Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

.. here’s the incredible part .. when the market bottomed in Oct of 2022, $NVDA had a market cap of $280bn and a 12-month forward P/E of 32x.

“.. on Thursday, it added $276bn of market cap in one day alone, rounding up to $2tr, and the P/E is now ... 33x.” Source: Carl Quintanilla

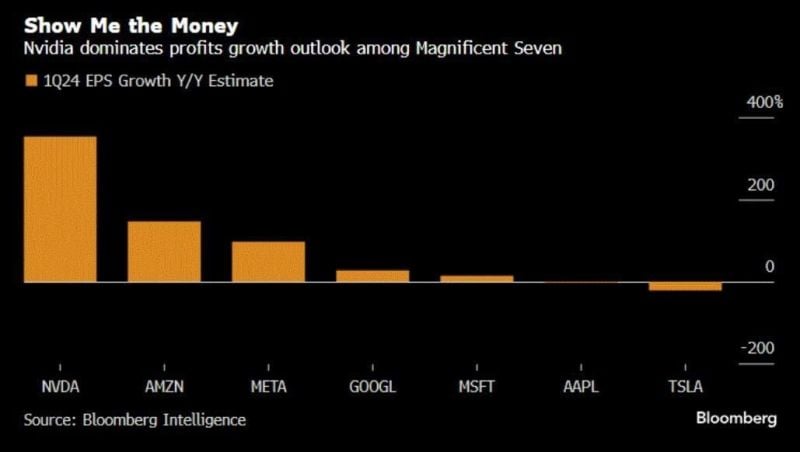

Should Nvidia have a higher market cap than Google and Amazon?

$NVDA $GOOGL $AMZN Source: Charlie Bilello

Yesterday was one of the most distorted markets we've seen yet. Just 2% of the index contributed over 60% of the bullish momentum.

That means ONLY TEN companies were the cause of well over half of the move in $SPX yesterday. $NVDA single handedly contributed an additional 50bps to the return in $SPX. Source: Hedgeye

Nvidia has now surpassed Germany's DAX in market capitalization.

Valued at just under $2 trillion, the chip company, established in 1993, now exceeds the total value of the DAX, which includes 40 companies, some over 130 years old. Source : HolgerZ

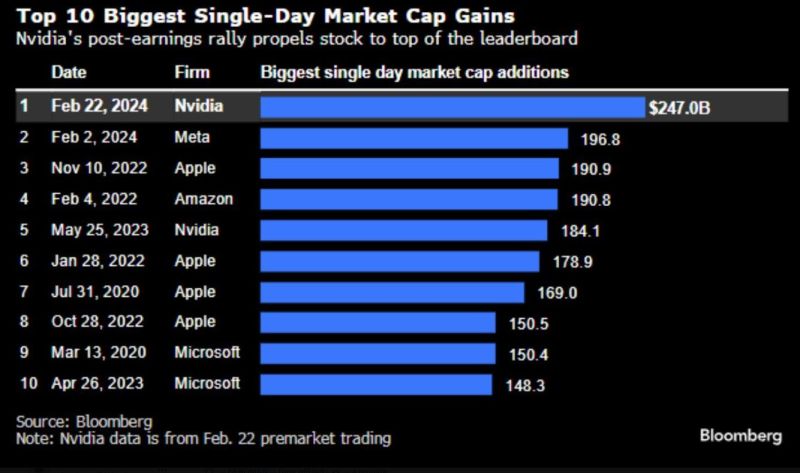

Nvidia has added nearly $250 billion in market cap so far today.

This puts the stock on track to post the biggest single-day market cap gain in stock market history. The previous record? -) Meta, 20 days ago ... source : The Kobeissi Letter, bloomberg

Nvidia, $NVDA, has added nearly $250 billion in market cap so far today.

This puts the stock on track to post the biggest single-day market cap gain in stock market history. The previous record? It was Meta, $META, just 20 days ago after reporting their quarterly earnings. Nvidia is now just 5% away from being the third US company with a $2 trillion+ market cap. Big tech stocks are getting bigger. Source: The Kobeissi Letter, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks