Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

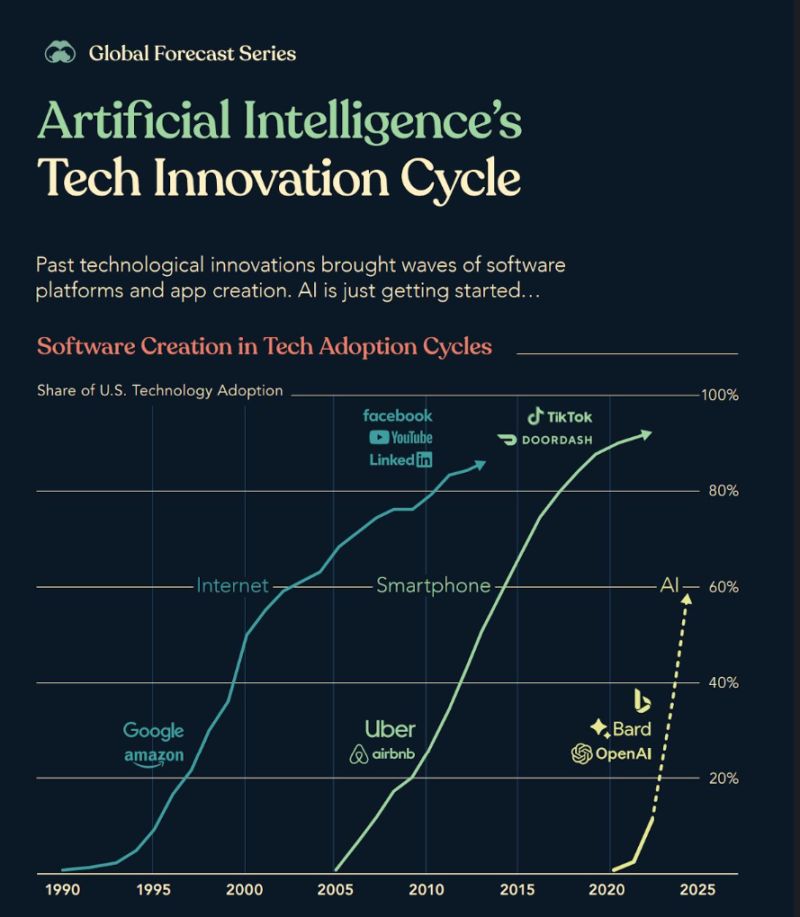

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

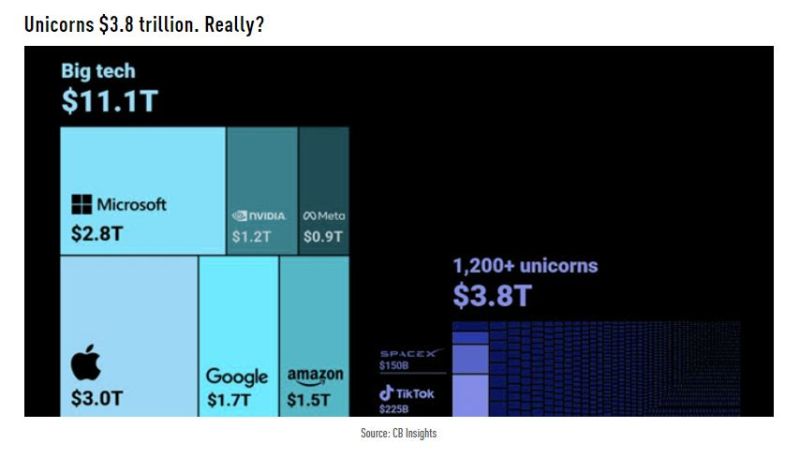

Big Tech of course "dwarfs" unicorn total market cap, but that 3.8T number still feels a little on the high side

Source: TME, CB Insights

Elon Musk said that the first human patient has received a brain implant from his startup Neuralink Corp.

A significant step forward for the company that aims to one day let humans control computers with their minds. In a post on X, formerly Twitter, Musk said that the patient is recovering well, and that initial results of the procedure were promising. Source: Bloomberg

Mega Cap Tech Stocks are now outperforming small-cap stocks by the largest margin since the peak of the Dot Com bubble

Source: Barchart

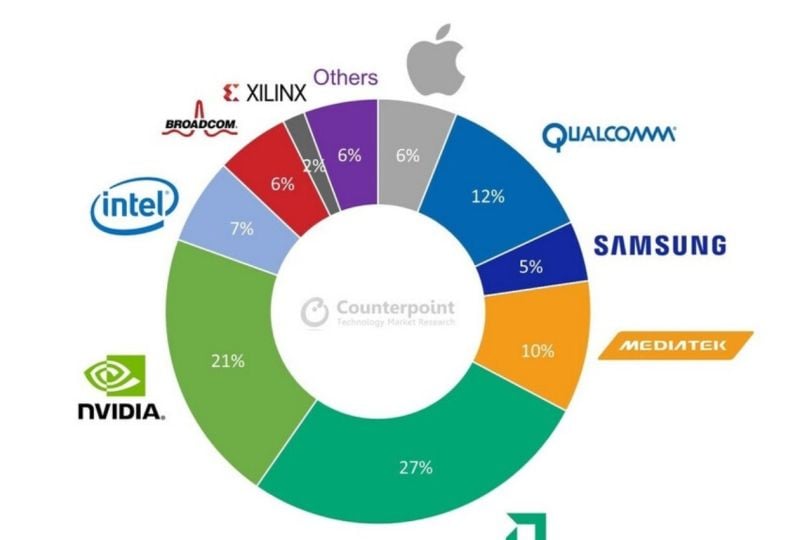

Taiwan semiconductor $TSM, the world's largest contract chip manufacturer, forecast 2024 revenue to grow more than 20% thanks to booming demands for high-end chips used in AI applications

Taiwan Semi's main customers include AMD $AMD, Nvidia $NVDA, Qualcomm $QCOM, Intel $INTC, Apple $AAPL, and Broadcom $AVGO. Source: Jesse Cohen

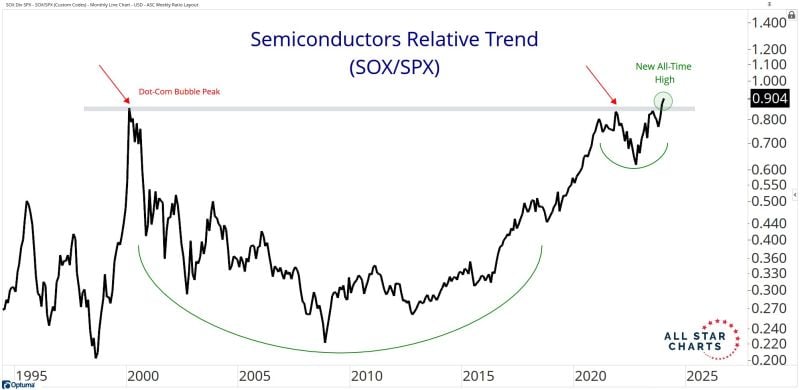

More to come for semiconductors? The chart below shows a 24-yr base breakout for semiconductors RELATIVE to the S&P 500 $SOX $SPX

Source: Steven Strazza

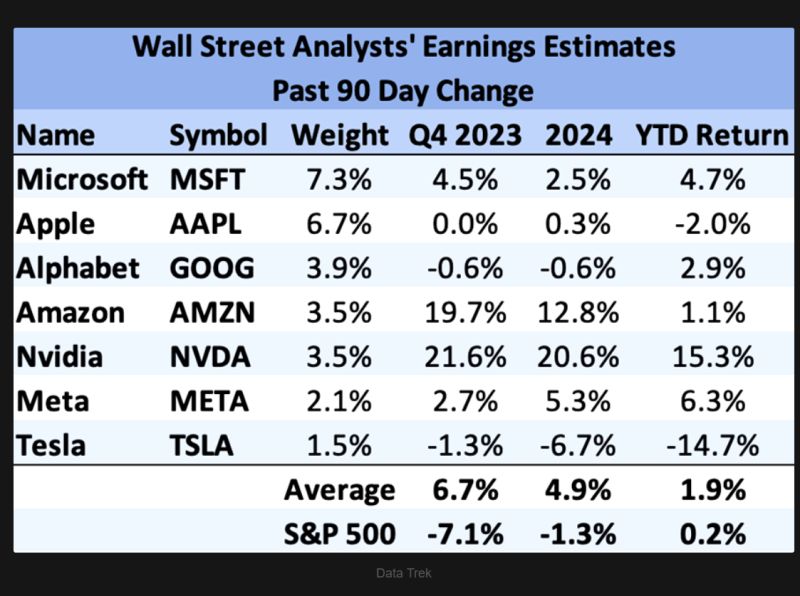

US earnings revision: a big tailwind for big tech >>> 5 out of 7 Big Tech names have seen upward earnings estimate revisions for the last quarter and this year over the past 3 months

As a group, they’ve seen average upward earnings revisions of 6.7% and 4.9% for last quarter and 2024 respectively, considerably better than the S&P (-7.1%, -1.3%). Source: DataTrek, TME

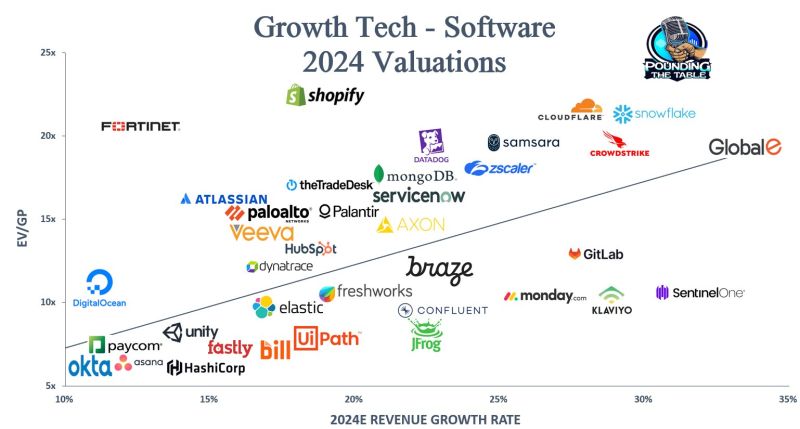

This scatter plot shows where growth tech valuations stand based on 2024 metrics

Source: Shay Boloor

Investing with intelligence

Our latest research, commentary and market outlooks