Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Technology

- Commodities

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

Nvidia was only worth $9bn 10 years ago and is now worth almost $1.7tn, i.e. 184 times as much.

Source: HolgerZ, Bloomberg

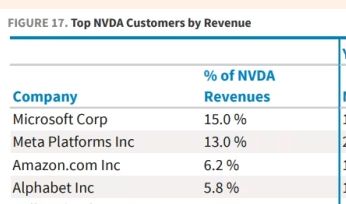

$NVDA's top 4 customers account for 40% of revenues, and every one of them is actively working on their own custom AI silicon.

AI capex will keep flowing to NVDA in the short run, but what will happen when initial training is done and inference is done locally? Source: Supreme Bagholder

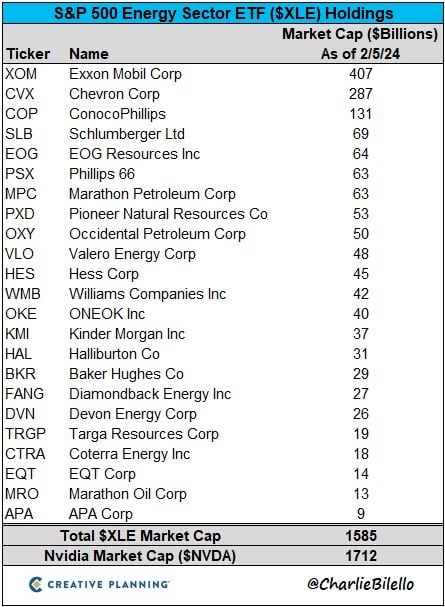

Nvidia's market cap is now over $100 billion higher than all of the companies in the S&P 500 energy sector ... combined. $NVDA $XLE

Source: Charlie Bilello

Waiting for the pullback...

On October 31st, 2023, Nvidia, $NVDA, had a market cap of ~$950 billion. Since then, Nvidia is up 79% and just hit an all time high market cap of $1.7 trillion. In other words, Nvidia has added $750 BILLION in market cap in 70 trading days. That's an average of $10.7 billion PER DAY for 70 trading days in a row. Source: Trendspider, The Kobeissi Letter

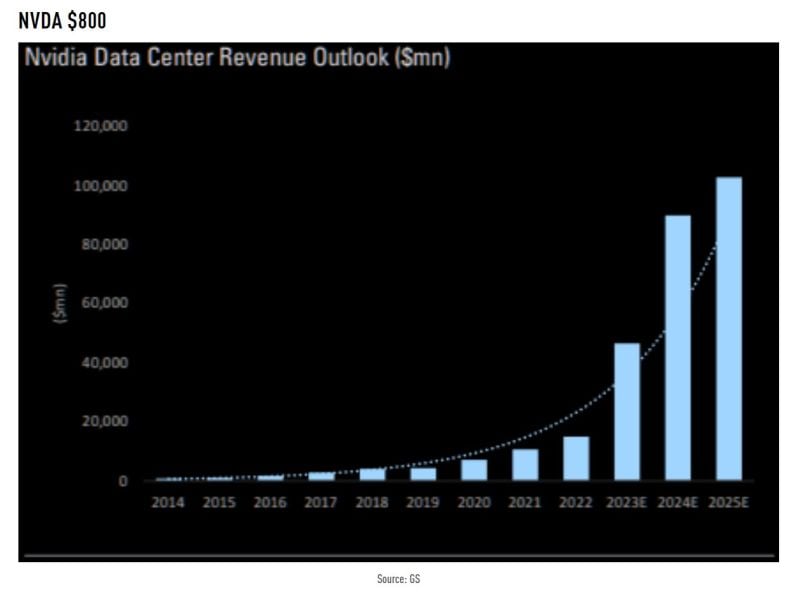

Goldman's main points from the nvidia upgrade today

1. Non-GAAP EPS estimates for FY2025/26 increased by 22% due to strong AI server demand and better GPU supply. 2. Predicted decline in Data Center revenue in 2HCY24 revised to steady growth through 1HCY25, fueled by Gen AI spending and diverse customer base. 3. Growth supported by new product cycles, including H200 and B100, and expansion in cloud service provider investments. Source: TME, Goldman Sachs

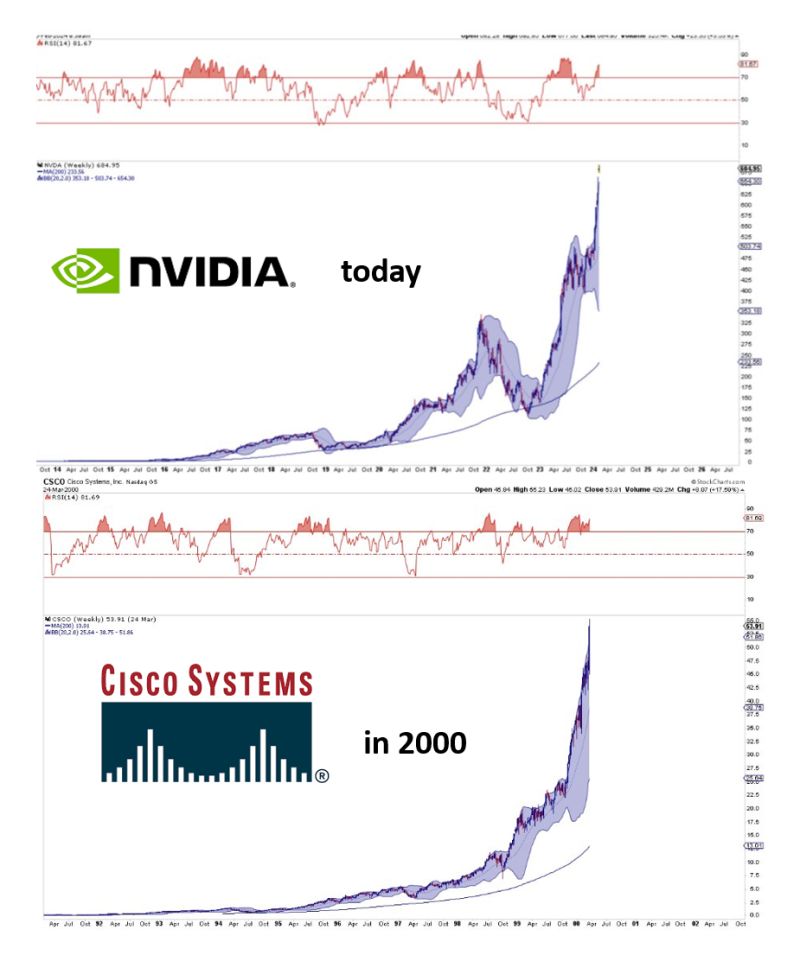

Who did it better? $NVDA or $CSCO in 2000?

On this day in 1996: Apple cover story “The Fall Of An American Icon.” Source: Jon Erlichman

To put things into perspective

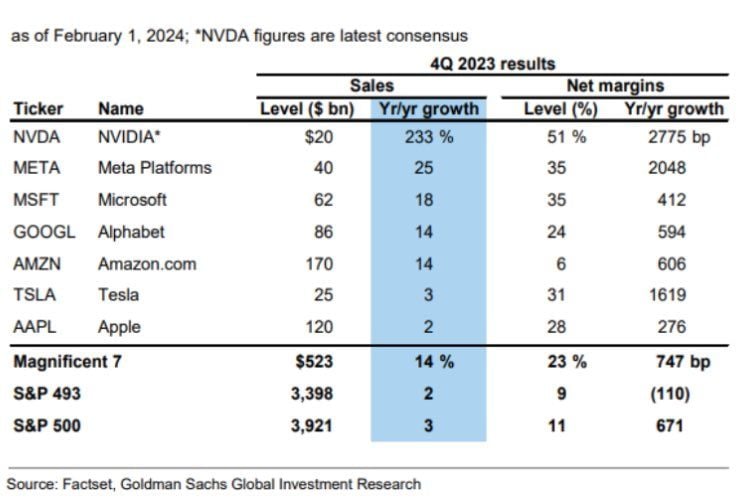

Assuming Nvidia meets estimates, the Mag 7 generated $523bn in sales during 4Q, +14%YoY. Revenue growth for remaining 493 S&P 500 stocks was a comparatively paltry 2%. Margins for the mag 7 expanded by ~750 bp YoY to 23% vs. a 110 bp contraction to 9% for remaining 493 stocks in the S&P 500, Goldman has calculated. Source: HolgerZ, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks