Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

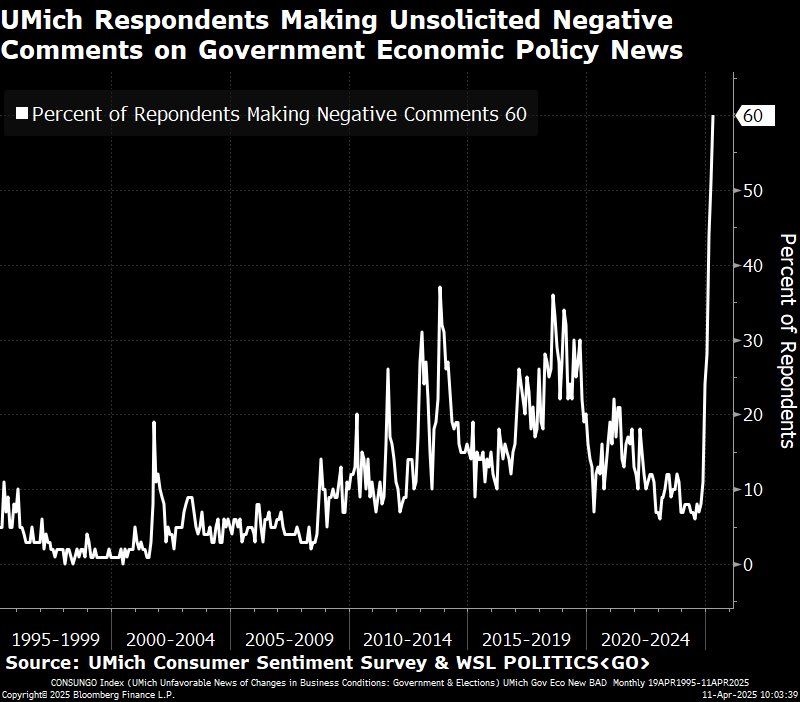

Chart for future history books...

Source: Michel A.Arouet, Bloomberg

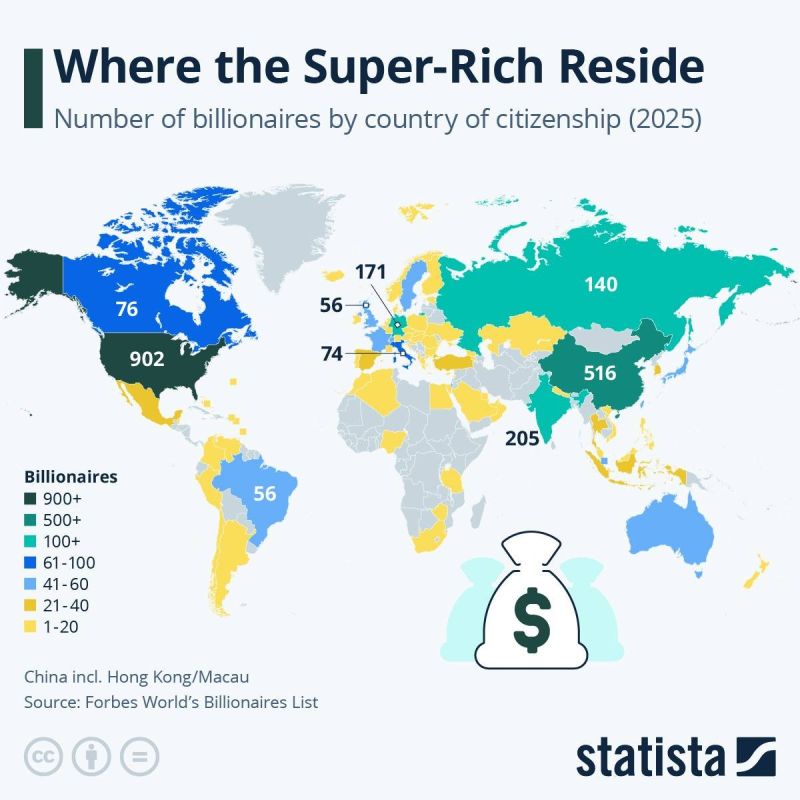

AMERICA STILL RULES BILLIONAIREVILLE—BUT LOOK WHO’S CLOSING IN...

The US has 902 billionaires in 2025, holding the crown as the planet’s top luxury zip code for the super-rich. But China (yes, including Hong Kong and Macau) isn’t exactly playing small—it’s up to 516 and catching up fast. India’s creeping in with 205, while the rest of the billionaire club is scattered across Europe, Russia, and a few surprise players like Brazil and Canada, each with 56. Moral of the story? The money’s global—but it mostly speaks English and Mandarin. Source: Statista thru Mario Nawfal

The only person that can lose you money in the stock market?

Yourself. Source: Compounding Quality

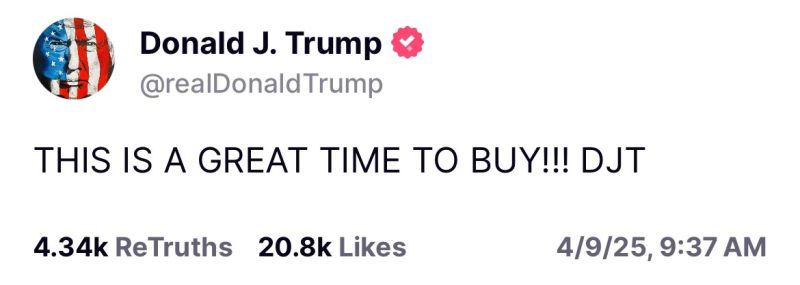

Just a reminder that this story was leaked on Monday, and then denied by the White House.

Source: James Chanos @RealJimChanos

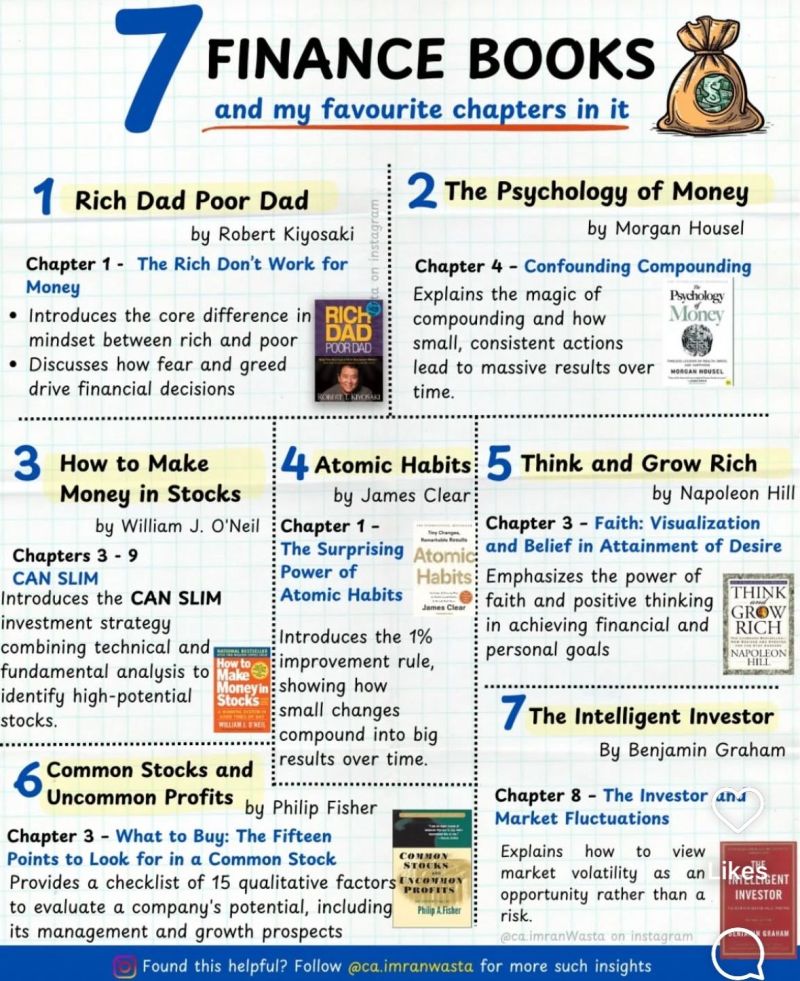

7 Finance Books

Source: Compounding Dividends @CompoundingW

Investing with intelligence

Our latest research, commentary and market outlooks