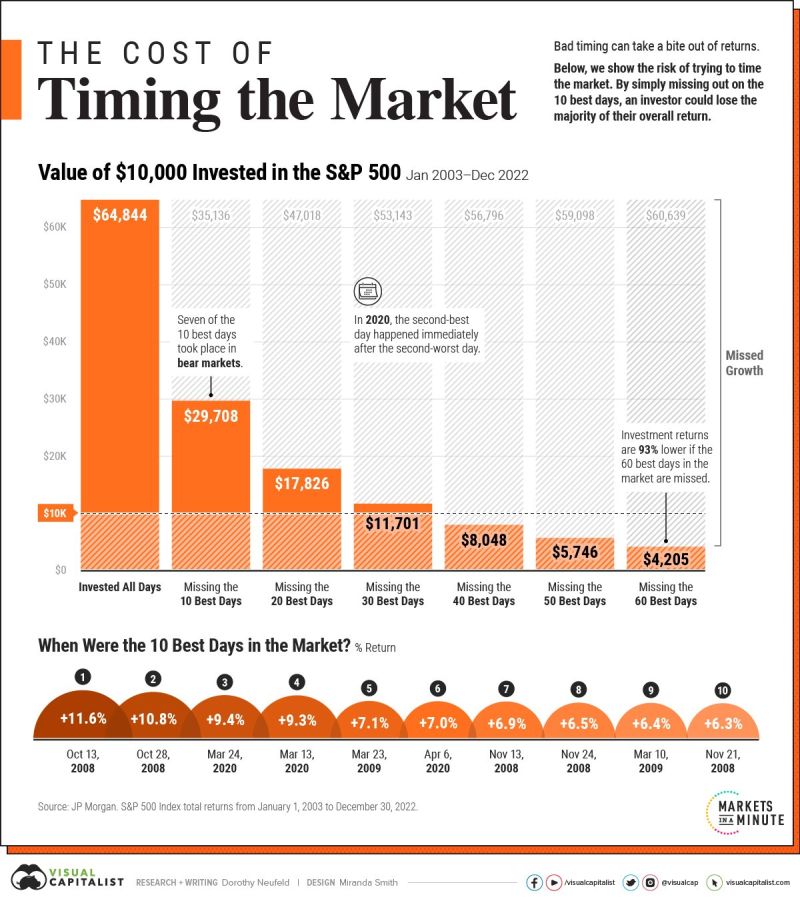

The cost of timing the market

Source: Elements / Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks