Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

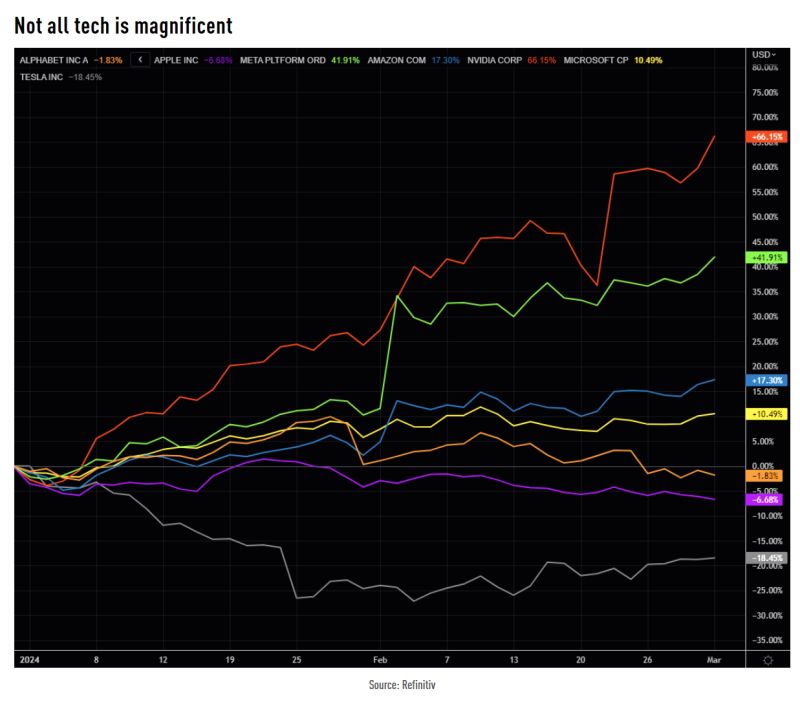

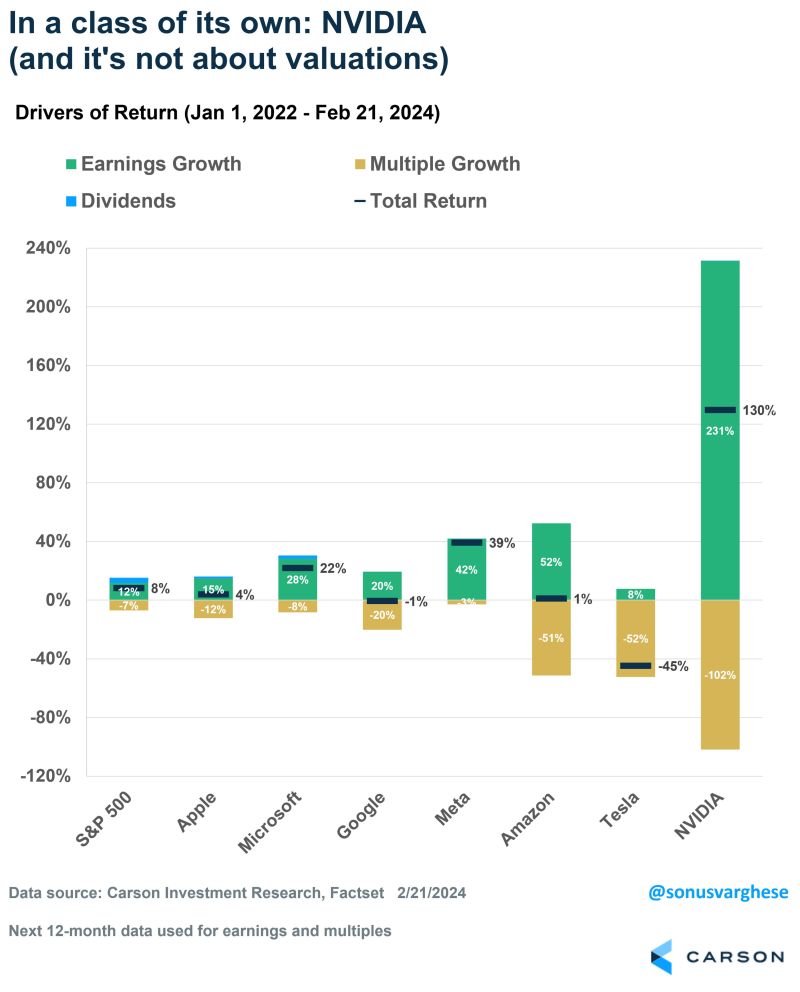

Not all Tech stocks are magnificent...

$AAPL and $TSLA the main downside outliers...

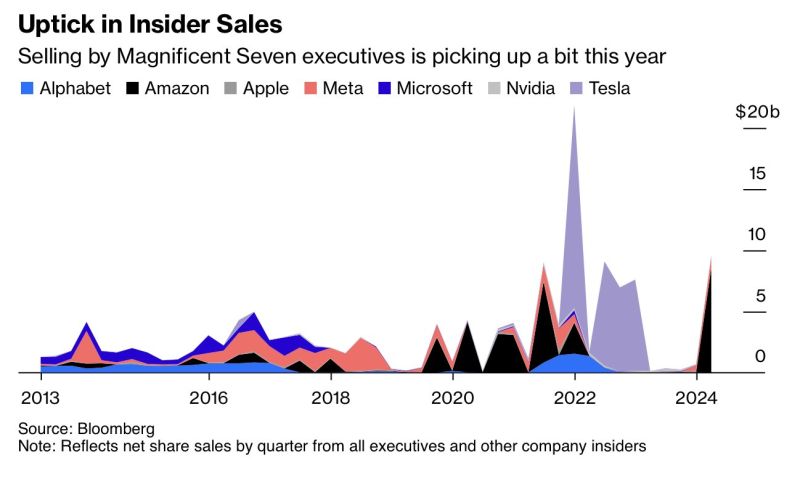

Magnificent 7 Corporate Executives are dumping shares are the fastest rate since 2021 🚨

Source: Barchart, Bloomberg

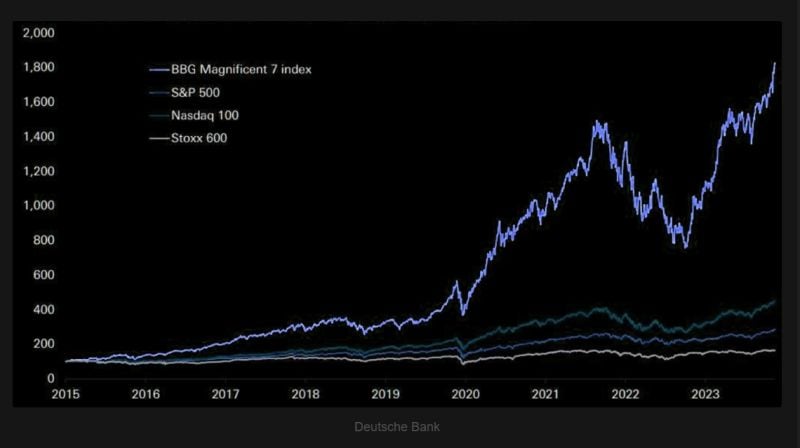

The Magnificent 7 are now up ~1,700% since 2015 compared to the S&P 500's ~140% gain.

Even the Nasdaq Composite Index, the largest tech index in the world, is up just ~230% since 2015. Source: DB, TME

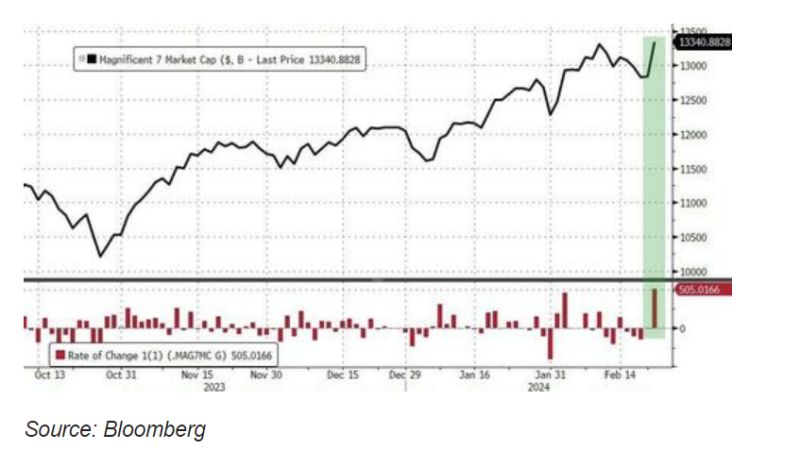

A record day on Wall Street: MAG7 stocks added over $500BN today to a new record high, second only to 11/10/22's explosion higher driven by AAPL...

And all that market cap gain was driven by a $2.1BN 'guide-up' on nvidia Q1 revenue... $NVDA stock is up +$277BN today, adding the most market cap in a single-day ever - up $277BN...That is 2 Goldmans, half a JPMorgan, or a whole Netflix or Adobe added in a day...And as goes NVDA, so goes the entire stock market with Nasdaq leading the charge (up 3%) and the S&P up over 2%. Small Caps lagged with a mere 0.75% gain... Source: www.zerohedge.com

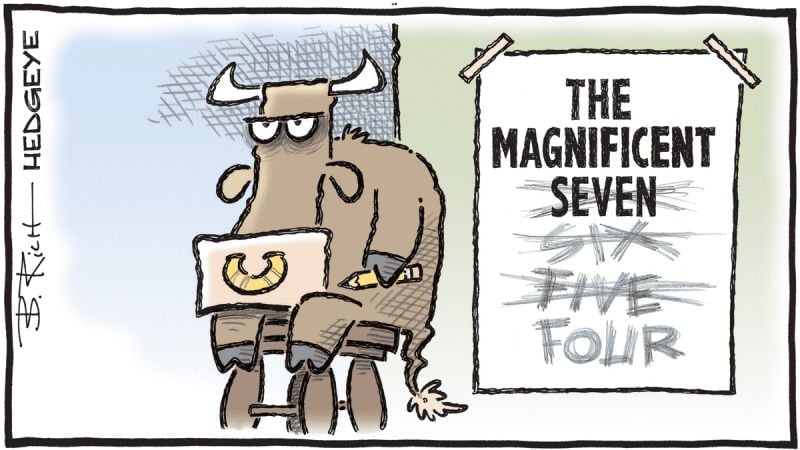

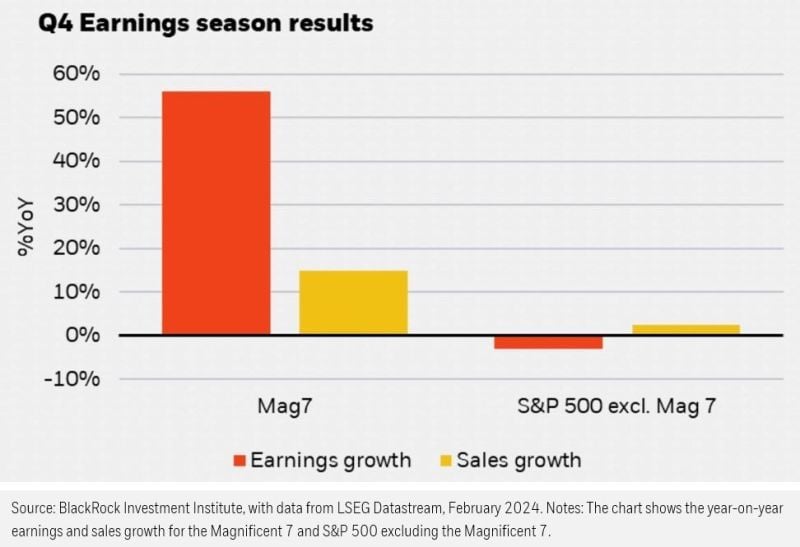

Are Mag7 stocks in a bubble?

No doubt, in some ways they are really pricey BUT as shown by this work from Sonus Varghese on this important question, fundamentals justify to some extent their dominance. Since 2021, NVDA stock is up 130%, yet earnings are up 231%. And other Mag 7 names are similar... Source: Carson, Ryan Detrick

Investing with intelligence

Our latest research, commentary and market outlooks