Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Divergence of Commodities and Consumer Inflation (2017–2026)

Source: Lawrence McDonald, Bloomberg

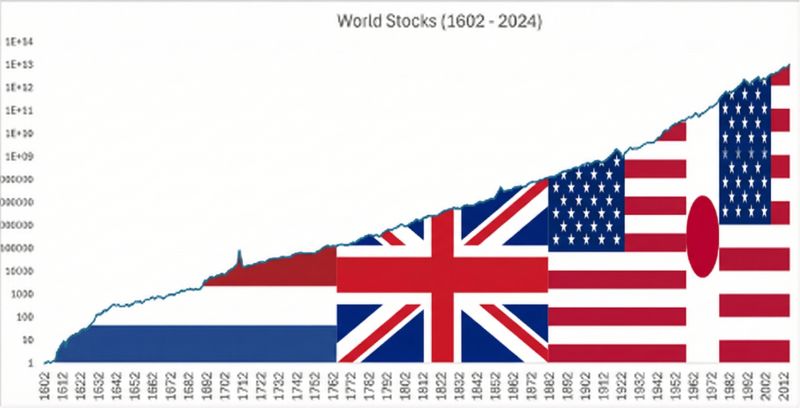

Largest stock market in the world at the time

not always U-S-A... Source: Meb Faber

Market manipulation on Bitcoin

GOLD - new ATH SILVER - new ATH S&P 500 - near ATH NASDAQ - near ATH DOW - new ATH While Bitcoin is down -28% from its peak, having the worst Q4 in the last 7 years without any negative news, FUD, or scandal. There is no explanation for this except pure market manipulation. Source: Bull Theory @BullTheoryio

Investing with intelligence

Our latest research, commentary and market outlooks