Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

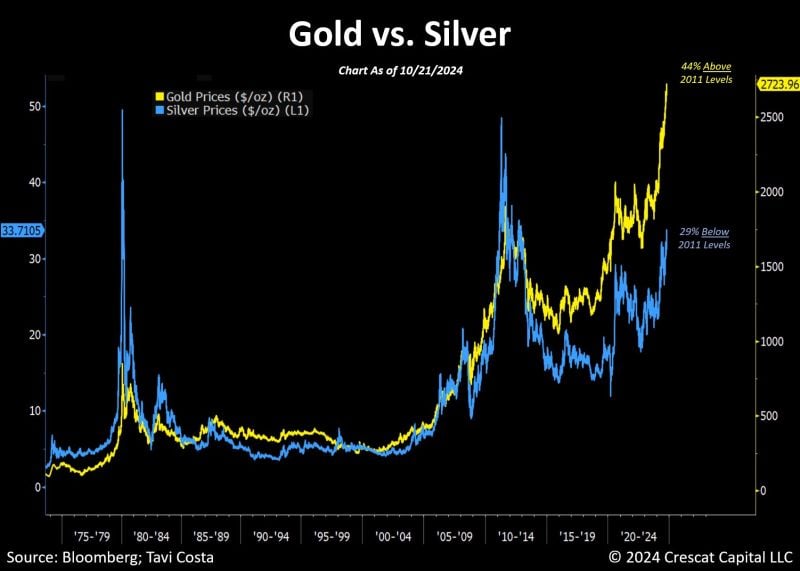

Gold is now 44% above its 2011 peak, while silver remains nearly 30% below its level from the same period.

Source: Crescat Capital, Blomberg, Tavi Costa

Central Bankers from Mexico, Mongolia, and the Czech Republic say they will buy more Gold to add to their Reserves

Source: Barchart

BREAKING: GOLD NOW MAKES UP A RECORD 31.5% OF RUSSIA'S TOTAL RESERVES.

Source: Make Gold great again on X

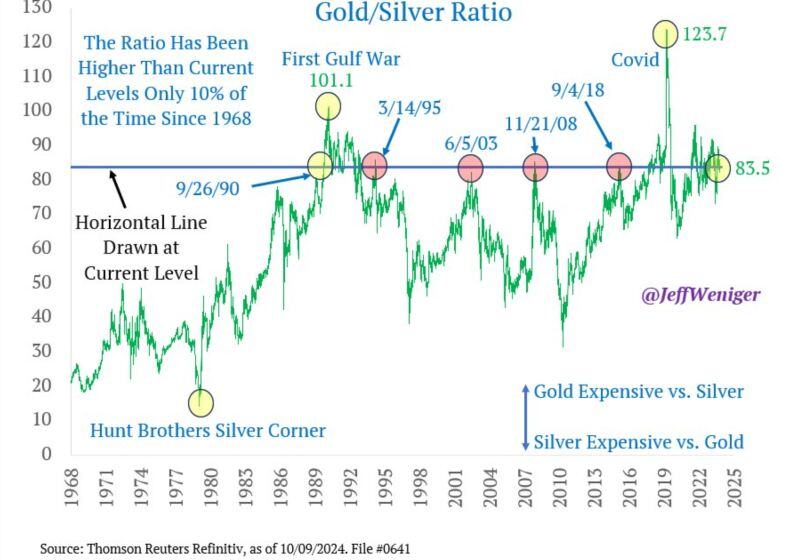

The gold / silver ratio is 83.5.

Since 1968, this ratio has spent only 10% of the time above current levels. Sometimes switching to silver didn't work (look at 1990). But in 1995, 2003, 2008 and 2018, switching paid off.

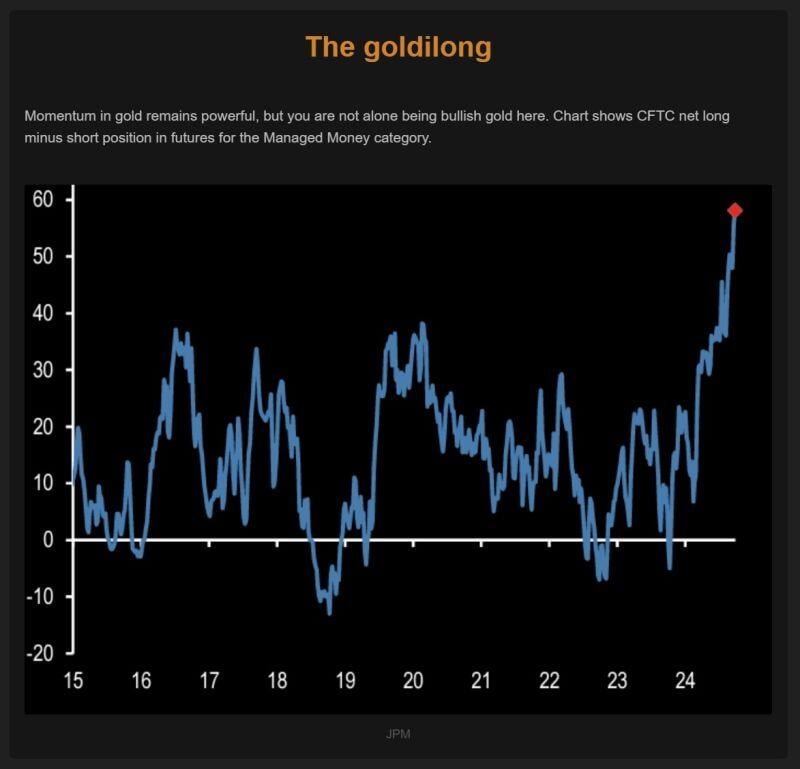

😱 The shocking chart of the day: Too many goldilongs?😱

Momentum in gold remains powerful, but you are not alone being bullish gold here... The chart below shows CFTC net long minus short position in futures for the Managed Money category. Source: The Market Ear, JPM

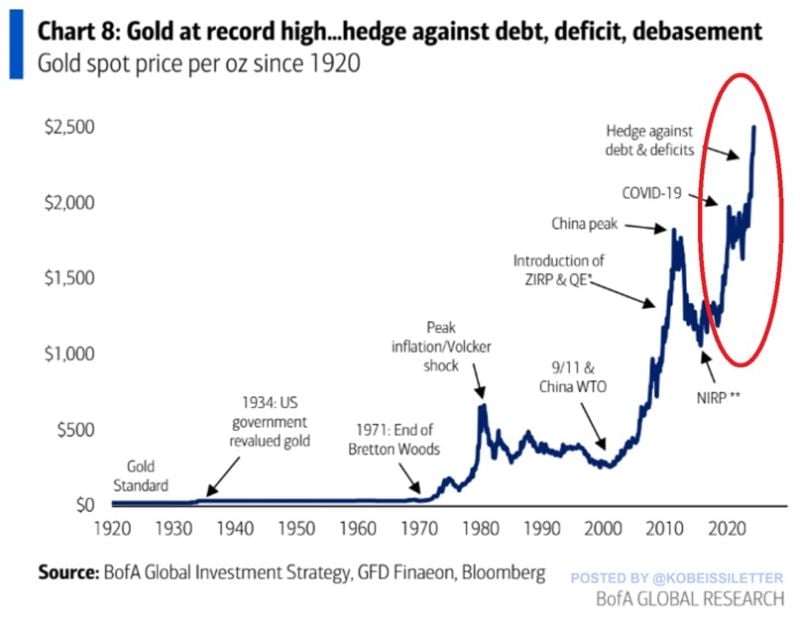

Gold as the ultimate store of value?

Over the last decade, gold prices have more than DOUBLED, marking one of the best rallies in modern history. Over the last 5 years alone, gold is up 76% and on track to be the best-performing asset class of the year, excluding bitcoin. So why gold keeps rising? Ever-rising debt and money debasement seem to be the main culprits. Since the pandemic, US national #debt has soared by $12 trillion while the US dollar lost ~25% of its value. Source: The Kobeissi Letter, BofA

Gold continues to shine, trading at all time highs and up 34% since February.

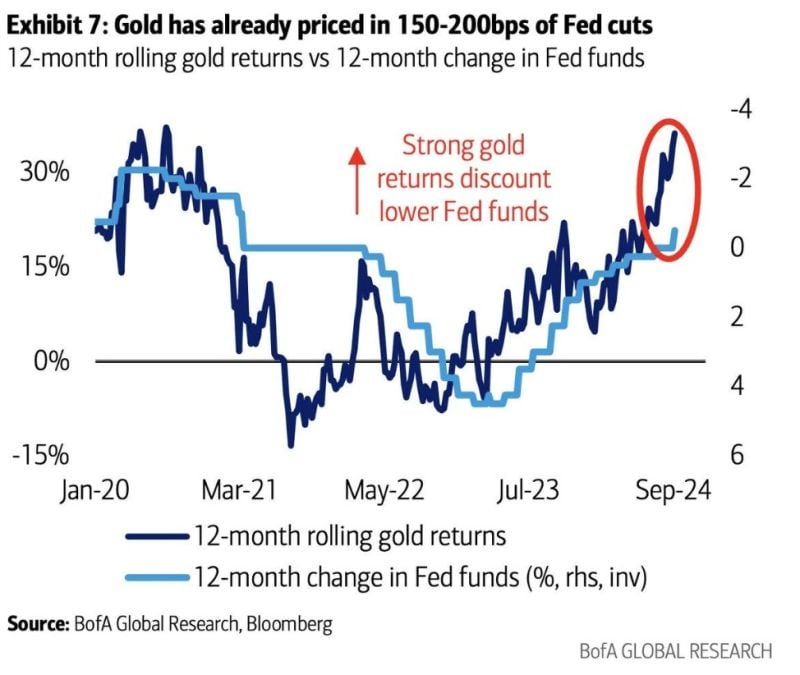

To BAML, gold is frontrunning rate cuts. Or is it something else?

Investing with intelligence

Our latest research, commentary and market outlooks