Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

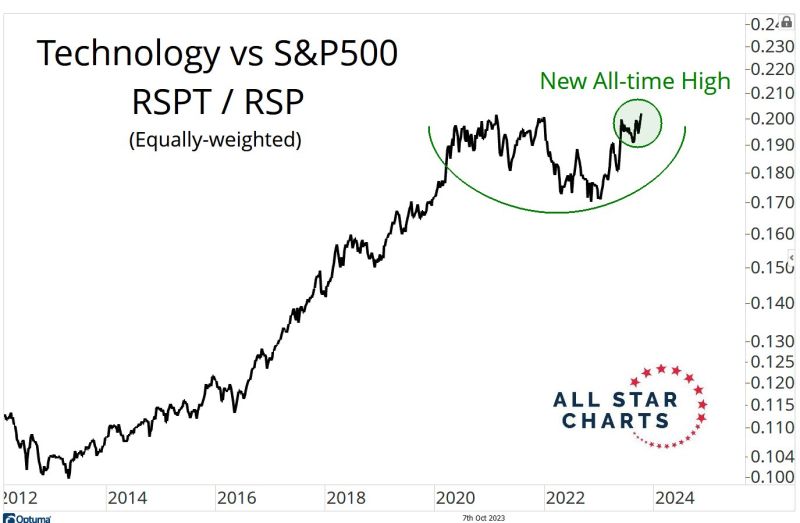

Tech relative to small caps JUST hit the highest level EVER seen This ratio is higher than even the peak of the Dot Com bubble

Source: Game of Trades

Interesting development which has been taking place recently with bitcoin rising despite Tech stocks losing ground

Source: J-C Parets

Some updates on Chatgpt by Linas Beliūnas

OpenAI just released two biggest updates to ChatGPT ever 😳

Nasdaq 100 dropped 1.9%, now down 11% from Jul high, so Big Tech now in correction territory

It looks like some P/E air is being let out of the Magnificent 7 bubble... Source: HolgerZ, Bloomberg

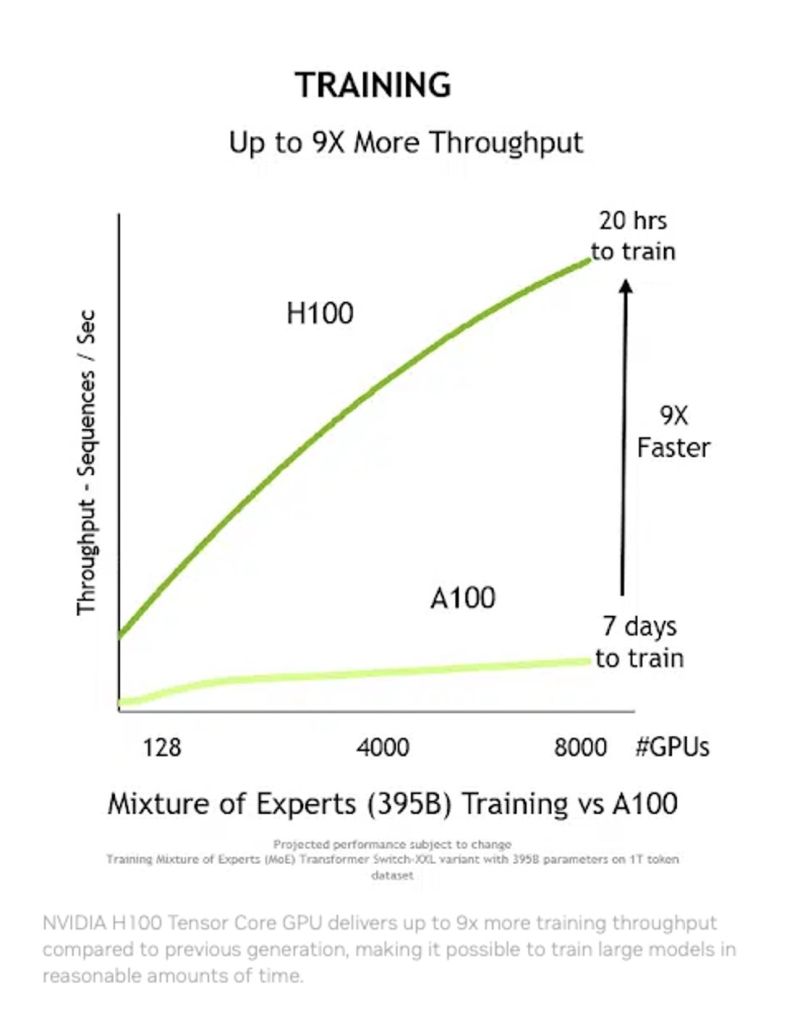

Nvidia's $NVDA data center revenue surpassed it's core business gaming thanks to two key releases, one of which could contribute upwards of $45B in revenue alone in FY24:

- The A100 GPU, released in 2020, boosted AI inference, training times and performance up to 20x over its predecessors. - The H100 GPU, released in late 2022, which is 9x faster than the A100. Source: Beth Kinding

Have you ever played Microsoft's games?

Microsoft is the world's largest gaming company, with an astonishing market capitalization of $2,441 billion. Some of Microsoft's popular games include Call of Duty and World of Warcraft. Genuine Impact

In case you missed it: technology hit a new all-time relative high

And this is on an equally-weighted basis. So it is not just 7 stocks... Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks